Economic Overview

Another week, and another uncertain market environment. While the week started vigilantly, sentiment slightly improved by Friday, because of softer US inflation data and a more nuanced tone from the US administration regarding its recently proposed tariffs.

Earlier during the week, the Biden administration introduced a 90-day pause on its controversial reciprocal tariff plan – but only for countries that chose not to impose retaliatory measures. Notably, China was excluded from this concession. Instead, the tariff burden on Chinese imports rose sharply to 145%, and Beijing responded in kind, lifting tariffs on US goods to 125%. These developments fueled renewed anxiety around global trade disruptions and the risk of long-term decoupling between the two largest economies – the US and China!

Yet despite the tense headlines, last week painted a more balanced picture by the end of the week. The US Consumer Price Index (CPI) for March came in at a year-over-year increase of 2.4%, slightly below market anticipation and a signal that inflation may be improving – though not convincingly enough for the Fed to relax entirely. Markets reacted positively, with risk assets springing back midweek, supported by the possibility that the Fed could begin considering rate cuts if inflation trends continue to diminish.

Equities, Fixed Income, and Commodities

Equity markets staged a notable recovery over the week, overcoming early jitters driven by trade tensions. Led by tech and growth sectors, major indices saw a sharp rebound. The S&P 500 rose to 5.96%, the Dow Jones Industrial Average rose to 5.93%, and the NASDAQ Composite rose to 7.30%. Majority of the indices have significant allocation to the tech sector which regained its momentum over the last week, hence the indexes’ positive performances. The positive returns reflected a mix of stable macro data, improving inflation conditions, and investor confidence that trade tensions may not spiral further.

On the bond side, the 10-year Treasury yield slipped to 3.85%, down from 3.99% last week. That dip came after the inflation data dropped, and investors figured the Fed might be easing off the gas pedal a bit. Markets are now pricing in a higher probability of a rate cut later this year, should inflation remain on a downward path.

Commodities were a mixed bag last week. Gold? Still shiny. It climbed above $2,050 as people got jittery about global trade dynamics and started clinging to safe havens.

Oil markets, however, struggled to find direction. Brent crude hovered around $82 per barrel, waiting for clearer signals on China and global demand.

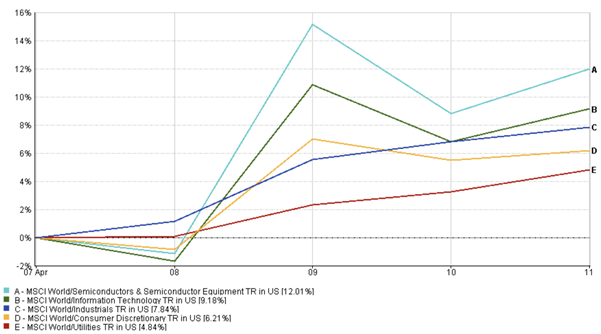

Sector Performance Updates

In terms of sector performance, technology stocks crushed it last week with 9.18% returns, buoyed by strong early earnings and a general sigh of relief that inflation may finally be losing its grip. Key semiconductor and software names saw increased flows (a return of 12.01% over the last week), driven by both fundamentals and the ongoing AI wave.

Contrary to last week, industrials and consumer discretionary sectors displayed solid gains, 7.84% and 6.21% respectively, reflecting improved investor confidence in cyclical sectors. Contrary to that, utilities underperformed compared to other sectors as risk appetite improved, causing a rotation out of traditionally defensive segments.

One notable trend was the relative outperformance of small-cap and mid-cap equities versus large caps. This move could be a sign that risk appetite is creeping back in, although cautiously.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 11 April 2025.

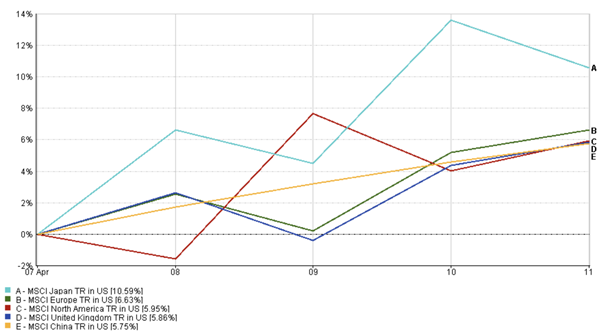

Regional Market Updates

Japan took the spotlight last week, surging 10.59% as a weaker yen boosted exporters and investors responded positively to upbeat earnings. The rally also drew strength from foreign capital inflows, fueled by growing speculation that the Bank of Japan may be inching toward policy normalisation – a shift that’s long been anticipated but rarely confirmed.

Across Europe, markets climbed 6.63%, helped by expectations that the European Central Bank could soften its stance in the upcoming meeting. It’s giving people a reason to lean back into riskier bets.

In North America, the MSCI index gained nearly 6%, powered by tech and consumer strength. The UK saw a similar bump – 5.9% – as money rotated into undervalued names in the FTSE 100.

China’s market, often viewed as the laggard in recent weeks, also saw a recovery. The market gained 5.75% last week, driven by local policy support and hopes of stabilization in key sectors, despite ongoing concerns over the tariff standoff with the US.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 11April 2025.

Currency Market Movements

The EUR/USD pair moved higher, from 1.0850 to 1.0950, implying strengthening of the euro against the dollar last week. The move reflected a softer dollar midweek and growing expectations that the ECB could adopt a more dovish tone by early summer – especially if inflation data continues to cool across the region.

Meanwhile, the USD/JPY pair slipped to 149.00. The shift was driven by falling US yields and a renewed tilt toward safe-haven currencies. Hints of a potential policy tweak from the BoJ added further support, reinforcing the yen’s midweek momentum.

The GBP/USD pair remained within its recent range, ending the week near 1.2950, as traders weighed stable UK economic data against broader USD volatility.

The GBP/JPY pair saw heightened activity, briefly testing resistance near 195.00 before pulling back to end around 194.00. The pair remains technically poised, with directional momentum likely to hinge on this week’s macro data.

Market Outlook and The Week Ahead

While last week ended on a calmer note, the US-China tensions aren’t going anywhere fast, and investors know it. Everyone’s still cautious, and any optimism feels very... conditional. Will this rally last? That’s what markets will test next week with CPI data in focus.

US Retail Sales to be published on April 15 will form a crucial barometer for the health of the US consumer. This could either calm recession fears or stir them up again.

The ECB Meeting on April 17 will provide clues on its inflation outlook and policy direction. If they start sounding dovish, that could shake things up.

Q1 Corporate Earnings will provide insight into how businesses are managing inflation, cost pressures, and global demand fluctuations as the new earnings season unfolds.

Whether this resilience holds depends on next week’s earnings flow. But with plenty of variables like trade policies, central bank decisions, and earnings surprises, volatility remains the only constant.

For investors, the message is clear – diversification is key, closely monitor data, and don’t get too comfortable. Flexibility and discipline remain the cornerstones for navigating a fast-changing market environment.

For more insights and real-time analysis, follow EC Markets.