| |

| Market Update |

| |

|

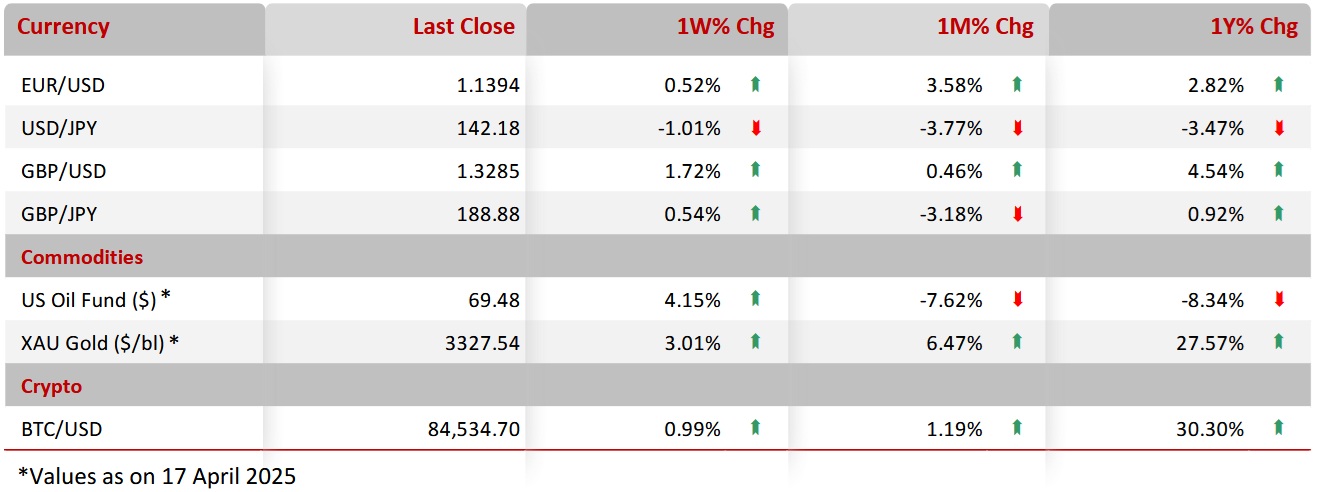

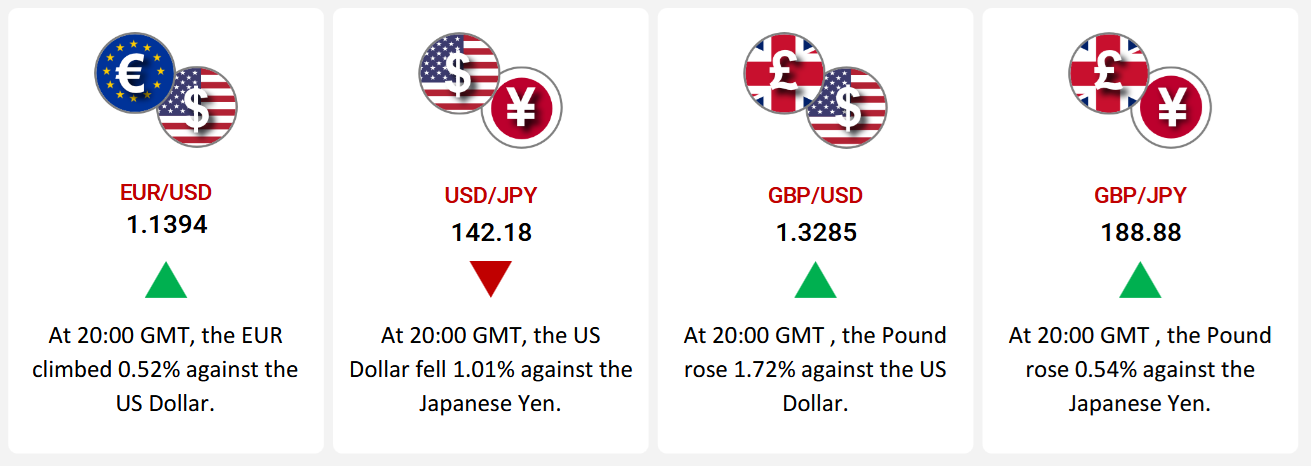

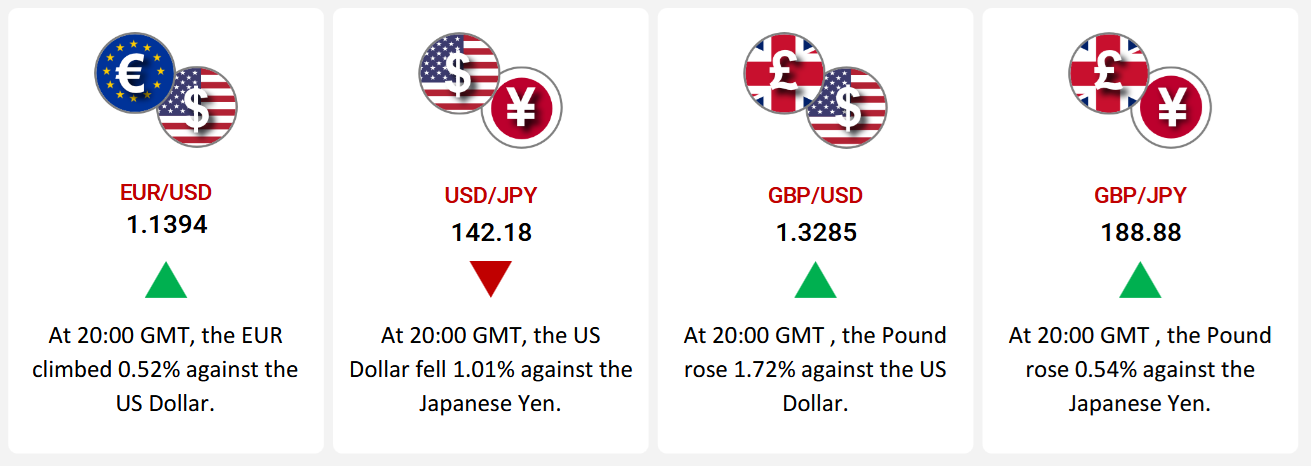

The Euro strengthened against the US Dollar, rising 0.52%, supported by stronger-than-expected Eurozone industrial output and stable inflation. Optimism grew as industrial production rebounded in February, suggesting a possible end to the sector’s prolonged slump. Meanwhile, the European Central Bank cut interest rates by 25 basis points to support the economy amid lingering trade tensions. Conversely, weak US industrial data, falling capacity utilization, and a drop in mortgage applications reflected a softening US economy, despite slightly improving jobless claims.

The US Dollar weakened further against the Japanese Yen, falling 1.01% amid disappointing US economic data. In contrast, Japan posted strong core machinery orders and an expanding trade surplus in March, bolstering investor confidence. However, Japan's inflationary pressures remain a concern, as consumer prices continued to rise.

The British Pound rose sharply against the US Dollar, up 1.72%, driven by resilient UK economic data. Retail sales outperformed expectations, while steady unemployment and robust wage growth pointed to labour market strength. However, these factors may complicate the Bank of England’s policy decisions. Simultaneously, weak US industrial and housing data added further pressure on the greenback.

The Pound also gained 0.54% against the Yen, as UK retail and labor market data outshone Japan’s weaker industrial production and capacity utilization figures.

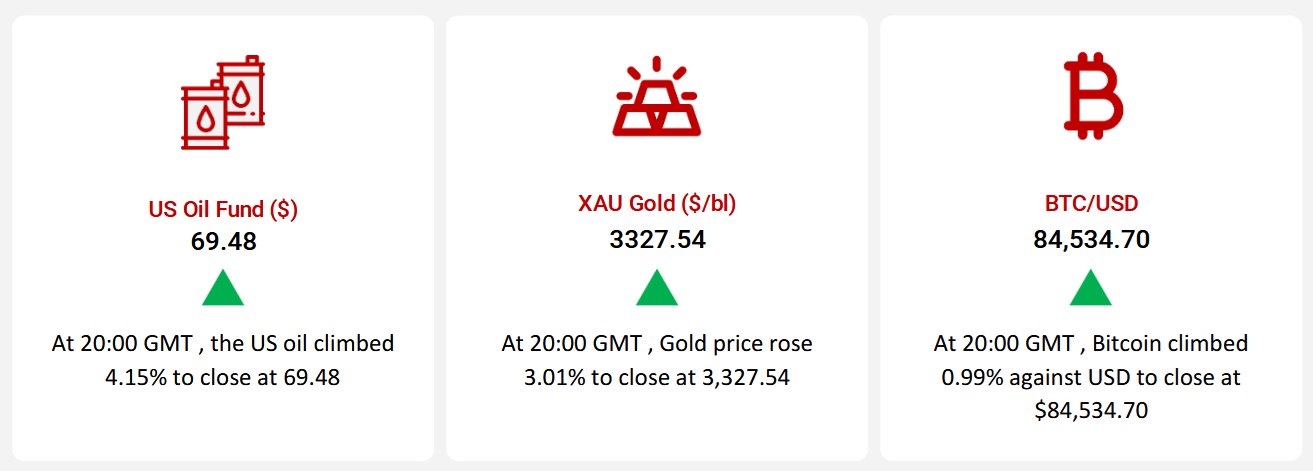

Oil prices rising due to tightening supply fears, including renewed US sanctions on Iran and OPEC+ production cuts. China’s increased crude imports also supported prices.

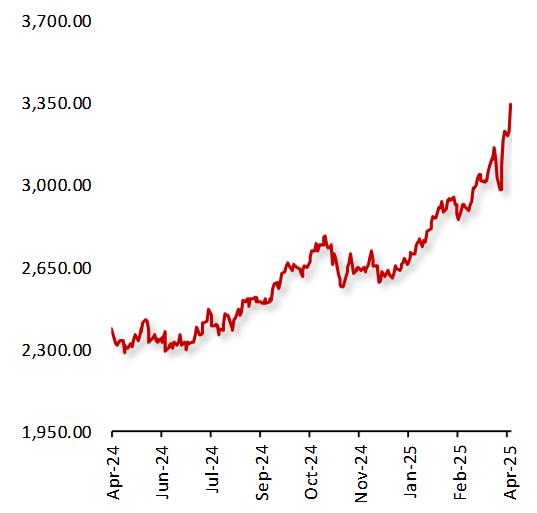

Gold prices climbed, driven by US Dollar weakness and growing US-China trade tensions. Fed Chair Powell’s inflation warnings further boosted gold’s safe-haven appeal.

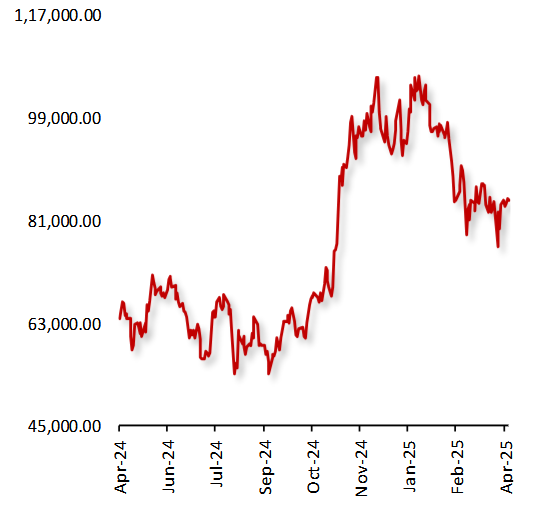

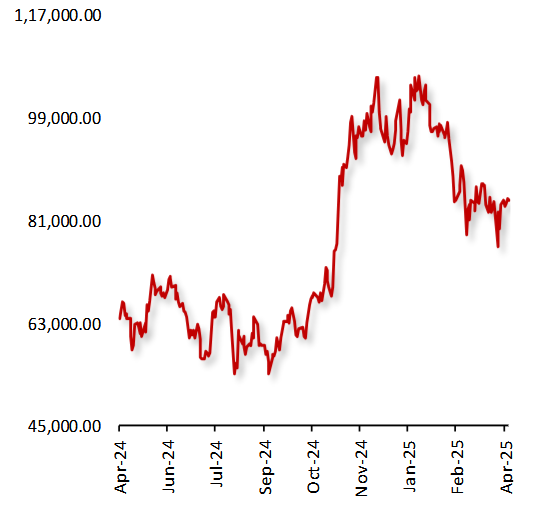

Bitcoin rose, fuelled by inflation concerns and uncertainty over US tariffs. Investor appetite for alternatives grew amid fears of slower growth. Tech developments from Aztec Labs and Eliza Labs also supported crypto market sentiment.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

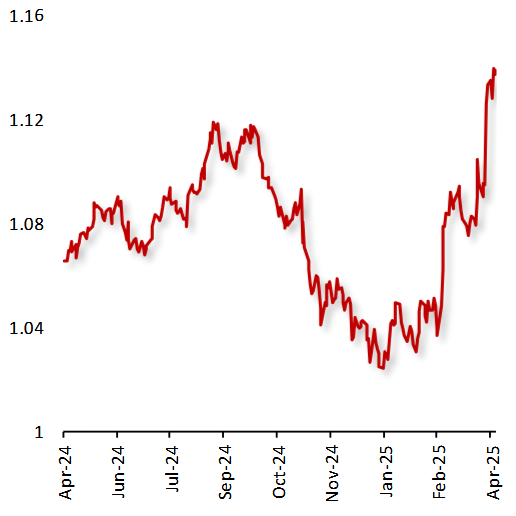

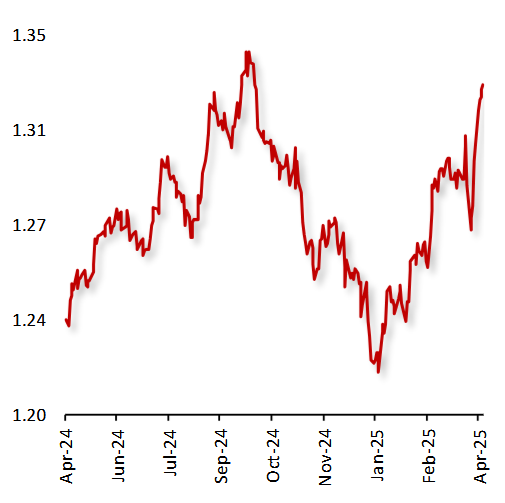

EUR/USD

|

|

|

Euro Strengthens Against Dollar Amid Easing Trade Tensions and weak US Economic Data

|

|

| |

|

|

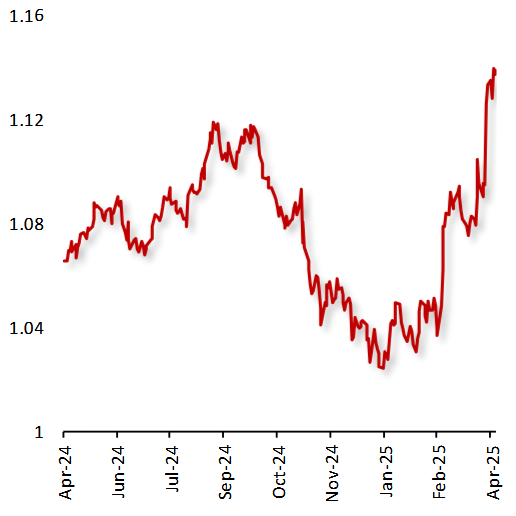

The EUR rose by 0.52% this week, supported by strong industrial data, steady inflation, and increasing indications of a weakening US economic outlook.

In the Eurozone, industrial production rose more than expected in February, raising optimism that the sector may have reached a turning point after a prolonged two-year downturn. Additionally, consumer price inflation remained steady in March, in line with expectations. However, the ECB cut interest rates to support the economy amid rising uncertainty.

Conversely, in the US, industrial production contracted more than expected, and capacity utilization dropped, reflecting a moderation in activity across manufacturing, mining, and utilities. The Philadelphia Fed manufacturing survey also showed a decline in April.Additionally, Mortgage applications fell sharply amid market volatility and rising rates, but a slight decline in jobless claims signals labor market strength.

|

|

| |

| |

| |

|

|

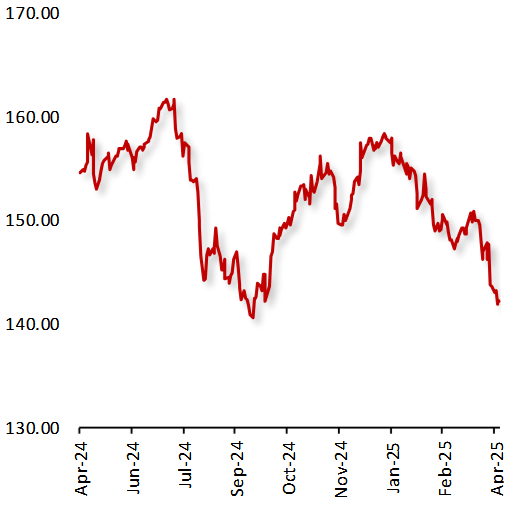

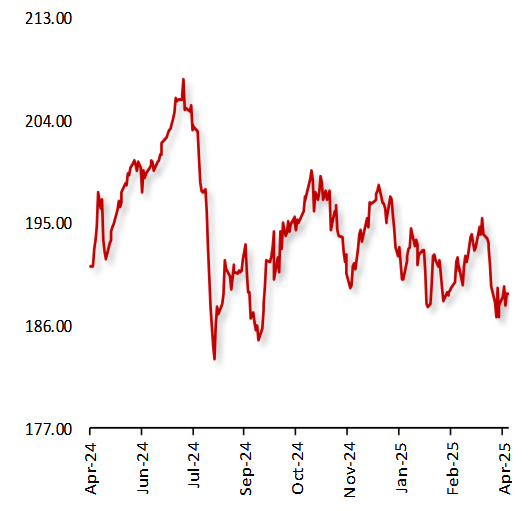

USD/JPY

|

|

|

Dollar Weakens Against Yen Amid Weak US Economic Data

|

|

| |

|

|

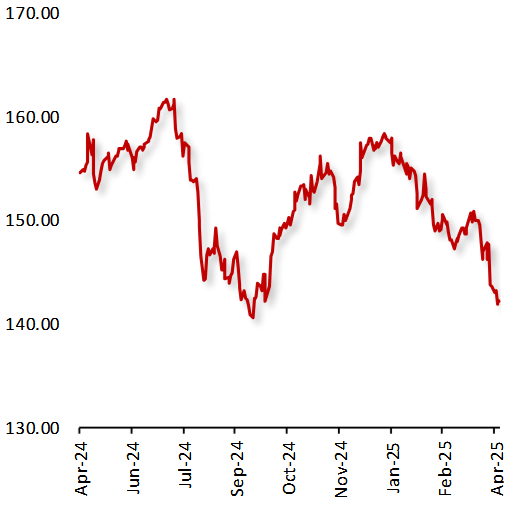

The USD declined 1.01% against the JPY, pressured by disappointing US industrial data and stronger-than-expected economic data from Japan.

In the US, industrial production declined in March, reflecting subdued demand and the continued impact of elevated interest rates. The contraction affected output from manufacturers, utilities, and mines, with capacity utilization slipping in February, signaling a pullback in production. Meanwhile, mortgage applications for both new home purchases and refinancing dropped sharply amid heightened market volatility and rising mortgage rates, underscoring the strain on housing demand.

On the other hand, Japan reported a solid increase in core machinery orders in February, exceeding expectations and pointing to stronger investment sentiment. Adding to the positive momentum, the merchandise trade surplus also expanded significantly in March, supported by rising exports and a moderate uptick in imports.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

Dollar Weakens Against Yen Amid Weak US Economic Data

|

|

| |

|

|

The USD declined 1.01% against the JPY, pressured by disappointing US industrial data and stronger-than-expected economic data from Japan.

In the US, industrial production declined in March, reflecting subdued demand and the continued impact of elevated interest rates. The contraction affected output from manufacturers, utilities, and mines, with capacity utilization slipping in February, signaling a pullback in production. Meanwhile, mortgage applications for both new home purchases and refinancing dropped sharply amid heightened market volatility and rising mortgage rates, underscoring the strain on housing demand.

On the other hand, Japan reported a solid increase in core machinery orders in February, exceeding expectations and pointing to stronger investment sentiment. Adding to the positive momentum, the merchandise trade surplus also expanded significantly in March, supported by rising exports and a moderate uptick in imports.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound Rises Against Dollar Amid Robust British Economic Data

|

|

| |

|

|

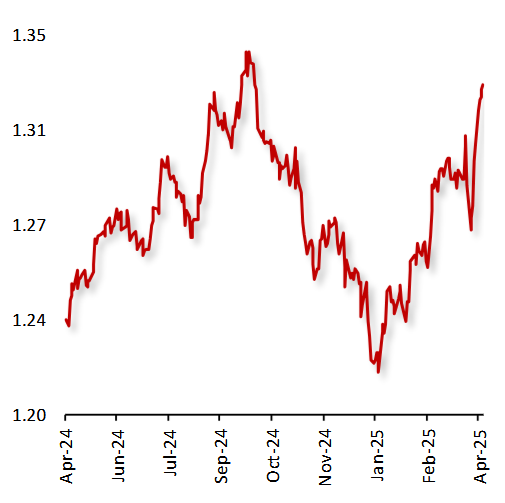

The GBP rose 1.72% against the USD this week, buoyed by stronger-than-expected UK economic data.

In the UK, BRC like-for-like retail sales rose more than expected in March, signaling resilient consumer demand. Additionally, the ILO unemployment rate held steady, pointing to labor market stability amid broader economic uncertainty. Labour market remained strong in the three months leading up to February, despite the looming rise in payroll taxes and the implementation of new trade tariffs. However, wage growth has remained strong, which might create a hurdle for the Bank of England (BoE).

Meanwhile, In the US, industrial production declined more than expected, with capacity utilization also falling, indicating a slowdown in overall production activity. The Philadelphia Fed manufacturing survey for April reflected further contraction, adding to signs of weakness in the sector.

|

|

| |

| |

| |

|

|

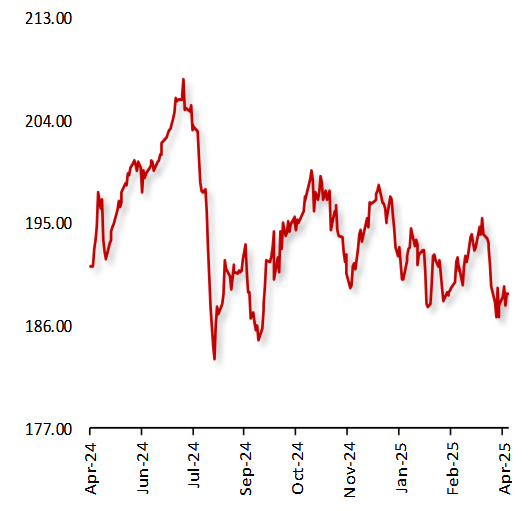

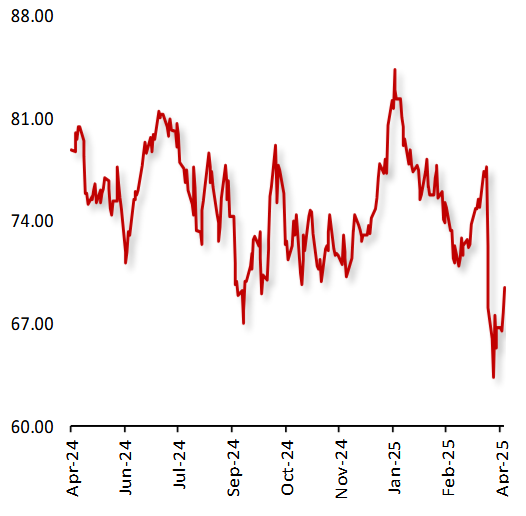

US Oil Fund ($)

|

|

|

Sterling Rises Against Yen on Robust UK Data and Sluggish Japanese Industrial Activity

|

|

| |

|

|

The GBP rose 0.54% against the JPY this week, amid Japan’s weaker industrial production and capacity utilization data.

In the UK, BRC like-for-like retail sales in March exceeded expectations, reflecting strong consumer demand. Additionally, the steady ILO unemployment rate reflects ongoing stability in the labor market. Furthermore, the labor market remained resilient in the three months leading up to February, despite the upcoming rise in payroll taxes and the implementation of new trade tariffs.

In contrast, Japan's economic data painted a less optimistic picture, contributing to weakness in the yen. Capacity utilization fell in February, reflecting a slowdown in industrial activity and signaling reduced efficiency and output across key sectors such as manufacturing and utilities. Additionally, the national consumer price index (CPI) rose in March, pointing to persistent inflationary pressures.

|

|

| |

| |

| |

|

|

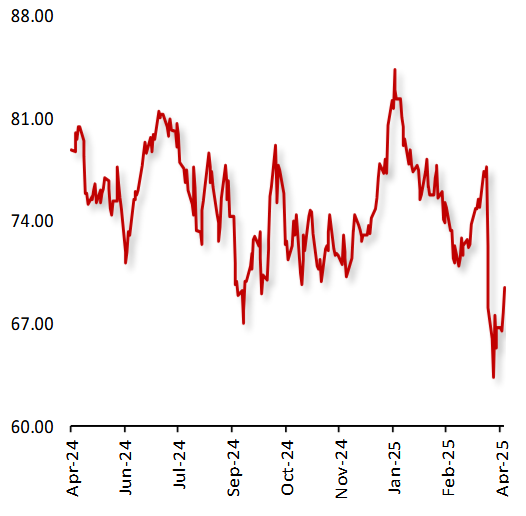

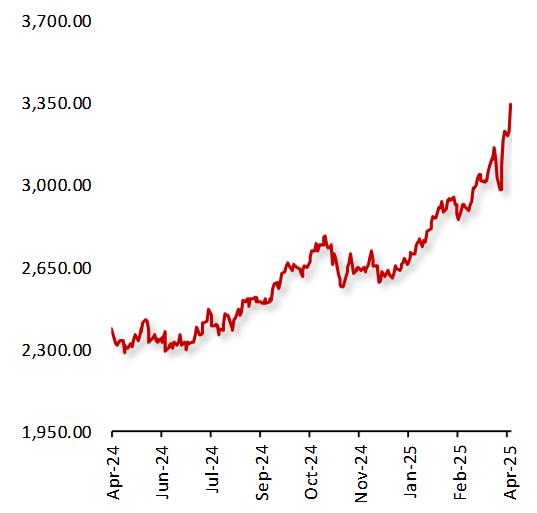

XAU Gold (XAU/USD)

|

|

|

Oil Prices Rise Amid Concerns Over Supply Constraints

|

|

| |

|

|

Oil prices gained this week, supported by new tariff exemptions floated by US President Donald Trump and a rebound in China crude oil imports in anticipation of tighter Iranian supply. Additionally, newly imposed US sanctions targeting Iranian oil exports, heightening concerns over global supply constraints. Meanwhile, the US Energy Information Administration (EIA) reported that crude oil inventories rose by 515,000 bls to 442.9mn bls in the week ended 11 April 2025.

Moreover, the OPEC+ confirmed updated plans to extend production cuts through mid-2026, with key members including Iraq and Kazakhstan committing to deeper reductions. The decision is intended to support market stability amid persistent demand uncertainty and to offset recent overproduction beyond agreed quotas.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Gold climbs Amid Weakness in the US Dollar

|

|

| |

|

|

Gold prices gained this week, amid weakness in the US Dollar and as escalating US-China trade tensions boosted demand for the safe-haven asset. Moreover, US President Donald Trump has ordered an investigation into possible tariffs on all US critical minerals imports, further intensifying its dispute with global trade partners as well as China.

Additionally, US Federal Reserve (Fed) chair, Jerome Powell, in his speech warned that rising uncertainty over the impact of President Donald Trump’s reciprocal tariffs plans, would lead to higher inflation and slowdown the country’s economic growth. This further contributed to the bullion’s safe appeal.

|

|

| |

|

| |

|

|

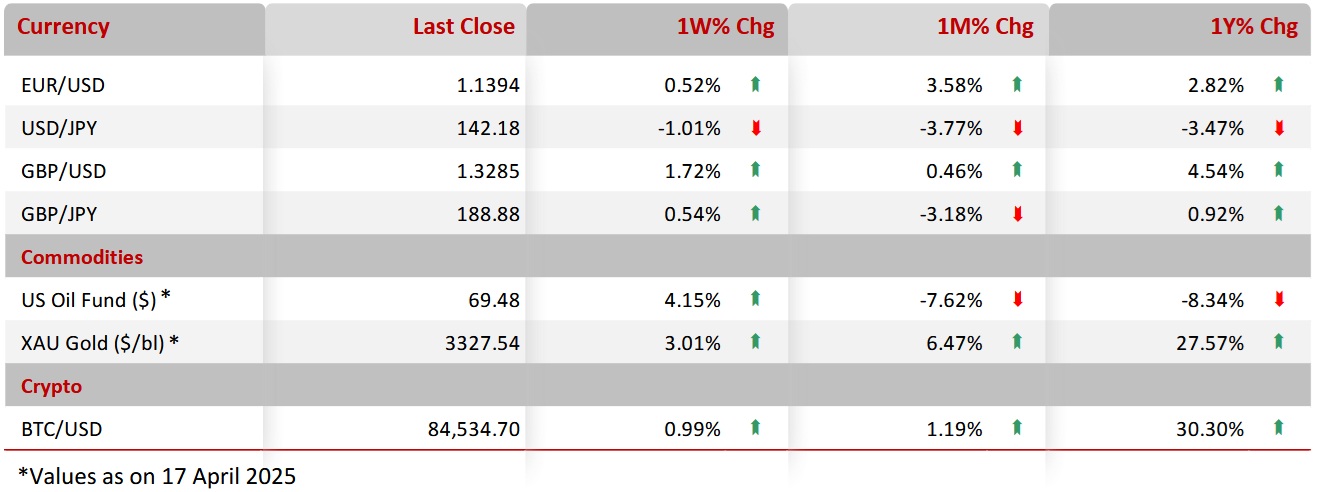

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|