Economic Overview

Markets had another eventful week, trying to build on the optimism from last week’s tech rally and easing inflation signs. Hopes were high early on after the US temporarily removed new tariffs on smartphones and laptops. That gave investors a reason to stay upbeat, especially with strong earnings from major US banks adding momentum.

But the mood quickly shifted. US retail sales for March came in softer than expected, raising doubts about how strong the consumer really is. Meanwhile, Powell stuck to a cautious tone, warning that rising tariffs could hurt both inflation and growth. That cooled expectations for any quick interest rate cuts.

In Europe, the ECB followed through with a 0.25% rate cut – widely expected – to support its economy amid trade concerns. President Lagarde kept the door open for more, but didn’t fully commit. Over in Asia, China posted better-than-expected GDP growth at 5.4%, yet markets didn’t celebrate much. Fresh US export bans on Chinese tech firms weighed heavily on sentiment.

By the end of the week, investors were left juggling signs of resilience with rising geopolitical risk. There’s a growing sense that policymakers may need to do more to steady the path ahead.

Equities, Fixed Income, and Commodities

Global stocks took a breather last week, giving back some of the gains from the tech-led rally. In the US, the S&P 500 fell around 1.5%, and the Nasdaq dropped 2.6% as trade worries returned. While markets initially rallied on news of temporary tariff relief and strong bank earnings, things turned mid-week when the US imposed new restrictions on chip exports to China. That hit tech stocks hard. Still, losses were limited by week’s end, with investors hoping central banks might step in to cushion the blow.

Europe fared better. The ECB’s rate cut and tariff exemptions on some European goods helped boost confidence. The STOXX 600 rose early in the week and held onto gains. In Asia, the picture was mixed – Japan’s Nikkei finished flat, while China’s markets fell as trade tensions overshadowed strong GDP numbers.

Bond markets rallied as investors sought safety. US 10-year yields fell to 4.32%, while short-term yields dropped even more, hinting at hopes for a Fed rate cut. In Europe, yields also slid ahead of the ECB meeting.

Gold continued to shine, hitting record highs near $3,300. While gold benefited from risk aversion and falling yields, oil struggled as weaker global demand projections outweighed any geopolitical supply fears.

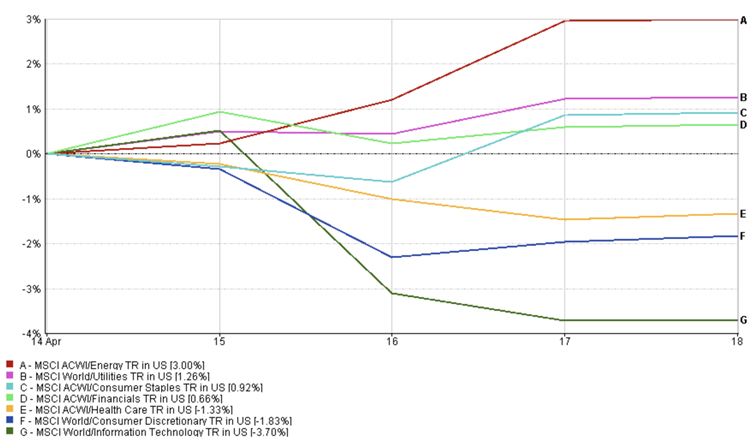

Sector Performance Updates

Sector leadership shifted sharply as markets tried to make sense of mixed signals. Early in the week, tech and consumer discretionary stocks rallied as tariff exemptions for electronics and autos sparked hope that trade tensions might ease. Apple and Dell jumped on relief buying. But that optimism faded fast. The US tightened chip export rules mid-week, which hit semiconductors hard – Nvidia plunged after a surprise inventory write-down, and investors quickly reassessed tech's near-term outlook. Tech and consumer discretionary provided a negative 3.7% and 1.83% returns respectively during the last week.

On the flip side, defensive sectors like consumer staples and healthcare gained traction. With geopolitical risks rising, investors rotated into companies less exposed to global trade – especially in Asia, where local consumer names are seen as more insulated. Supermarket stocks in China and Japan rallied on that logic. These sectors tend to hold up better when uncertainty rises, as their revenues are less dependent on global trade or economic cycles.

Financials outperformed, helped by better-than-expected earnings from major US banks. Strong balance sheets and stable loan demand reassured investors at a time when most sectors were under pressure. Energy and utilities performed well, returning 3% and 1.26% respectively.

Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 18 April 2025.

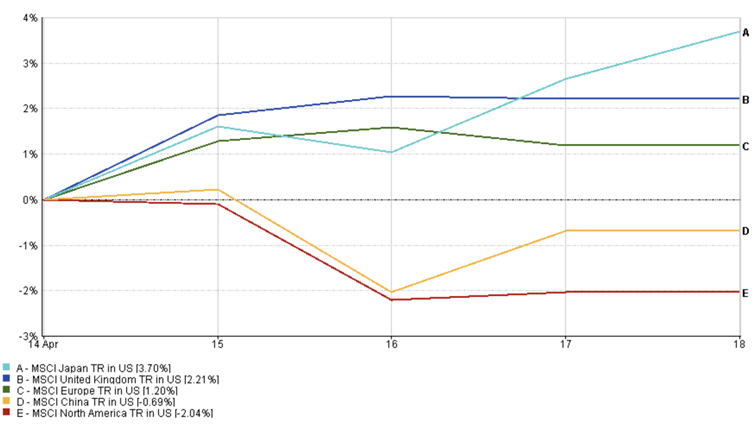

Regional Market Updates

US stocks paused after a strong two-week run. The MSCI North American index performed negatively (2.04%) as tech shares came under pressure from fresh chip export restrictions on China. Still, strong earnings from major banks helped limit the damage, keeping the pullback from turning into a full-blown correction. Investors remained cautious as soft retail sales and ongoing trade tensions clouded the outlook.

European markets outperformed (1.2%), helped by tariff relief and the ECB’s rate cut.

Japan provided 3.7%, led by strong auto stocks on optimism around tariff exemptions and earnings, though gains were capped by a stronger yen, which typically weighs on exporters’ overseas revenues.

China lagged (-0.69%) despite stronger-than-expected GDP growth at 5.4%. Markets largely shrugged off the data, instead focusing on rising trade risks. US export restrictions on Chinese tech and pharma firms, combined with Beijing’s halt on Boeing deliveries, weighed on sentiment and raised fresh concerns about near-term corporate earnings.

Regional Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 18April 2025.

Currency Market Movements

Currency markets reflected a cautious shift in sentiment last week as investors responded to mixed signals on inflation, growth, and global trade. The euro gained ground, with EUR/USD rising from 1.1313 to 1.1391, supported by the ECB’s rate cut and softer US data that weighed on the dollar. Markets began pricing in diverging policy paths, with the Fed staying patient while the ECB made its first move.

The Japanese yen strengthened, pushing USD/JPY down to 142.17. Risk-off flows and falling U.S. bond yields drove demand for the yen, which remains a safe-haven currency during global uncertainty – especially amid deepening U.S.-China tensions.

The British pound also rallied, with GBP/USD finishing at 1.3294. Strong UK retail sales and steady inflation data helped reinforce expectations that the Bank of England may not need to ease as aggressively as peers.

Against the yen, however, GBP/JPY slipped to 189.00, as the pound’s strength was offset by a bigger move in the yen. This cross reflected the broader risk-averse tone in markets and shifting rate expectations globally.

Market Outlook and The Week Ahead

Markets head into the final full week of April walking a fine line between resilience and caution. Key data releases – especially global PMI surveys – will show whether business activity is holding up in the face of trade tensions. A strong showing could calm nerves, but any weakness may quickly reignite volatility. In the US, the Fed’s Beige Book will offer a ground-level look at how consumers and businesses are coping, just ahead of the central bank’s May policy meeting.

All eyes will also be on corporate earnings. Big names in tech, consumer goods, and manufacturing are reporting – and after last week’s mixed signals from Netflix and Nvidia, investors want to see whether companies can still grow despite supply chain hiccups and margin pressures. Solid results could keep markets steady. Disappointments, especially tied to tariffs or demand slowdowns, could drag sentiment.

Geopolitics remains the wildcard. Any flare-up in the US–China trade dispute could shift markets fast. Meanwhile, investors will assess whether the ECB’s rate cut was enough, how the BoE responds to cooling inflation, and whether Japan’s central bank may pivot later this month.

For now, cautious optimism rules. But in a headline-driven market, staying nimble is key.

Stay tuned with EC Markets as we continue to break down the moves that matter.