| |

| Market Update |

| |

|

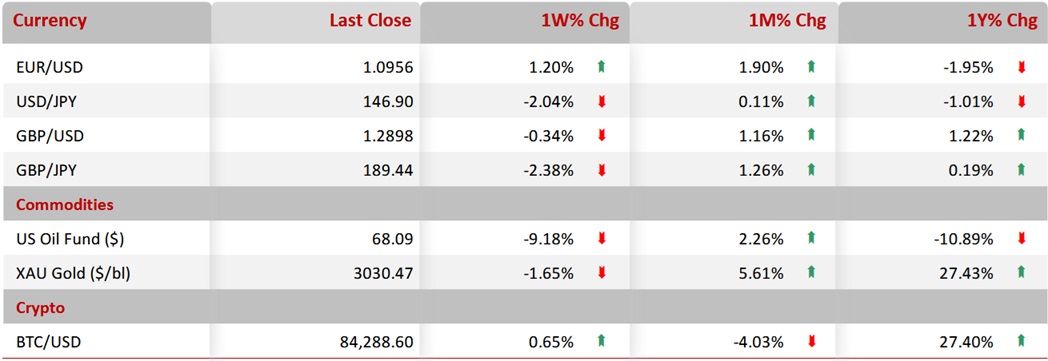

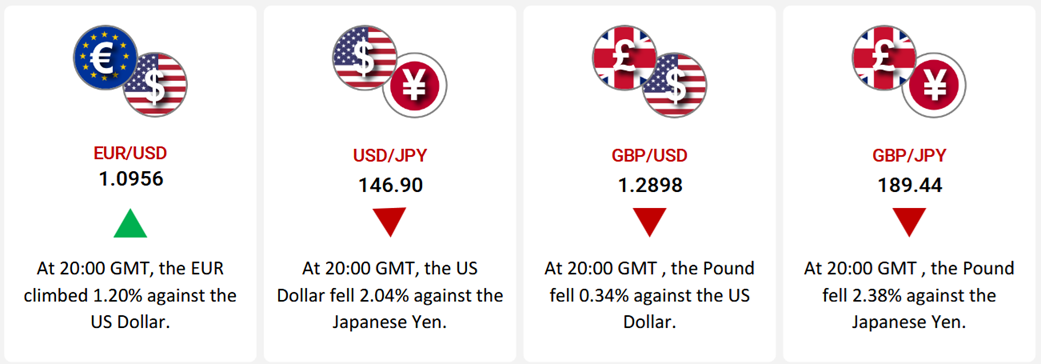

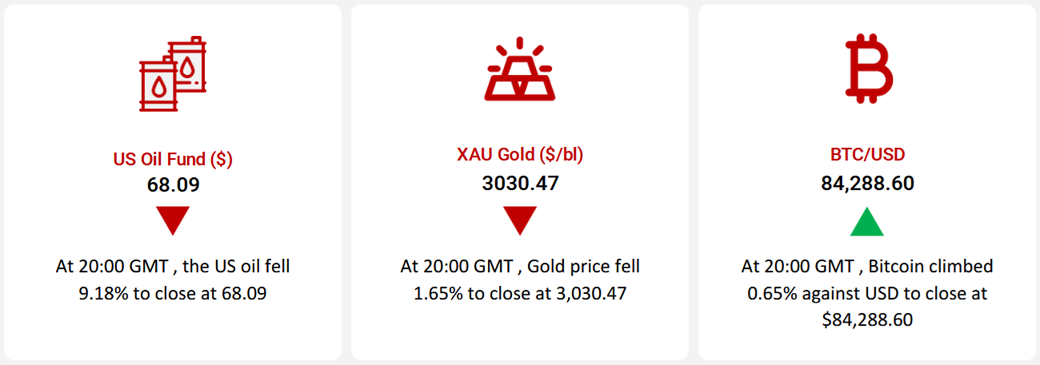

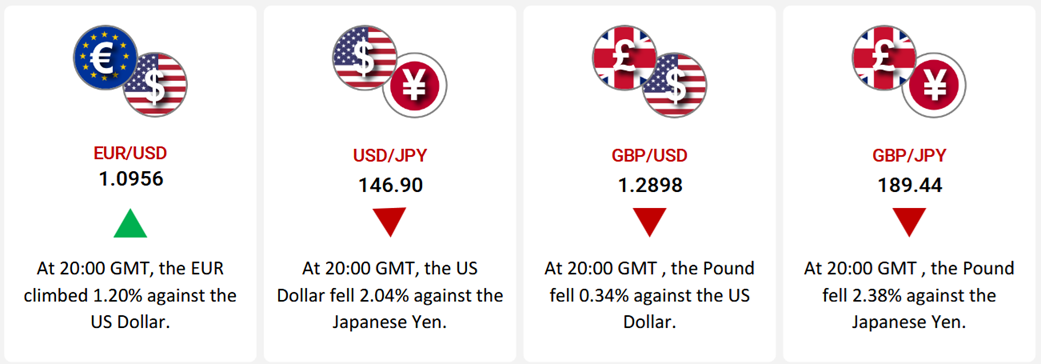

The Euro gained 1.20% against the U.S. Dollar, supported by stronger-than-expected inflation and unemployment data in the Eurozone, despite weaker consumer confidence and sluggish manufacturing activity. In the U.S., manufacturing and services activity declined, while job openings fell. However, labour market strength was evident in the ADP jobs report, which exceeded expectations.

The Japanese Yen rose 2.04% against the Dollar as investors sought safe-haven assets amid global uncertainty. Japan’s labour market improved, with falling unemployment and rising housing starts, although manufacturing sentiment and activity remained weak.

The British Pound slipped 0.34% against the Dollar and 2.38% versus the Yen, pressured by lacklustre UK data, including a 17-month low in manufacturing PMI and flat housing prices. Risk aversion further dampened GBP performance.

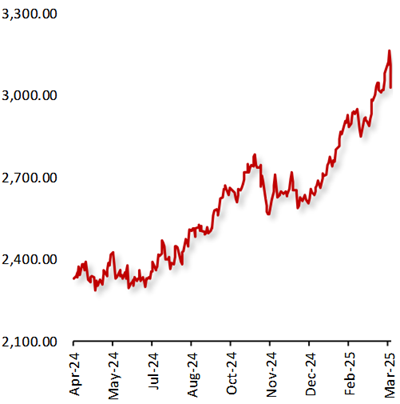

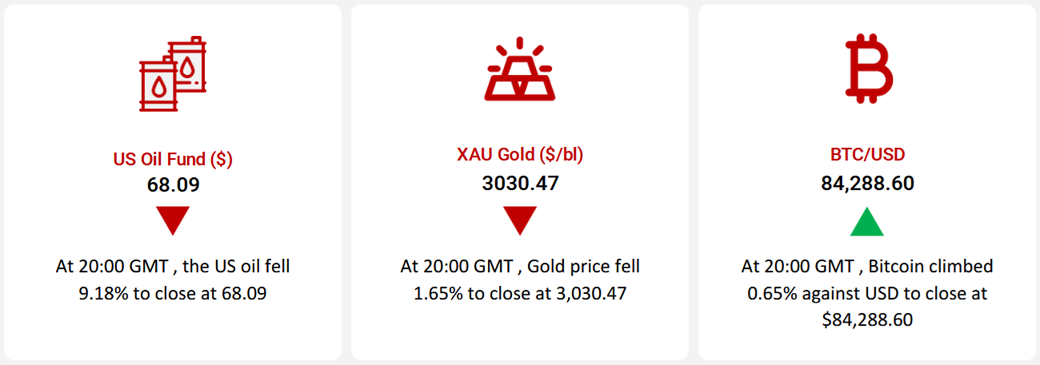

Gold prices declined despite ongoing geopolitical uncertainty and safe-haven demand. Investors balanced fears of retaliatory tariffs with central bank buying. Data showed central banks added 44 tons of gold in January-February, with Poland and China leading. Expectations of further reserve diversification away from the Dollar also supported sentiment for bullion.

Oil prices tumbled amid fears of slowing demand due to trade tensions and rising U.S. inventories. Additionally, OPEC+ unexpectedly advanced plans to increase output by 411,000 barrels per day in May, sparking oversupply concerns.

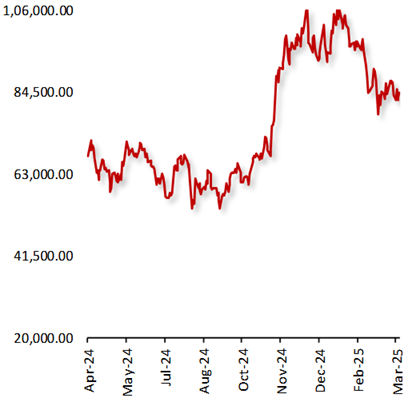

Bitcoin gained, benefiting from the shift away from traditional markets. Meanwhile, U.S. lawmakers advanced crypto legislation, including bills restricting Federal CBDCs and establishing a stablecoin framework.

The U.S. economy added 228,000 jobs in March, far surpassing expectations. Employment rose across healthcare, retail, and transport sectors. The unemployment rate edged up to 4.2%, while wage growth slowed to 3.8% annually.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

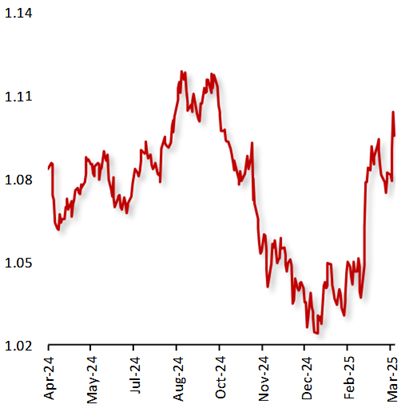

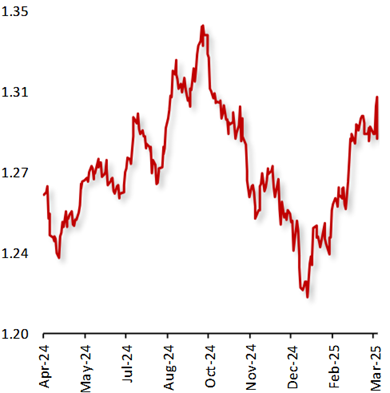

EUR/USD

|

|

|

Euro Climbs Amid Mixed Eurozone Data and US Economic Uncertainty

|

|

| |

|

|

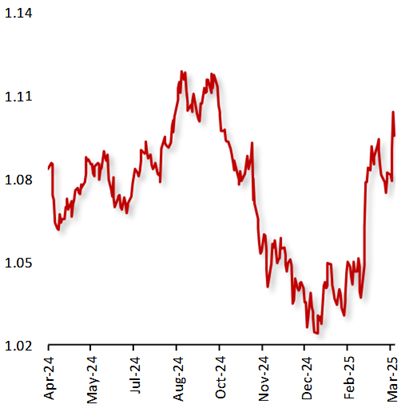

The EUR rose 1.20% against the USD, influenced by mixed economic data from the Eurozone and mounting concerns over US trade policies.

In the Eurozone, consumer confidence fell more than expected in March, reflecting growing unease about economic momentum amid looming US tariffs. Meanwhile, the producer price index (PPI) rose in February, surpassing market expectations. Inflationary pressures remained evident as the consumer price index (CPI) increased in March. The unemployment rate also improved, falling to 6.1% in February from 6.2% previously. However, the manufacturing sector’s performance remained weak, with the HCOB manufacturing PMI rising to 48.6, below market forecasts.

Conversely, in the US, manufacturing activity contracted in March. Additionally, job openings declined in February as economic uncertainty, driven by import tariffs, dampened labor demand. The ISM Services Index dropped sharply, well below market forecasts.

|

|

| |

| |

| |

|

|

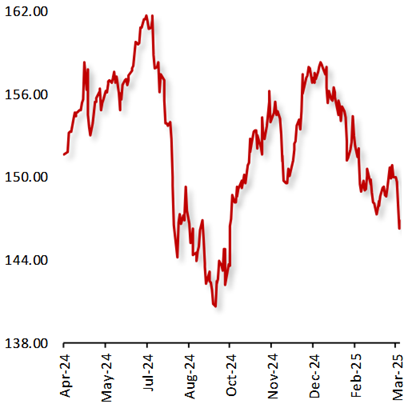

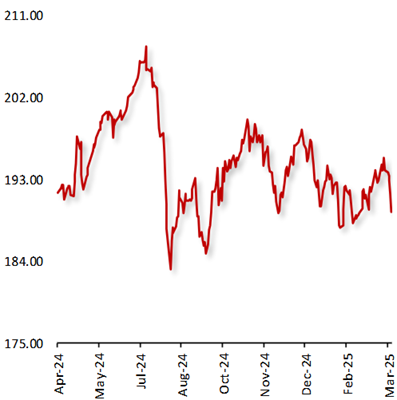

USD/JPY

|

|

|

Dollar Weakens as Mixed US Data and Trade Tensions Boost Yen’s Safe-Haven Appeal

|

|

| |

|

|

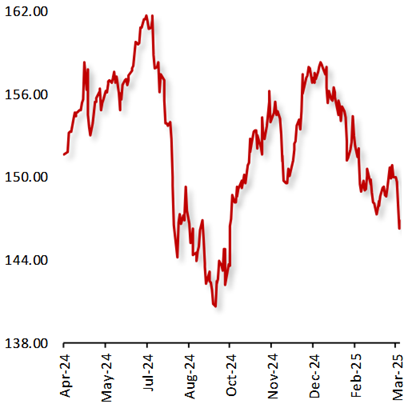

The USD declined 2.04% against the JPY, amid US economic data shows concerns.

In Japan, housing starts rebounded in February, driven by strong demand for new homes and improved market conditions. Additionally, the unemployment rate dropped in February, reflecting a stronger labor market. However, the Tankan large manufacturing index declined in the first quarter, indicating reduced optimism among large manufacturers. The Jibin Bank manufacturing PMI also dropped in March, remaining in contraction territory.

The week was marked by heightened global trade tensions as US President Donald Trump announced aggressive new tariffs, including a baseline 10% tariff on all imports and higher rates targeting approximately 60 countries. This escalated existing trade disputes and led to a flight to safe-haven assets, bolstering demand for the Japanese yen.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

GBP Edges Lower Despite Weaker USD Amid Mixed Economic Data and Trade Policy Uncertainty

|

|

| |

|

|

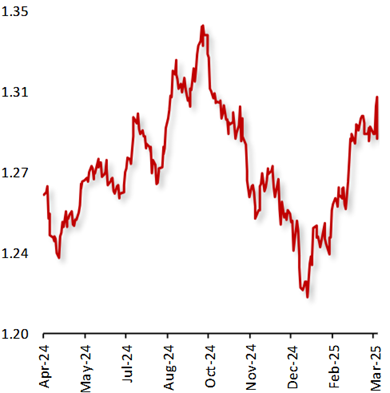

The GBP fell 0.34% against the USD this week, amid weaker dollars and seasonal strength in the Pound.

In the UK, economic data was mixed. The manufacturing PMI fell to a 17-month low in March, while the services PMI rose but missed expectations. Additionally, Nationwide housing prices remained flat, and mortgage approvals saw a sharp decline in February.

Meanwhile, the US Dollar climbed as concerns grew over the economic impact of new trade policies. The ISM Manufacturing and Services PMIs both dropped more than expected in March, though factory orders increased in February. Labor market data was mixed, with JOLTS job openings declining, while ADP employment and jobless claims exceeded expectations.

Trump’s 10% import tariff proposal spurred uncertainty, limiting USD recovery prospects.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP Declines as Trade Tensions Boost Demand for Safe-Haven Yen

|

|

| |

|

|

The GBP closed 2.38% lower against the JPY this week, as escalating US trade tensions triggered a risk-off sentiment, boosting demand for the safe-haven Japanese yen.

The UK manufacturing PMI dropped to a 17-month low in March, while the services PMI rose but fell short of expectations. Additionally, Nationwide housing prices remained flat, and mortgage approvals declined sharply in February.

In Japan, economic data were more resilient. The Jibin Bank Manufacturing and Services PMIs both declined in March, but less than expected. Meanwhile, Japan’s unemployment rate unexpectedly fell in February, and annualized housing starts increased.

Overall, GBP/JPY movements were driven by global trade developments and market risk appetite, with the Japanese yen strengthening as investors sought safe-haven assets amid escalating trade tensions.

|

|

| |

| |

| |

|

|

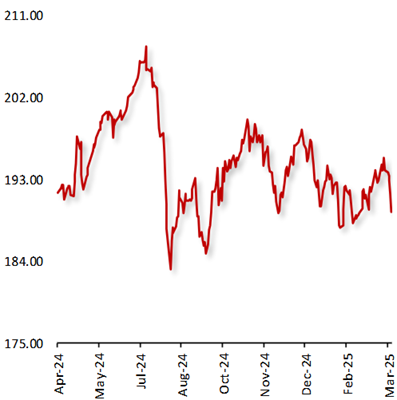

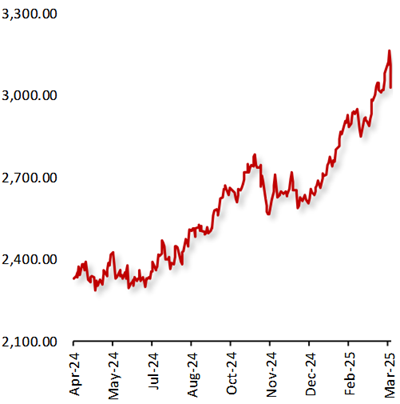

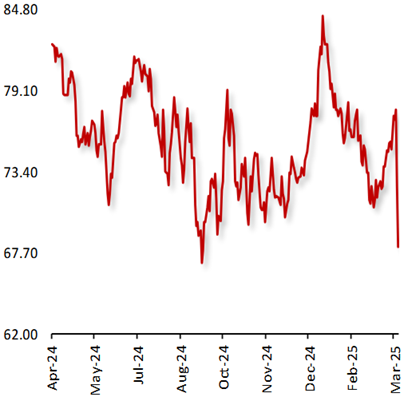

US Oil Fund ($)

|

|

|

Oil Prices Plunge Amid Concerns Over Economic Slowdown and OPEC+ Output Hikes

|

|

| |

|

|

Oil prices declined this week, after US President Donald Trump announced broad new reciprocal tariffs on its key trading partners, fueling concerns that these policies could stoke inflation, slow economic growth and escalate trade disputes that would dampen demand for oil. Additionally, the US Energy Information Administration (EIA) reported that crude oil inventories rose by 6.2mn bls in the week ended 28 March 2025, amid a surge in imports from Canada.

Adding to the negative sentiment, the eight OPEC+ countries unexpectedly agreed to advance their plan to phase out oil output cuts by increasing output by 411,000 barrels per day in May, raising oversupply concerns. Meanwhile, the eight OPEC+ countries are expected to meet on 05 May to decide on June output.

|

|

| |

| |

| |

|

|

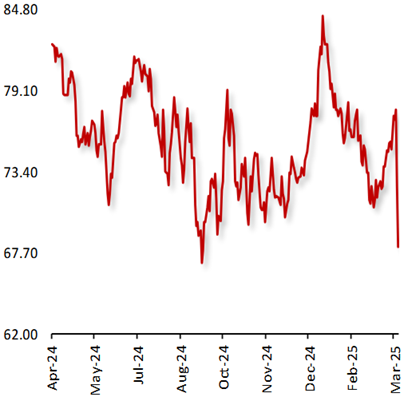

XAU Gold (XAU/USD)

|

|

|

Gold Slips Despite Safe Haven Demand as Trade Tensions and Central Bank Buying Persist

|

|

| |

|

|

Gold declined this week, amid weakness in the US Dollar and as worries surrounding the reciprocal tariffs and potential retaliatory measures from its trading partners, boosted demand for the haven asset. The Trump administration unveiled larger than expected levy on trillions of imports, with a baseline levy of 10% and larger reciprocal tariffs on some countries, including China and the European Union.

Furthermore, a sustained demand from the central banks supported the bullion. Data indicated that the central banks added a net 44 tons to their gold reserves in January-February with Poland and China being the largest buyers. Moreover, the central banks are expected to further diversify reserves away from the Dollar due to risks stemming from US President Donald Trump's policies.

|

|

| |

| |

| |

|

|

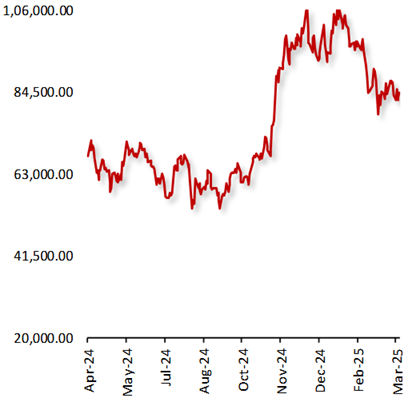

BTC/USD

|

|

|

Bitcoin Gains Amid Rising Trade Tensions and Advancing U.S. Crypto Legislation

|

|

| |

|

|

Bitcoin rose this week, as risk appetite diminished among investors after US President Donald Trump unveiled higher-than-expected reciprocal tariffs on its key trading partners around the world. The move reignited concerns over escalating global trade tensions and a potential economic slowdown, further dampening investor sentiment.

In the major news, the US House Financial Services Committee advanced a bill aimed at preventing Federal banks from using or issuing the central bank digital currencies, or CBDCs, paving the way for a vote in the chamber. Separately, The US House Financial Services Committee has passed a Republican-backed stablecoin framework bill, which will head to the House floor for a full vote.

|

|

| |

| |

| |

| Nonfarm payrolls: 228K Jobs Added in March |

| |

|

The US economy added 228,000 jobs in March, from a revised rise of 117,000 jobs recorded in February and surpassed the market expectation of 135,000 by a wide margin. In March, job gains occurred in health care, in social assistance, and in transportation and warehousing. Employment also increased in retail trade, partially reflecting the return of workers from a strike. Federal government employment declined.

Healthcare added 54,000 jobs in March, in line with the average monthly gain of 52,000 over the prior 12 months. Over the month, employment continued to trend up in ambulatory healthcare services (+20,000), hospitals (+17,000), and nursing and residential care facilities (+17,000). Retail trade added 24,000 jobs in March, as workers returning from a strike contributed to a job gain in food and beverage retailers (+21,000).

Meanwhile, the unemployment rate rose to 4.2% as the participation rate climbed. Finally, annual wage inflation, as measured by the change in the average hourly earnings, declined to 3.8% from 4%.

|

| |

|

| |

|

|

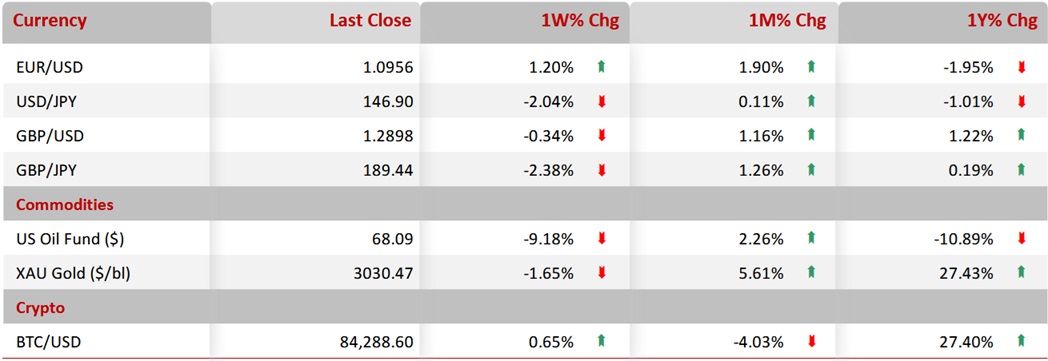

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|