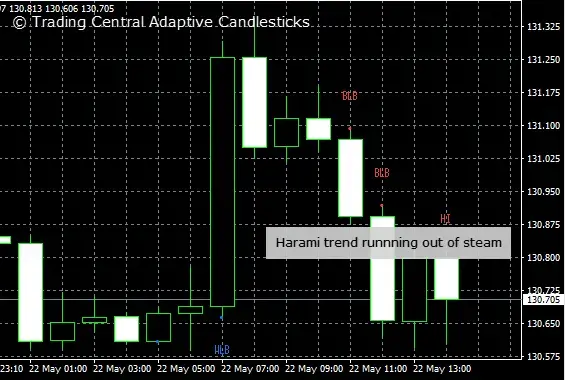

Labels guide you in spotting trading opportunities: ↑ (long), LX (long exit), ↓ (short), SX (short exit). These signals are generated based on the status of all ADC components, including price lines, indicators, and oscillators. While these components are derived from the same adaptive “window” of market data, they maintain a degree of independence, allowing Trading Central to make decisions based on the weight of evidence.