| |

| Market Update |

| |

|

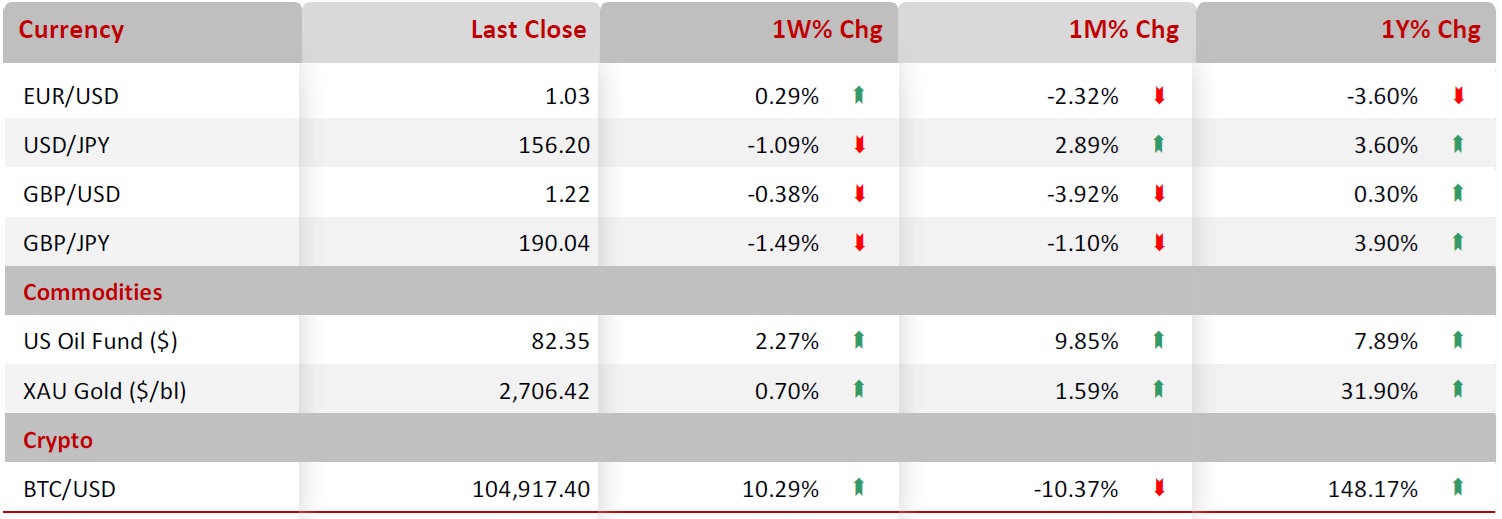

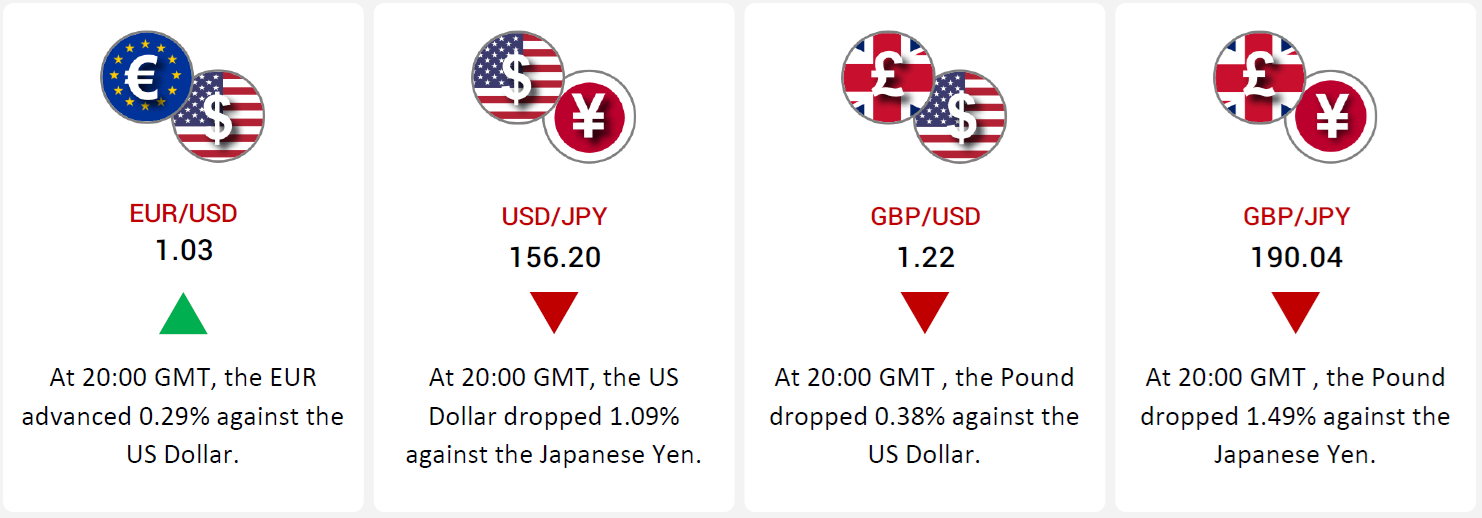

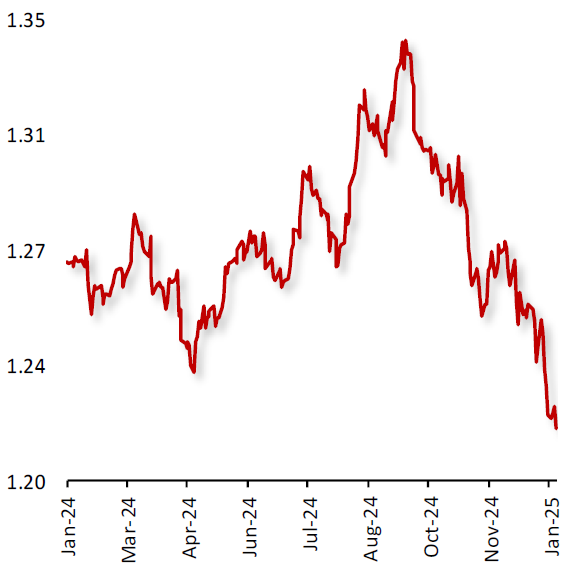

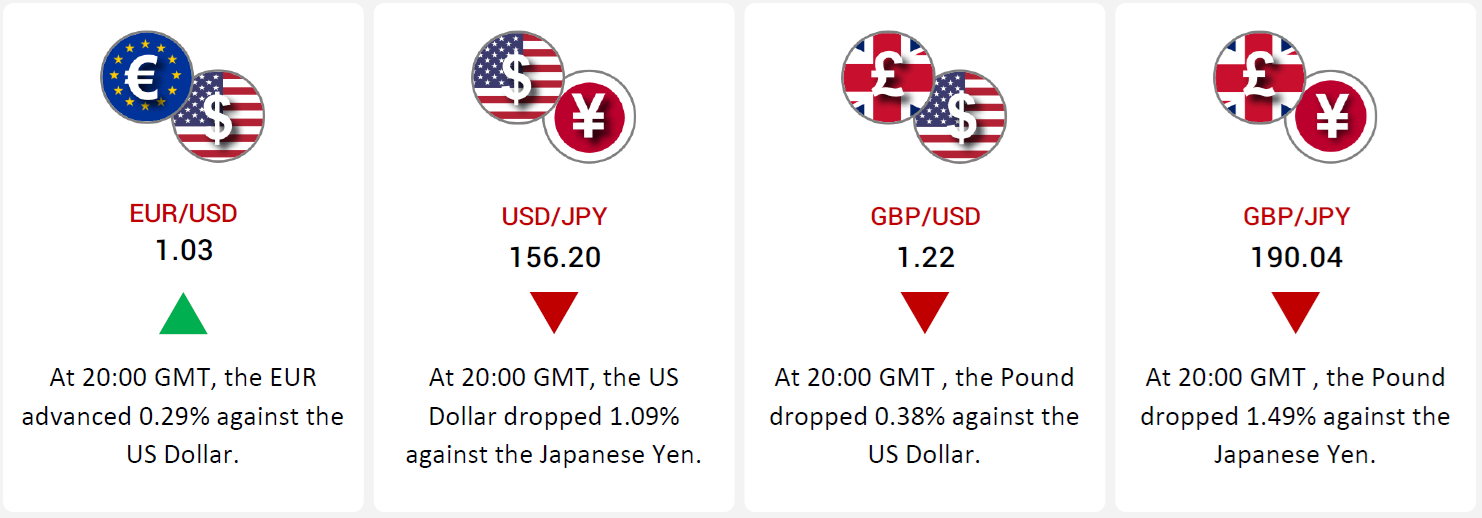

The EUR/USD rose 0.29% amid mixed Eurozone data and strong US economic performance. While Eurozone industrial production fell short of expectations and Germany's CPI exceeded forecasts, indicating inflationary pressures, the US economy showed strength with a surge in nonfarm payrolls, a drop in the unemployment rate, and a recovery in manufacturing.

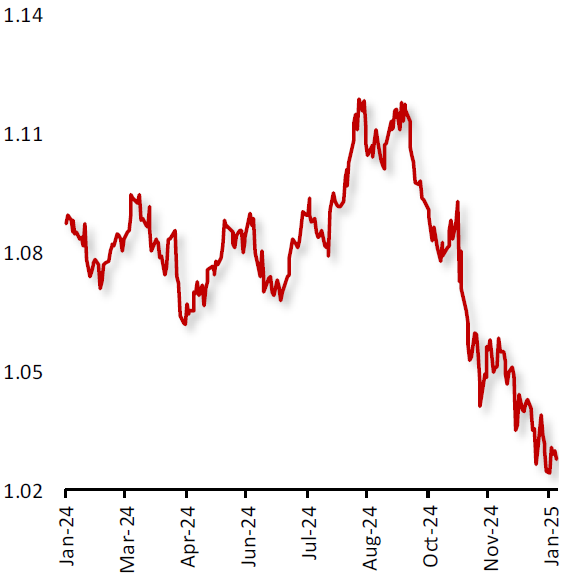

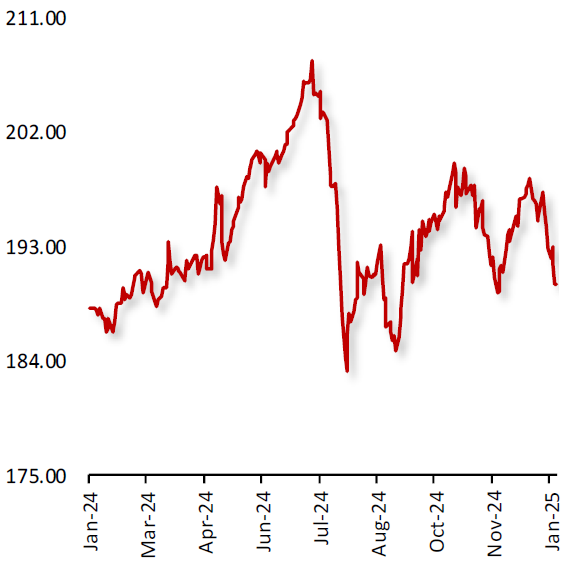

The USD dropped 1.09% against the JPY, with strong US economic data supporting the dollar, including a rise in nonfarm payrolls and the Philadelphia Fed Manufacturing Index. Meanwhile, the Bank of Japan maintained its dovish stance, keeping the yen weak.

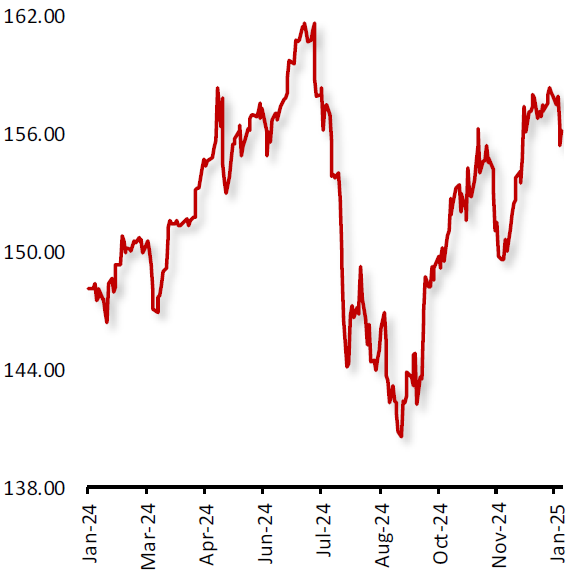

The GBP fell 0.38% against the USD, influenced by mixed UK data and a strong US economy. UK GDP rose slightly, but industrial production and manufacturing fell, while inflation showed signs of moderation. The GBP also dropped 1.49% against the JPY, supported by robust UK data but ongoing yen weakness due to Japan's monetary policy.

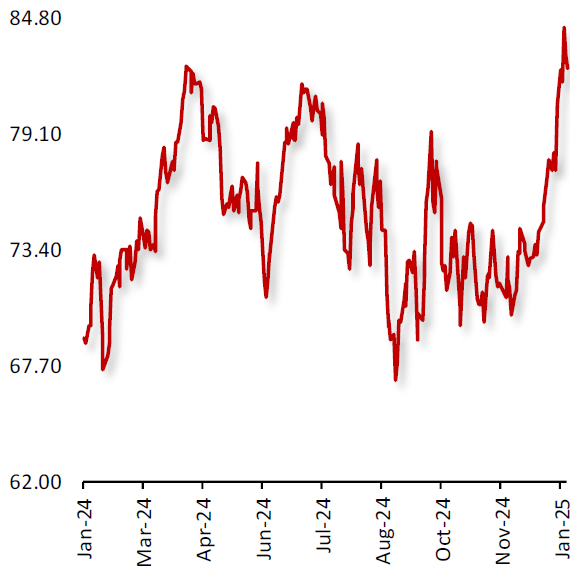

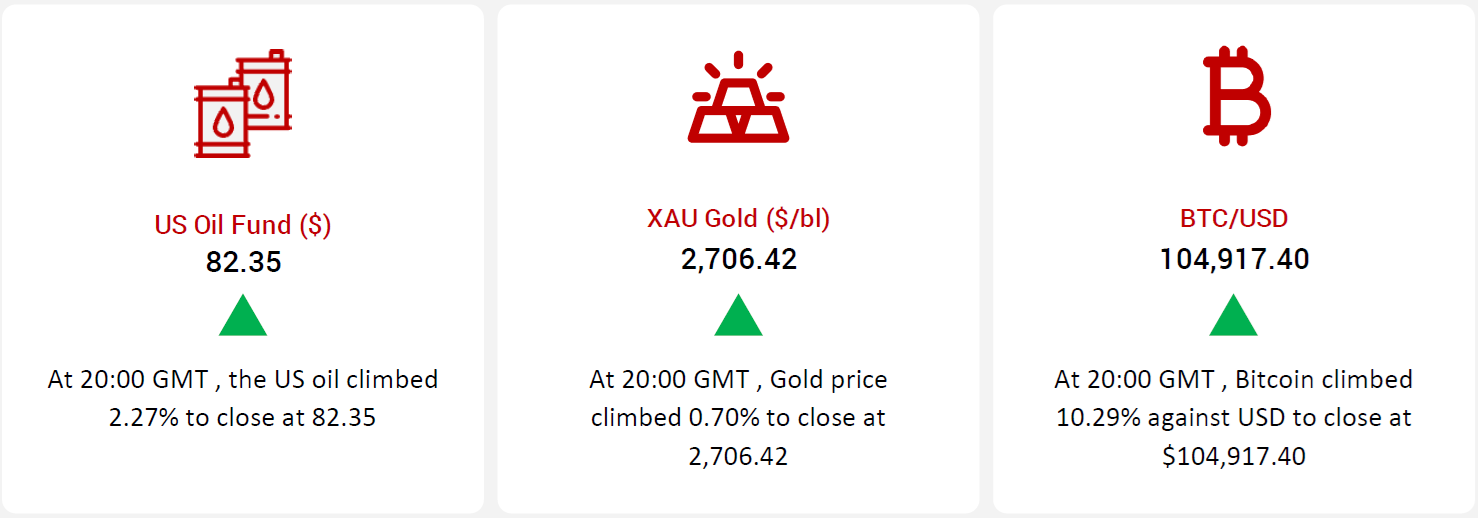

Oil prices surged due to concerns over supply disruptions, especially with sanctions against Russia. The demand outlook and hopes of US Federal Reserve rate cuts added to the positive sentiment.

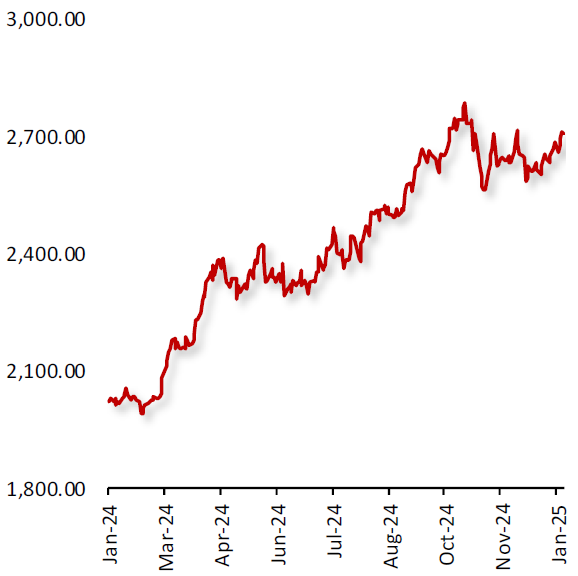

Gold prices rose as US core inflation came in lower than expected, boosting hopes for rate cuts by the Federal Reserve. The weaker US Dollar and falling Treasury yields further supported gold.

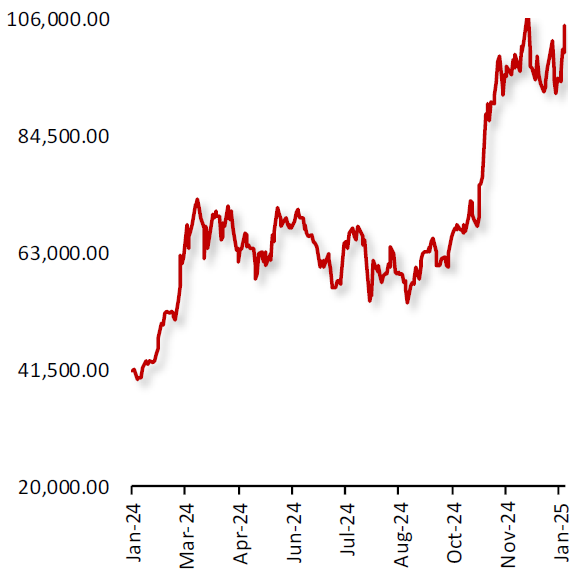

Bitcoin climbed ahead of US President-Elect Donald Trump’s inauguration, driven by positive sentiment, including expectations of lower borrowing costs. Phantom's $150 million funding and Coinbase’s Bitcoin-backed loans also contributed to the surge.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

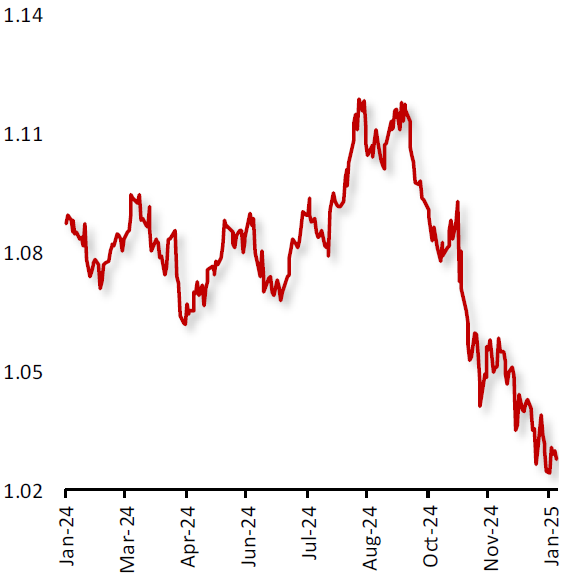

EUR/USD

|

|

|

EUR/USD Rises Amid Mixed Eurozone Data and Strong US Economic Performance

|

|

| |

|

|

The EUR closed 0.29% higher against the USD during the week, as mixed economic data from the Eurozone and strong US indicators fueled heightened volatility.

In the Eurozone, industrial production rose in November, falling short of expectations, reflecting persistent challenges in the manufacturing sector. Additionally, Germany’s consumer price inflation (CPI) climbed in December, exceeding forecasts, highlighting ongoing inflationary pressures despite sluggish economic growth.

On the other hand, the US economy demonstrated robust performance. Nonfarm payrolls surged by 256K in December, well above expectations, while the unemployment rate dipped to 4.1%, signaling sustained strength in the labor market. The Philadelphia Fed Manufacturing Index rebounded sharply in January to its highest level since April 2021, indicating a solid recovery in manufacturing activity.

|

|

| |

| |

| |

|

|

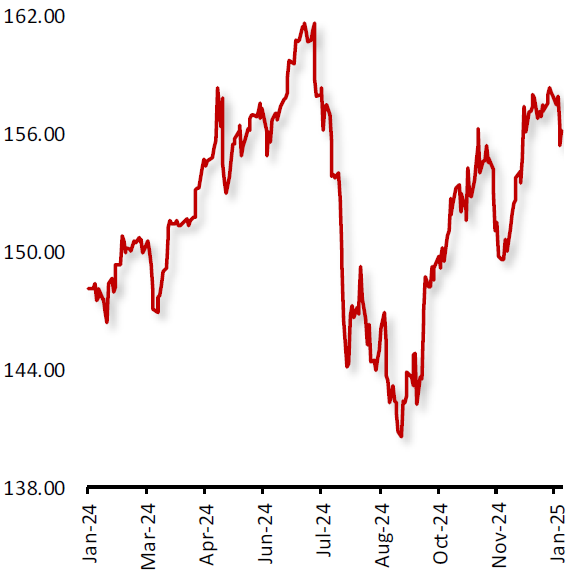

USD/JPY

|

|

|

USD Drops Against JPY Amid Strong US Data and Bank of Japan’s Dovish Stance

|

|

| |

|

|

The USD closed 1.09% lower against the JPY during the week, driven by strong US economic data and continued dovishness from the Bank of Japan (BoJ).

In the US, robust economic indicators strengthened the dollar. Nonfarm payrolls rose in December, while the unemployment rate dropped, signaling a tight labor market. The Philadelphia Fed Manufacturing Index jumped in January, its highest level since April 2021. Meanwhile, the CPI increased in December, surpassing expectations. The NAHB Housing Market Index unexpectedly advanced in January, a nine-month high. However, retail sales grew less than expected in December.

On the other hand, the Japanese yen continued to face headwinds due to the BoJ’s ultra-loose monetary policy. The central bank maintained its yield curve control program, keeping the 10-year government bond yield capped despite inflation in Japan remaining above target.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

Pound edges lower amid mixed UK data and strong US Dollar

|

|

| |

|

|

The GBP closed 0.38% lower against the USD during the week, as the combination of mixed UK economic data and strong US economic performance reinforced the dollar’s strength over the pound.

In the UK, GDP rose slightly below expectations in November, reflecting moderate economic expansion driven by gains in the services sector. However, industrial production and manufacturing output both fell unexpectedly, highlighting ongoing challenges in the production sectors. Consumer price inflation rose slightly below expectations in December, signaling tentative signs of easing price pressures. The UK’s goods trade deficit narrowed marginally in November, providing limited support for the pound. Meanwhile, the housing market remained resilient, with the RICS Housing Price Balance rising in December, indicating steady demand.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP Falls Against JPY as UK Data Strengthens Amid Ongoing Yen Weakness

|

|

| |

|

|

The GBP closed 1.49% lower against the JPY during the week, supported by robust UK economic data and persistent yen weakness driven by the Bank of Japan’s (BoJ) accommodative monetary stance.

In the UK, GDP rose in November, marking a modest expansion. Industrial production declined reflecting sectoral challenges, but the broader economy showed resilience, driven by gains in services and construction. Meanwhile, consumer price inflation increased in December, slightly below forecasts, suggesting some moderation in inflationary pressures. The UK’s trade deficit narrowed to GBP 19.31 billion in November, contributing to a more balanced economic outlook. Housing market indicators remained robust, with the RICS housing price balance advancing to 28% in December, reflecting resilient demand.

Conversely, the Japanese yen faced continued pressure as the BoJ maintained its ultra-loose monetary policy.

|

|

| |

| |

| |

|

|

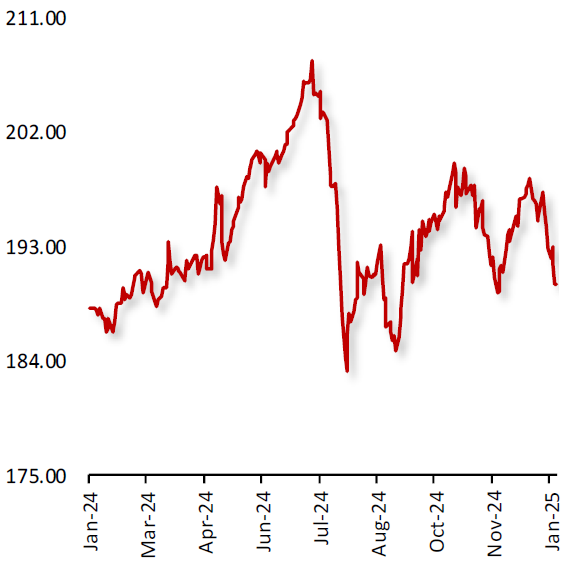

US Oil Fund ($)

|

|

|

Oil Prices Surge on Supply Fears & Fed Rate Cut Hopes

|

|

| |

|

|

Oil prices advanced during the week, amid concerns over potential supply disruptions after the US President Biden’s administration announced widening sanctions targeting Russian oil producers and tankers, followed by more measures against Russia’s military-industrial base and sanctions-evasion efforts. However, gains were limited as prospects that Yemen's Houthi militia would halt its attacks on ships in the Red Sea, following a ceasefire deal in the war in Gaza between Israel and the militant Palestinian group Hamas.

Additionally, improving global oil demand outlook and renewed hope of interest rate cuts by the US Federal Reserve boosted investor sentiment after data indicated that easing inflation in the world’s biggest economy.

|

|

| |

| |

| |

|

|

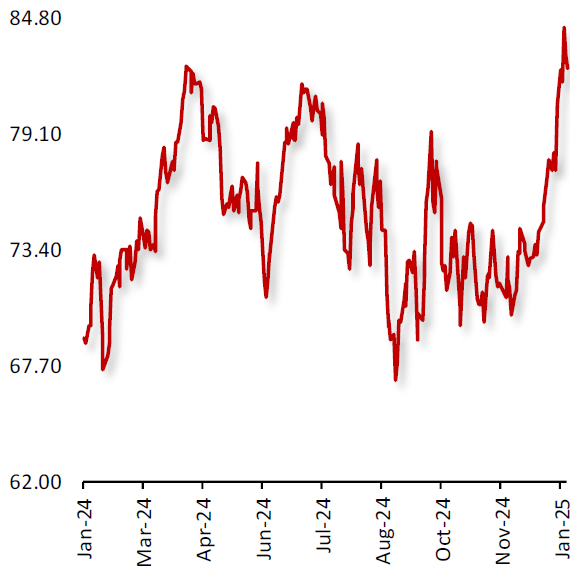

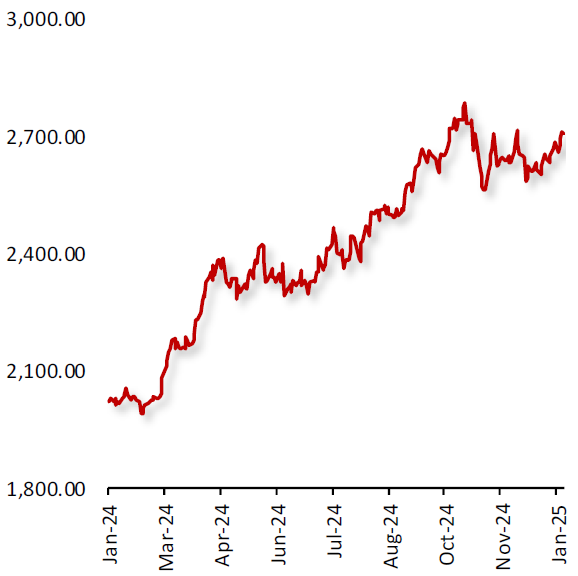

XAU Gold (XAU/USD)

|

|

|

Gold Prices Rise Amid Renewed Hopes Surrounding Rate Cuts

|

|

| |

|

|

Gold prices advanced during the week, as softer than expected US core inflation data renewed hopes for less restrictive monetary policy stance by the Federal Reserve (Fed). Adding to the positive sentiment, Fed Governor Christopher Waller indicated that three or four rate reductions are still possible this year if the US economic data weakens further. Additionally, weakness in the US Dollar and drop in the US Treasury yields supported the bullion.

Moreover, persistent concerns over potential tariffs from US president-elect Donald Trump’s incoming administration, which could further worsen inflationary pressures boosted demand for the safe haven metal. Elsewhere, Israel and Hamas reached a ceasefire and hostage agreement, reducing some safe haven appeal of the metal.

|

|

| |

| |

| |

|

|

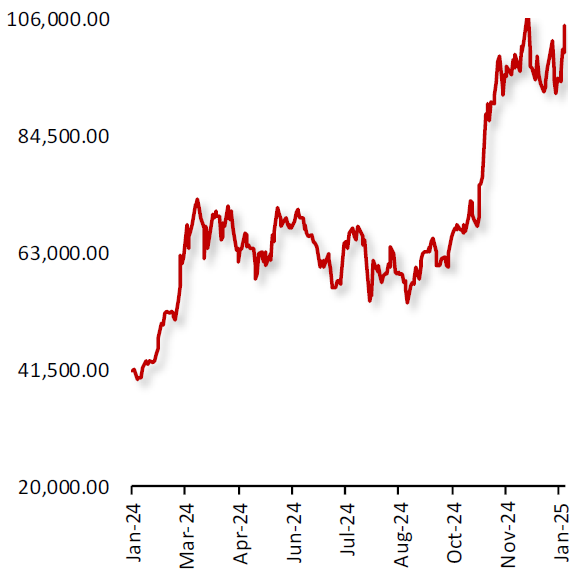

BTC/USD

|

|

|

Bitcoin Climbed Ahead of US President-Elect Donald Trump's Inauguration

|

|

| |

|

|

Bitcoin’s price advanced last week, ahead of US President-Elect Donald Trump's Inauguration on 20 January. Additionally, news reports indicated that US President-elect Donald Trump plans to release an executive order designating cryptocurrency as “national policy priority”.

Adding to the positive sentiment, a softer-than-forecast core inflation data reinforced expectations that the Federal Reserve is on track to continue lower borrowing costs this year.

In major news, digital asset wallet Phantom announced that it has raised $150 mn from a Series C funding round led by venture capital firms Sequoia Capital and Paradigm, valuing the firm at $3 bn. Separately, cryptocurrency exchange Coinbase has reintroduced Bitcoin-backed loans in the United States, giving users the ability to borrow against their digital asset holdings.

|

|

| |

| |

| |

| |

|

| |

|

|

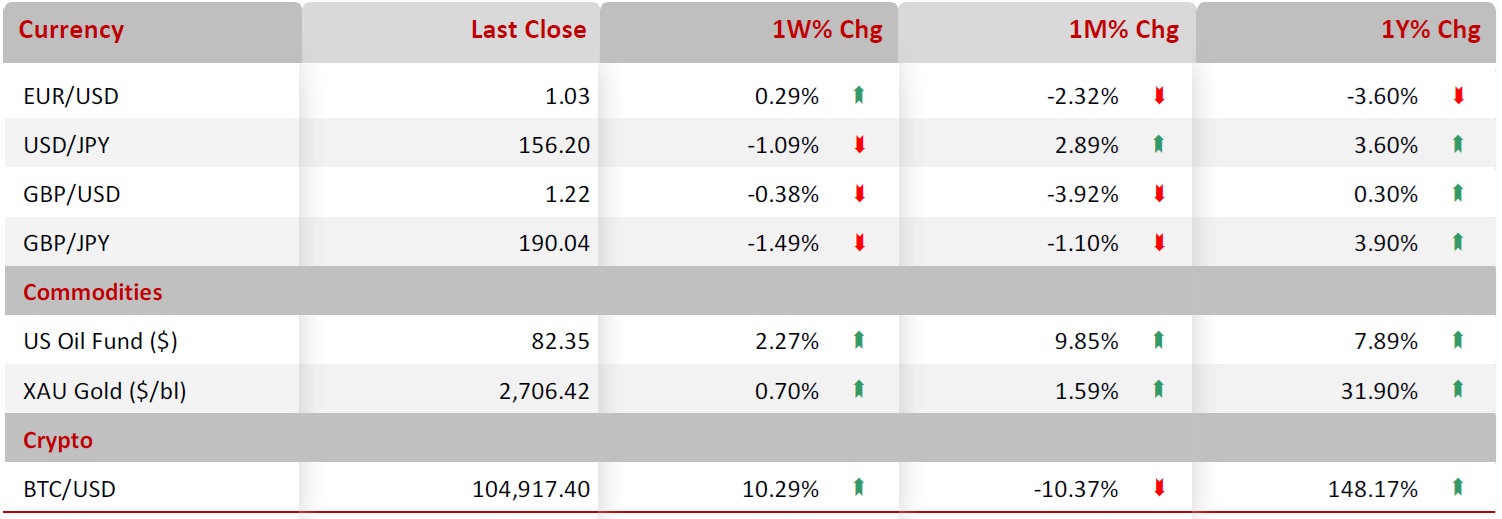

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|