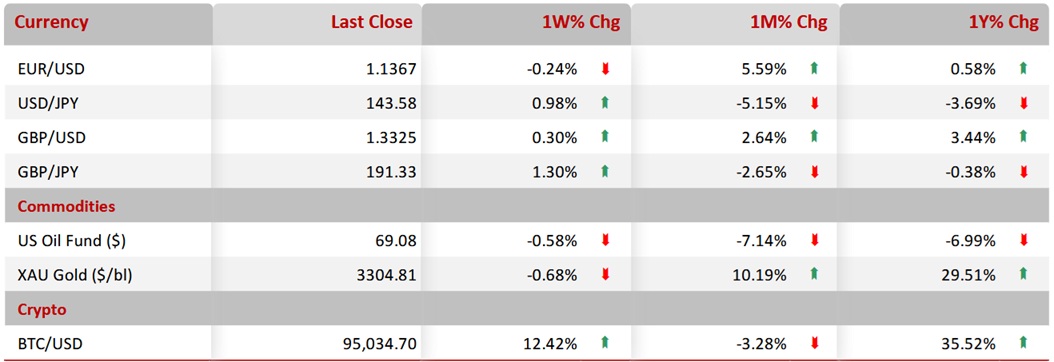

| |

| Market Update |

| |

|

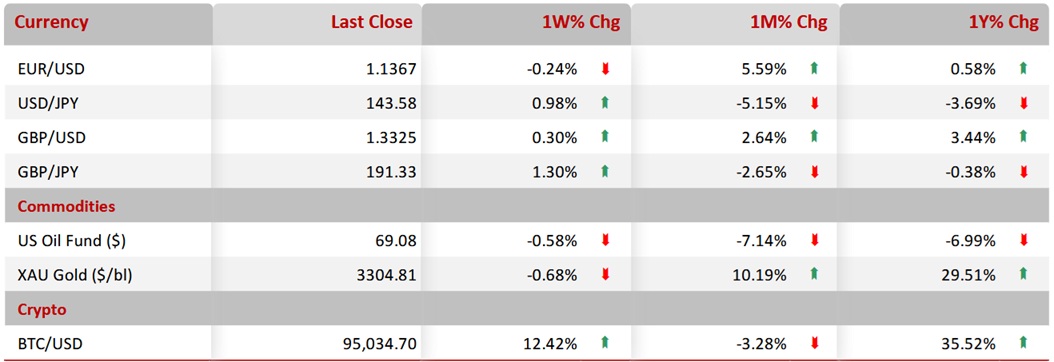

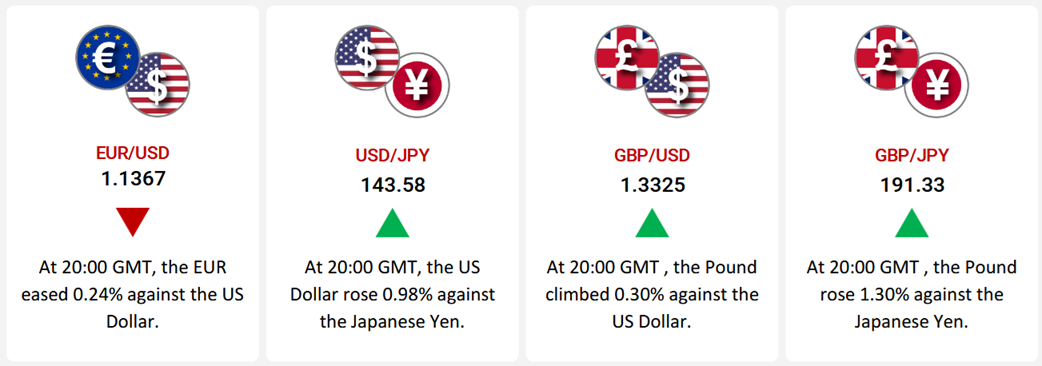

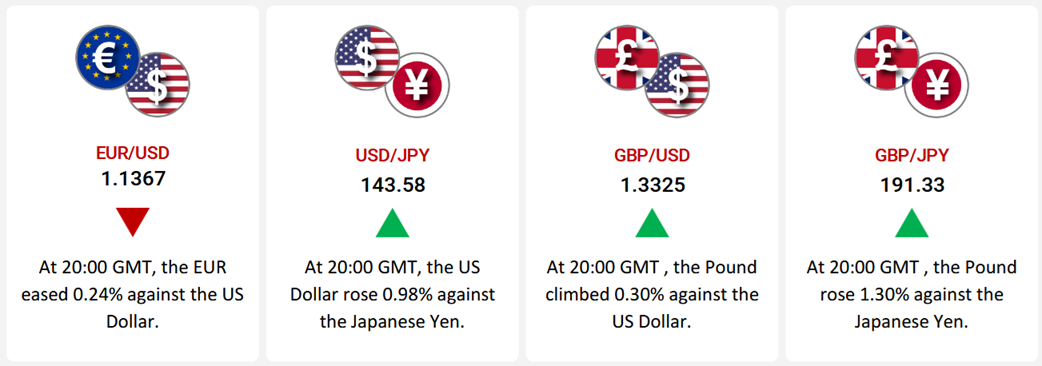

The euro weakened 0.24% against the dollar this week, weighed down by weaker Eurozone economic data and trade concerns. Consumer confidence dropped in April, while ECB President Lagarde warned that redirected Chinese exports could pressure European prices. Business activity slowed, with services contracting amid weak demand. In contrast, US manufacturing and housing data improved, supported by lower borrowing costs and optimism over US-China trade talks, boosting the dollar.

The dollar rose 0.98% against the yen, as strong US economic data contrasted with Japan's ongoing struggles. US housing and manufacturing sectors showed resilience, while Japan’s manufacturing contracted for the tenth month, business sentiment weakened, and Tokyo’s CPI highlighted stubborn inflation.

The pound gained 0.30% against the dollar, supported by strong March retail sales. However, this momentum was offset by declining consumer confidence and slowing business activity, with composite PMI slipping into contraction. In the US, jobless claims rose, and consumer sentiment weakened amid renewed trade policy uncertainty.

Sterling also rose 1.30% against the yen, as Japan’s weak economic indicators weighed on the yen. Japan’s persistent trade uncertainty and flat tertiary industry index signaled softer domestic demand, boosting GBP/JPY.

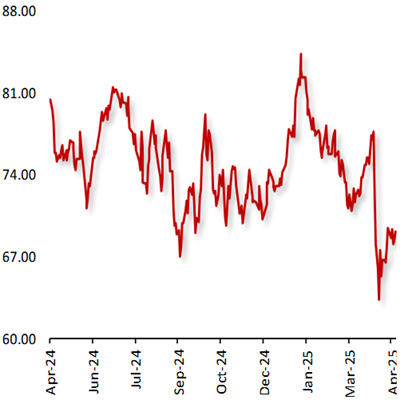

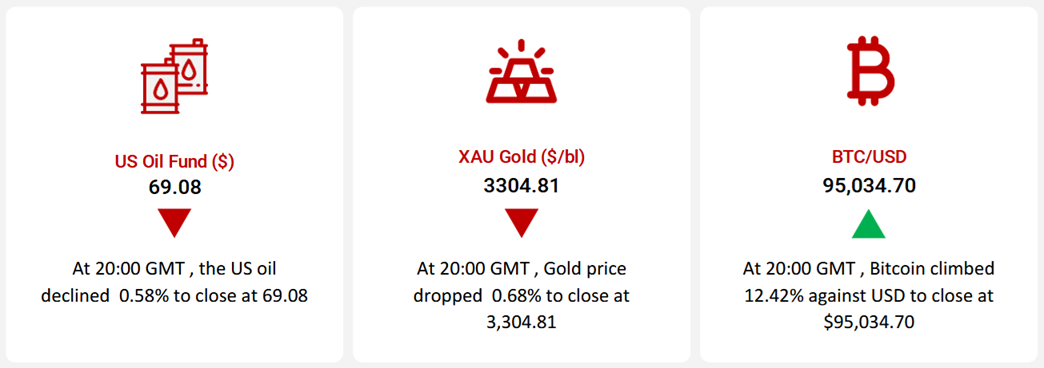

Oil prices fell, pressured by expectations of an OPEC+ output increase and progress in US-Iran nuclear talks. US crude inventories also rose, while demand outlook remained cautious pending US-China trade developments.

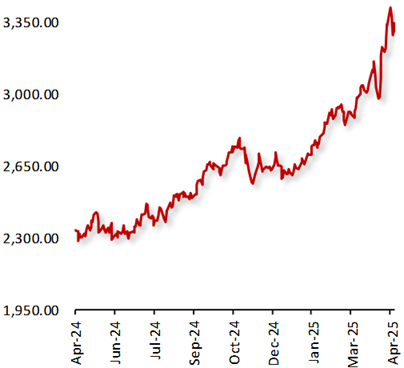

Gold prices declined as easing US-China trade tensions reduced safe-haven demand. Hopes that China might lift tariffs on some US goods and reassurances regarding US Fed leadership bolstered risk appetite, weakening gold.

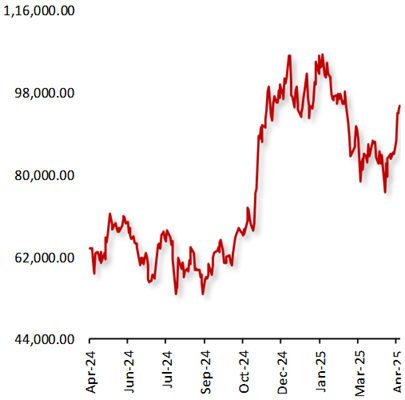

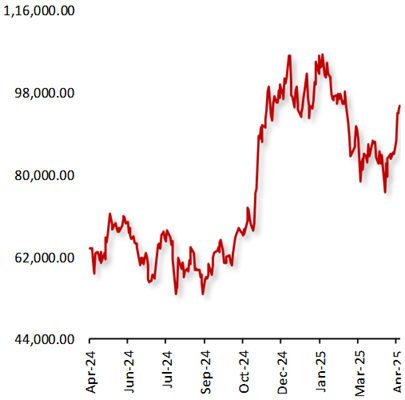

Bitcoin advanced, benefiting from a weaker dollar and positive trade news. President Trump's tariff rollback signals and Fed comments boosted sentiment. Meanwhile, Bitdeer secured $60 million to expand mining operations, and Coinbase explored a US federal bank charter.

|

| |

|

|

Key Global Commodities |

|

| |

| |

| |

|

| |

|

|

EUR/USD |

|

|

Euro Weakens Against Dollar Amid Weaker Demand and Heightened Global Trade Risks |

|

| |

|

|

The EUR declined by 0.24% this week, weighed down by weaker-than-expected domestic economic data and heightened trade concerns.

In the Eurozone, consumer confidence fell more than expected in April, reflecting growing unease about economic momentum amid looming US tariffs. Additionally, European Central Bank (ECB) President Christine Lagarde warned that US tariffs on Chinese goods could have a disinflationary effect in Europe if redirected exports flood the market. Additionally, business activity weakened in April, with the services sector contracted amid weak demand and economic uncertainty. The slowdown worsened due to weak confidence and US trade policy concerns.

Conversely, in the US, the S&P global manufacturing activity showed signs of improvement in April, with the sector returning to expansion amid stronger new orders and production. Moreover, sales of new single-family homes rose more than expected in March, amid a rush by buyers to benefit from lower mortgage rates.

|

|

| |

| |

| |

|

|

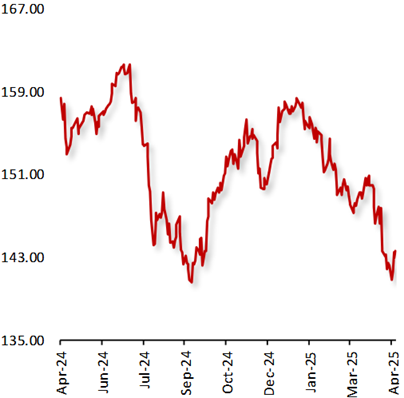

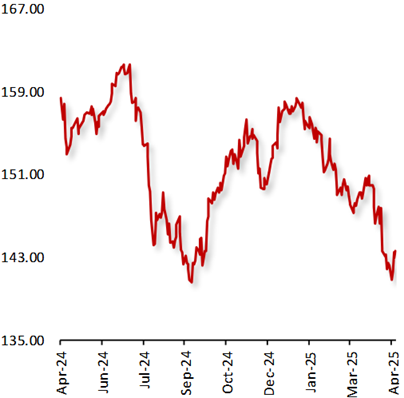

USD/JPY |

|

|

Dollar Strengthens Against Yen Amid Weak Japanese Economic Data |

|

| |

|

|

The USD rose 0.98% against the JPY, driven by strong US economic data and weakness in Japan’s manufacturing and services sectors.

In the US, housing market saw stronger-than-anticipated demand in March, as lower mortgage rates prompted a surge in new single-family home purchases. The decline in borrowing costs gave the market a temporary lift. Furthermore, manufacturing activity also picked up in April, with S&P Global data indicating a return to expansion driven by an increase in new orders and improved production levels.

On the other hand, Japan’s manufacturing activity contracted for the tenth consecutive month in April, amid a sharp decline in new orders driven by rising concerns over US tariff policies. The growing trade uncertainty has continued to weigh on business sentiments. Furthermore, the tertiary industry index showed no growth in February, suggesting a slowdown in momentum within the services sector and hints at easing domestic demand.

|

|

| |

| |

| |

|

|

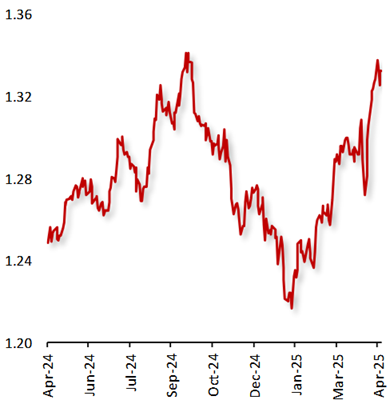

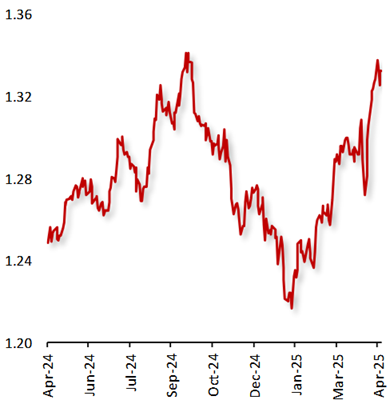

GBP/USD |

|

|

Pound Rises on Strong Retail Sales Despite Economic Headwinds |

|

| |

|

|

The GBP rose 0.30% against the USD this week, buoyed by unexpectedly strong retail sales in March.

In the UK, retail sales unexpectedly rose in March, marking the strongest first quarter since 2021, driven by improved weather that encouraged spending on clothing and outdoor goods. Moreover, manufacturing orders improved in April. However, this momentum was offset by a sharp drop in GfK consumer confidence, which fell to its lowest since Nov 2023 amid rising costs and US tariff worries.

Meanwhile, in the US, the S&P Global Composite PMI declined in April, suggesting slower overall business activity. Moreover, services PMI fell in April, highlighting waning demand. Additionally, the US initial jobless claims rose to 222,000 in the week ended 18 April 2025. Adding to the negative sentiment, the Richmond Fed manufacturing index plummeted more than expected in April. The Michigan consumer sentiment index fell in April amid trade policy uncertainty and renewed inflation fears.

|

|

| |

| |

| |

|

|

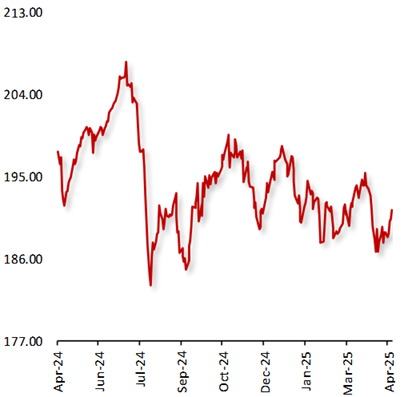

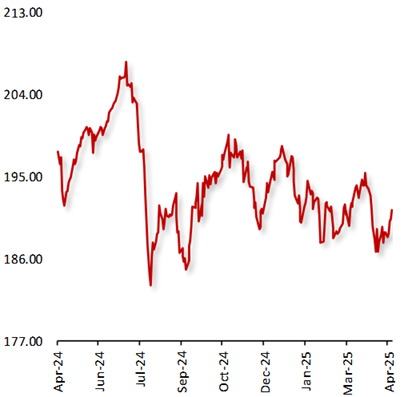

GBP/JPY |

|

|

Sterling Rises Against Yen Amid Weak Japanese Economic Data |

|

| |

|

|

The GBP rose by 1.30% against the Yen this week, despite disappointing UK economic indicators, as Japan's continued economic struggles weighed on the yen.

In the UK, retail sales unexpectedly rose in March, marking the strongest first quarter since 2021, driven by improved weather that encouraged spending on clothing and outdoor goods. However, this positive momentum was overshadowed by a sharp decline in GfK consumer confidence in April, as GfK index fell to its lowest since Nov 2023 amid rising costs and US tariff concerns.Meanwhile, Business activity weakened as composite PMI contracted, with services at a two-year low and manufacturing at a 20-month low.

In contrast, Japan's manufacturing sector contracted for the tenth consecutive month in April, as new orders declined sharply amid mounting concerns over US tariff policies. The ongoing trade uncertainty has dampened business sentiment. Additionally,

|

|

| |

| |

| |

|

|

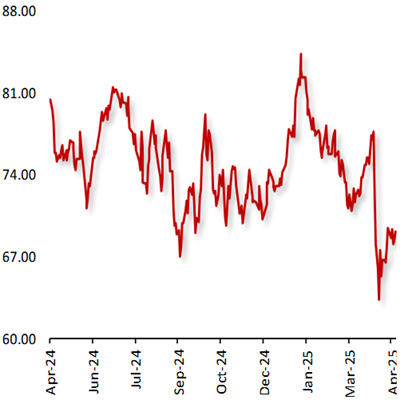

US Oil Fund ($) |

|

|

Oil Prices Decline on Potential OPEC+ Output Increase |

|

| |

|

|

Oil prices declined this week, amid speculations that the OPEC+ would accelerate its oil production for a second consecutive month in June and as signs of progress in nuclear talks between the US and Iran eased fears over supply disruption. Additionally, the Organization of the Petroleum Exporting Countries and allies (OPEC+) is scheduled to raise output by 144,000 barrels per day in May. Also, the US Energy Information Administration (EIA) reported that crude oil inventories rose by 244,000 bls to 443.1mn bls in the week ended 18 April 2025. Meanwhile, the oil demand outlook remains uncertain as investors await further developments in the US-China trade negotiations.

|

|

| |

| |

| |

|

|

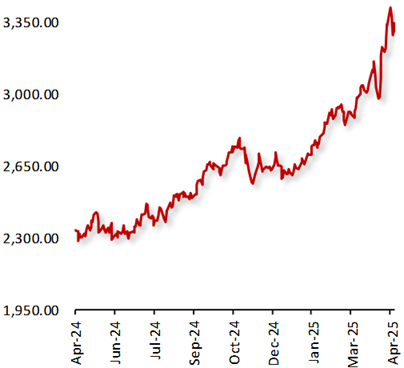

XAU Gold (XAU/USD) |

|

|

Gold Declines Amid Hopes Surrounding De-escalation in US-China Trade Tensions |

|

| |

|

|

Gold prices dropped this week, as signs of easing trade tensions between the US and China, dented demand for the safe haven metal. Reports indicated that, China is considering the suspension of its 125% tariff on certain US imports, including medical equipment, ethane, and aircraft leasing, raising hopes for improved trade relations, prompting investors to shift toward riskier assets.

Additionally, US President Donald Trump signaled that he had no plans to remove US Federal Reserve chair, Jerome Powell from his position and hinted at progress in tariff negotiations with China. These developments boosted investor confidence, reduced uncertainty, and further weakened the appeal of gold as a defensive investment.

|

|

| |

| |

| |

|

|

BTC/USD |

|

|

Bitcoin Advances Amid Signs of Progress in US-China Trade Negotiations |

|

| |

|

|

Bitcoin climbed this week, amid weakness in the US Dollar and as optimism surrounding de-escalation of the US-China trade tensions, boosted demand for the riskier assets like cryptocurrencies. Additionally, President Trump indicated that proposed 145% tariffs on Chinese goods would eventually be lowered and also hinted that he has no plans to remove Federal Reserve (Fed) chair, Jerome Powell from his position, easing worries surrounding the central bank’s autonomy and further boosting investor sentiment.

In major news, Bitdeer has secured $60 million in funding to boost ASIC (Application-Specific Integrated Circuit) production and scale up its self-mining operations. Meanwhile, major crypto exchange, Coinbase has confirmed that it is exploring the possibility of applying for a US Federal Bank charter.

|

|

| |

| |

|

|

Key Global Currencies and Commodities |

|

| |

| |

| |

| Currency |

| |

|

| |

| Commodities & Crypto |

| |

|

| |

|

| |

|

|