| |

| Market Update |

| |

|

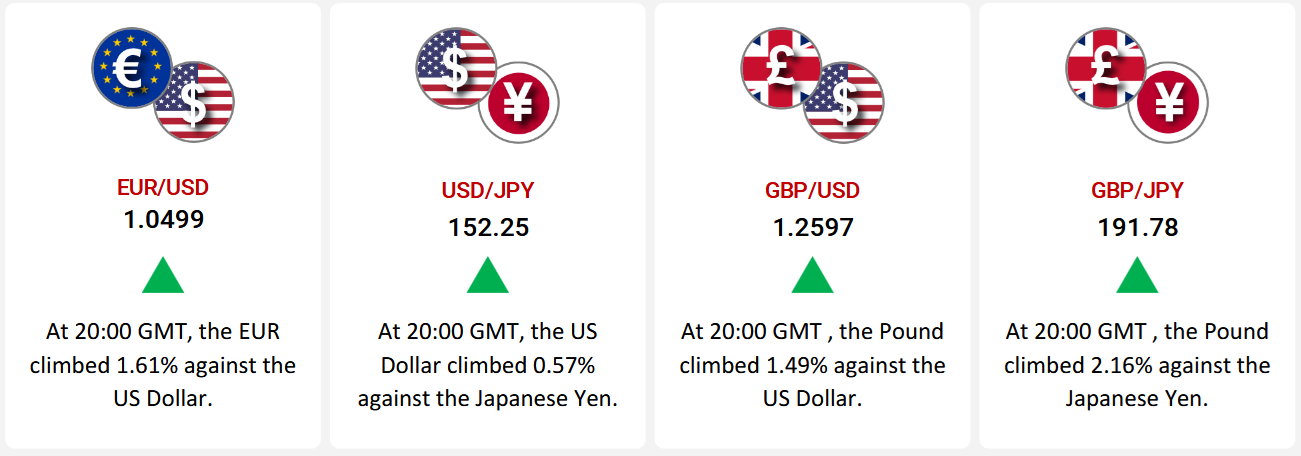

The Euro gained 1.61% against the Dollar, supported by improved Eurozone sentiment despite weak industrial production. US inflation rose 0.5% in January, lifting the annual rate to 3.0%, limiting the Dollar’s strength. President Trump’s planned reciprocal tariffs added further market uncertainty.

The Dollar strengthened against the Yen, rising 0.57%, as strong inflation data reinforced expectations of prolonged high interest rates. Japan’s producer prices and machine tool orders also increased, but concerns over a global trade war weighed on sentiment. Meanwhile, the British pound closed higher against both the Dollar and yen, driven by positive UK GDP growth and stronger-than-expected industrial production and retail sales.

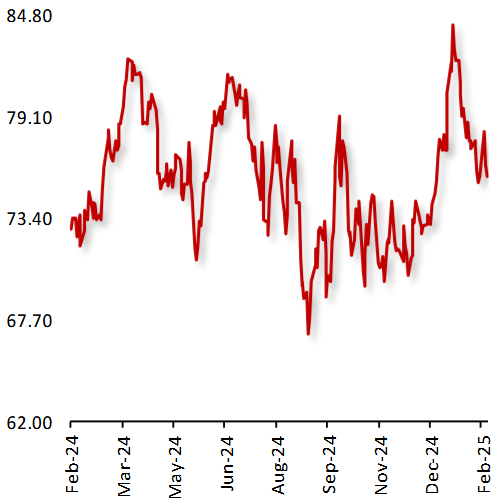

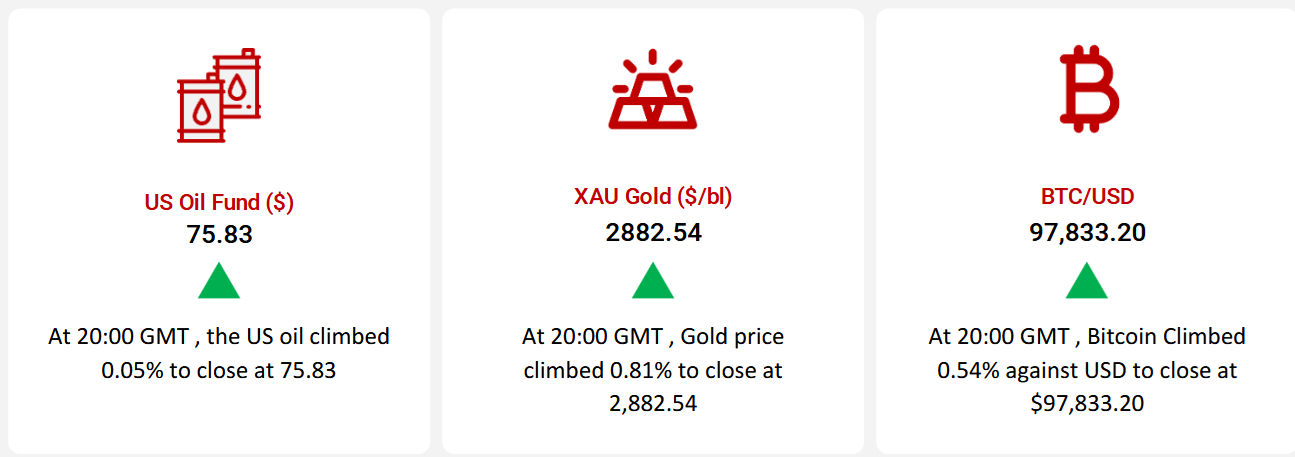

Oil prices rebounded after three weeks of losses, driven by demand optimism and the postponement of US tariffs to April. Concerns over Russian and Iranian supply disruptions further supported prices, though gains were capped by reports of a potential Russia-Ukraine peace agreement and rising US crude inventories.

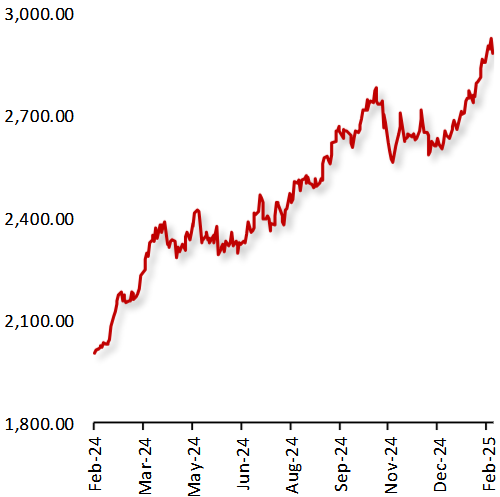

Gold extended its rally for the seventh consecutive week, fueled by trade war concerns and rising inflation, reinforcing its appeal as a hedge. Expectations of a potential Fed rate cut, and geopolitical risks further boosted demand for the metal.

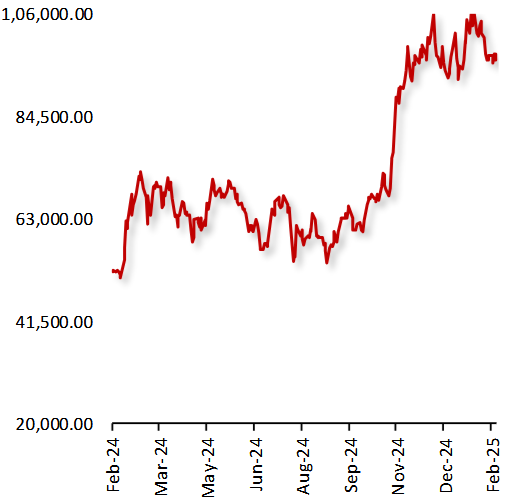

Bitcoin climbed despite inflation concerns and a stronger Dollar. While rising Treasury yields pressured risk assets, Trump’s delay of reciprocal tariffs limited losses. In crypto news, Coinbase reported a strong Q4 net income of $1.29 billion, with revenue of $2.2 billion, surpassing estimates. Robinhood also saw a 700% YoY surge in crypto revenue, signaling continued investor interest.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

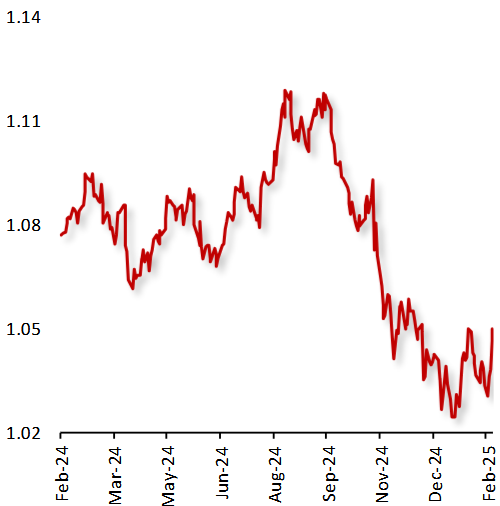

EUR/USD

|

|

|

EUR Rose Improved Eurozone Sentiment and Anticipated US Tariffs

|

|

| |

|

|

The Euro closed 1.61% higher against the Dollar, supported by improved investor sentiment in the Eurozone and mixed US economic data. The Eurozone Sen tix Investor Confidence Index hit a seven-month high in February, driven by rising economic expectations. However, industrial production fell 1.1% in December, highlighting continued manufacturing weakness.

In the US, inflation remained strong, with consumer prices rising 0.5% in January, pushing annual inflation to 3.0%. This fueled speculation about the Fed’s policy stance, but mixed data limited the dollar’s strength, allowing the euro to gain. Meanwhile, President Trump announced plans for reciprocal tariffs on countries with unfair trade practices, including the EU, adding further uncertainty to global markets.

|

|

| |

| |

| |

|

|

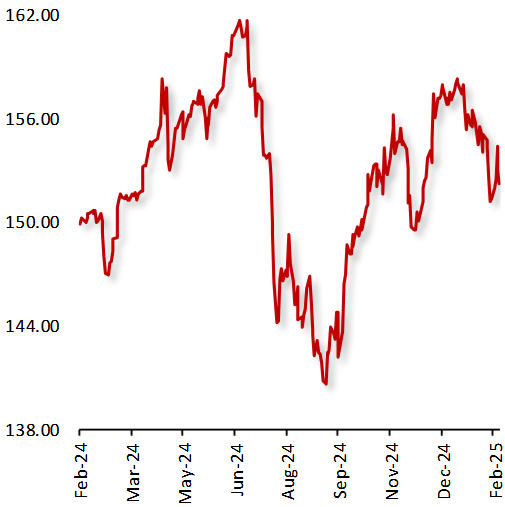

USD/JPY

|

|

|

Dollar jumps Amid Strong US Inflation Data and Anticipated Tariffs

|

|

| |

|

|

The USD closed 0.57% higher against the JPY, influenced by robust US inflation data and potential tariff implementations. USD/JPY

The US consumer prices increased more than expected in January. This surge heightened expectations that the Federal Reserve will maintain elevated interest rates for an extended period. Initial Jobless claims fell by slightly more than expected in the week ended 8 February 2025.

Japan’s producer prices advanced in January. Further, machine tool orders increased for the fourth straight month in January. Additionally, President Donald Trump's announcement of forthcoming reciprocal tariffs on countries imposing duties on US imports has raised concerns about a potential global trade war, further influencing market dynamics.

|

|

| |

| |

| |

|

|

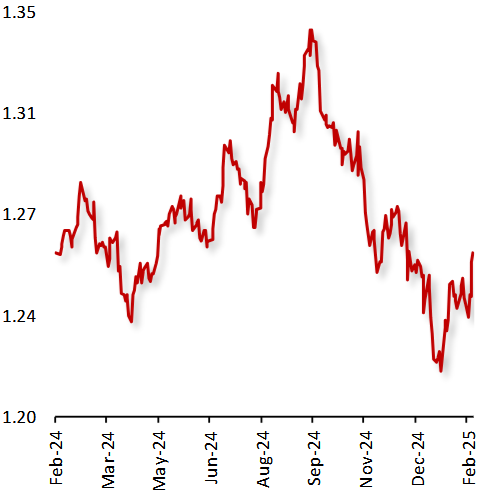

GBP/USD

|

|

|

GBP Closed higher Against the USD Amid Positive UK GDP Data and Tariff Delays

|

|

| |

|

|

The GBP closed 1.49% higher against the USD, influenced by favorable UK economic data and developments in the US trade policy.

The British Gross Domestic Product (GDP) unexpectedly expanded by 0.1% in the 4Q24. This positive economic performance bolstered the British pound.

Meanwhile stronger than expected US inflation reinforced expectations that the Federal Reserve would keep interest rates elevated for an extended period. Additionally, reports indicated delays in implementing proposed reciprocal tariffs. Initial jobless claims fell by slightly more than expected in the week ended 8 February 2025.

|

|

| |

| |

| |

|

|

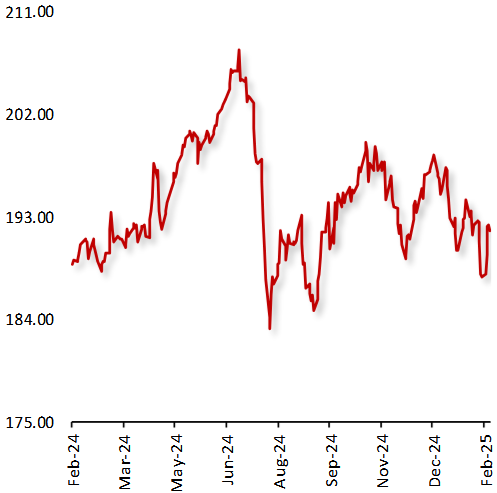

GBP/JPY

|

|

|

Pound Rose Amid Upbeat UK Data and Divergent Monetary Policies

|

|

| |

|

|

The GBP closed 2.16% higher against the JPY, amid favorable UK economic data and contrasting monetary policies between the Bank of England and the Bank of Japan.

The UK's Gross Domestic Product (GDP) unexpectedly expanded in 4Q24, exceeding forecasts and reinforcing confidence in the British economy. Industrial and manufacturing production posted gains in December, while BRC Like-for-Like retail sales outperformed expectations in January, signaling resilient consumer demand.

Meanwhile, in Japan, producer prices rose in January, and machine tool orders increased for the fourth consecutive month. However, uncertainty loomed after former US President Donald Trump announced upcoming reciprocal tariffs on countries imposing duties on US imports, raising fears of a potential global trade war and adding to market volatility.

|

|

| |

| |

| |

|

|

US Oil Fund ($)

|

|

|

Oil Prices Rebound on Demand Optimism Amid US Tariff Postponement

|

|

| |

|

|

Oil prices rose last week, ending a three-week losing streak, driven by stronger fuel demand and delayed US tariffs. President Trump postponed global reciprocal tariffs until April 1, 2025, easing trade war concerns and boosting optimism for economic growth and energy demand.

Further support came from worries over Russian and Iranian oil supplies amid US sanctions and rising Middle East tensions. However, gains were limited as Trump's Ukraine peace efforts and reports of a potential Russia-Ukraine agreement raised hopes of reduced supply disruptions.

Meanwhile, the EIA reported a 4.07 million-barrel rise in US crude stocks for the week ending February 7, exceeding the expected 2.80-million-barrel build, adding downward pressure on prices.

|

|

| |

| |

| |

|

|

XAU Gold (XAU/USD)

|

|

|

Gold Extends Rally on Trade War Concerns and Inflation Fears

|

|

| |

|

|

Gold rose last week, for the seventh consecutive week, due to escalating concerns over a potential global trade war, following US President Donald Trump's announcement of reciprocal tariffs on countries that tax US imports. Additionally, US inflation data showed a solid increase, reinforcing concerns about rising price pressures and strengthening gold’s appeal as an inflation hedge.

Moreover, expectations of a potential US Federal Reserve rate cut amid signs of slowing global growth further supported the metal’s rally. Geopolitical risks and anticipation of a dovish monetary stance added to the positive momentum. Although gold briefly paused ahead of key US inflation data, overall sentiment remained bullish. Persistent trade concerns and economic uncertainty continued to drive investors toward the precious metal, keeping demand strong and pushing prices higher throughout the week.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Rises Despite Inflation Concerns and Stronger US Dollar

|

|

| |

|

|

Bitcoin climbed last week, after the US annual consumer inflation accelerated in January, dampening expectations for imminent Federal Reserve interest rate cuts. Additionally, a surge in inflation has led to a rally in the US Dollar and rise in the US Treasury yields, putting pressure on risk assets like cryptocurrencies. However, losses were limited after US President Donald Trump signed a memo ordering his administration to draw up a plan for reciprocal tariffs, pausing its proposed start this week. The tariffs would begin in April and could negatively impact investor sentiment going into Q2.

In major news, crypto exchange Coinbase reported a net income of US$1.29 billion in the fourth quarter, while its US$2.2 billion net revenue comfortably surpassed industry estimates.

|

|

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|