Economic Overview

Markets wobbled early last week, with investors digesting a flood of worrying headlines around trade tensions and policy uncertainty. The Fed’s latest Beige Book didn’t help the mood, describing “pervasive” unease among businesses and pointing to flat economic activity as firms braced for higher costs. It wasn’t long before risk-off sentiment took hold – gold prices rallied, government bonds strengthened, and equities gave back some of the gains from the previous week.

Mid-week, the tone changed. News that the US administration was considering dialling back tariffs on Chinese imports offered a welcome reprieve, hinting at possible de-escalation in the trade war. President Trump’s public support for Fed Chair Jerome Powell added further calm, easing fears around central bank independence at a delicate time for markets.

Stronger-than-expected earnings reports added another layer of support. Companies across the US and Europe broadly outperformed forecasts, reinforcing the view that fundamentals remained solid even as external risks lingered.

By Friday, investors were balancing cautious optimism with lingering scepticism – relieved that worst-case scenarios might be avoided, yet wary about whether policymakers would follow through. Markets moved from fearing an imminent crisis to settling into a more watchful, measured stance.

Equities, Fixed Income, and Commodities

Equity and bond markets staged a cautious relief rally last week as trade tensions cooled and central banks maintained supportive tones.

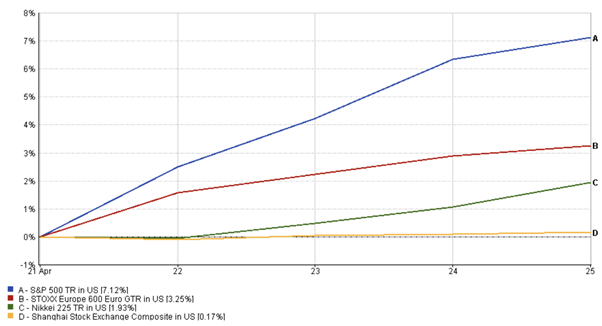

In the US, the S&P 500 rebounded to provide a 7.12% last week, reversing part of the previous week's losses, helped by strong earnings and a softer stance from Washington that lifted investor sentiment. European equities also gained ground, with the STOXX 600 rising 3.25%, supported by robust corporate results and momentum from the ECB’s recent rate cut. Performance across Asia was more mixed. Japan’s Nikkei 225 climbed 1.93%, though gains were tempered by a stronger yen that pressured exporters.

Meanwhile, China’s Shanghai Composite advanced 0.17%, fluctuating through the week as investors weighed signs of tariff relief against lingering trade uncertainties.

S&P 500, STOXX 600, Nikkei 225, Shanghai Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 25 April 2025.

On the bond side, Treasuries rallied, sending the 10-year US yield down about 10 basis points to around 4.25%. Investors initially sought refuge in safe assets early in the week, driving Treasury prices higher and yields lower, before shifting focus to a more patient Fed outlook. European bond yields mirrored this trend, drifting down as dovish expectations around the ECB persisted.

In commodities, gold prices surged early on renewed safe-haven demand, briefly trading near $3,310/oz, but eased later as market sentiment improved, finishing the week slightly off highs. Oil prices followed a volatile path, weakening first amid lingering concerns over global demand but finding support later after US inventory data showed stronger consumption and optimism around trade talks lifted broader risk appetite.

In short, risk assets recovered toward the end of the week, while safe-haven flows – including into gold and government bonds – moderated as investor confidence slowly returned.

Sector Performance Updates

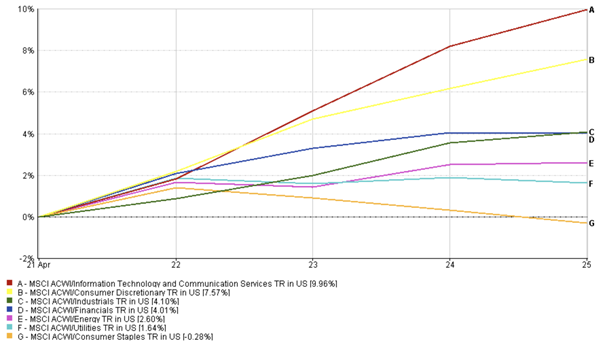

Sector leadership shifted sharply during the week as investors navigated changing risk sentiment. Early in the week, defensive sectors such as consumer staples, utilities, and healthcare outperformed, as investors braced for potential trade disruptions. Companies with stable revenue streams and lower exposure to global supply chains, like supermarkets and pharmaceutical firms across the US and Asia, attracted steady inflows, reflecting a preference for safety during the initial bout of market volatility.

However, sentiment began to shift mid-week. As trade fears eased and corporate earnings offered reassuring signals, investors rotated back into growth-sensitive areas. Technology stocks led the rebound, with the sector rising to about 9.96% for the week, helped by strong results from major players like Alphabet and Intel. Consumer discretionary names also returned around 7.57% during the week, supported by upbeat retail earnings and hopes that tariff pressures would ease. Industrials advanced as well, adding approximately 4.1% last week, with conglomerates providing reassurance around cost management despite external headwinds.

Financials extended their upward momentum, climbing around 4.01% for the week, buoyed by solid loan growth figures and steady credit quality trends reported by major US banks. Energy stocks, which struggled earlier alongside softer oil prices, rebounded (with a 2.60% return last week) later in the week as crude markets stabilized. Utilities and staples lagged in the latter half, reflecting investors rotating back into growth-sensitive areas, with a positive 1.64% and 0.28% negative returns respectively.

Overall, the week witnessed a shift from defensive safety to a cautious embrace of growth sectors.

Sector Winners and Losers: Weekly Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 25 April 2025.

Regional Market Updates

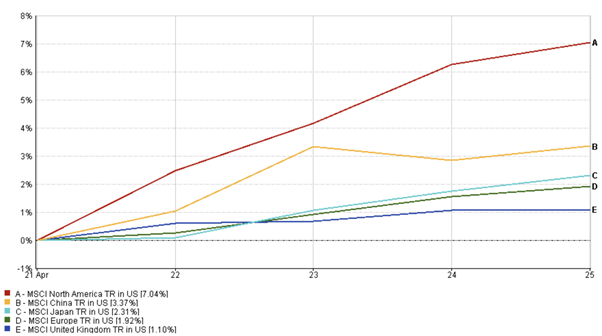

U.S. stocks regained modest momentum last week, with the MSCI North America index rising about 7.04%, recovering some of the ground lost during the previous pullback. Solid corporate earnings, particularly from the technology and financial sectors, combined with easing trade tensions, helped lift sentiment. However, caution remained in the background, as softer economic indicators reminded investors that growth risks had not fully disappeared.

European markets extended their gains, buoyed by strong earnings and lingering tailwinds from the ECB’s rate cut. The MSCI Europe index posted modest weekly advances (1.92%), helped by positive surprises from consumer and industrial giants. However, concerns around global trade remained a brake on further upside.

Asia-Pacific markets were mixed. Japan’s Nikkei 225 edged higher, though a stronger yen capped gains for exporters. The MSCI China index (3.37%) wavered through the week, initially pressured by tech export restrictions but recovering late on hopes for tariff relief.

Overall, international equities outperformed cautious but stabilizing US markets.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 25 April 2025.

Currency Market Movements

Currency markets reflected shifting risk sentiment over the course of the week.

EUR/USD started firm, trading near 1.14 early on as softer US data and risk aversion favoured the euro. However, optimism returned mid-week, driven by signs of easing trade tensions and better-than-expected corporate earnings, helping the dollar regain strength. The pair edged lower, finishing around 1.1345 by Friday.

USD/JPY saw early strength in the yen, with safe-haven flows pushing the pair down to a low of 139.88 by Tuesday. But as equities rebounded and risk appetite improved, the dollar recovered sharply, lifting USD/JPY to close near 143.67.

GBP/USD remained relatively stable, supported by strong UK retail sales and a steady inflation backdrop. Sterling traded in a narrow band between 1.3264 and 1.3295, showing resilience even as the dollar regained ground later in the week.

GBP/JPY tracked broader risk appetite shifts. After an initial dip, the pair steadily advanced as optimism returned to markets, closing at 191.28, driven by both pound strength and unwinding yen demand.

Overall, currencies moved from early risk-off positioning to a more risk-on environment by week’s end.

Market Outlook and The Week Ahead

As markets head into May, cautious optimism remains intact, tempered by ongoing concerns around growth and policy direction.

The coming week’s spotlight will fall on the US advance estimate of first-quarter GDP growth. Consensus forecasts point to a modest expansion of around 1.5% but any significant downside surprise could quickly revive fears of an economic slowdown. Conversely, a stronger print would bolster confidence in the economy’s underlying resilience and offer fresh support to equity markets.

Attention will also turn to the Fed’s policy meeting on May 7. No rate changes are expected, but investors will be closely watching the Fed’s language for any shifts around inflation, growth risks, or trade-related uncertainty. Even small changes in tone could ripple across bond and currency markets.

Meanwhile, earnings season continues in full swing, with nearly 60% of S&P 500 companies due to report. Results from major tech and consumer names will be pivotal in sustaining the current recovery momentum.

Geopolitical developments remain a wildcard. Markets are watching closely whether US-China tariff negotiations produce formal easing measures or stall again. European inflation data and BoE’s next moves will also be in focus.

For now, markets appear to have stabilized for now, but the week ahead will test whether optimism can transition into sustained confidence or falter under renewed pressure.

Stay tuned with EC Markets as we continue to break down the moves that matter.