| |

| Market Update |

| |

|

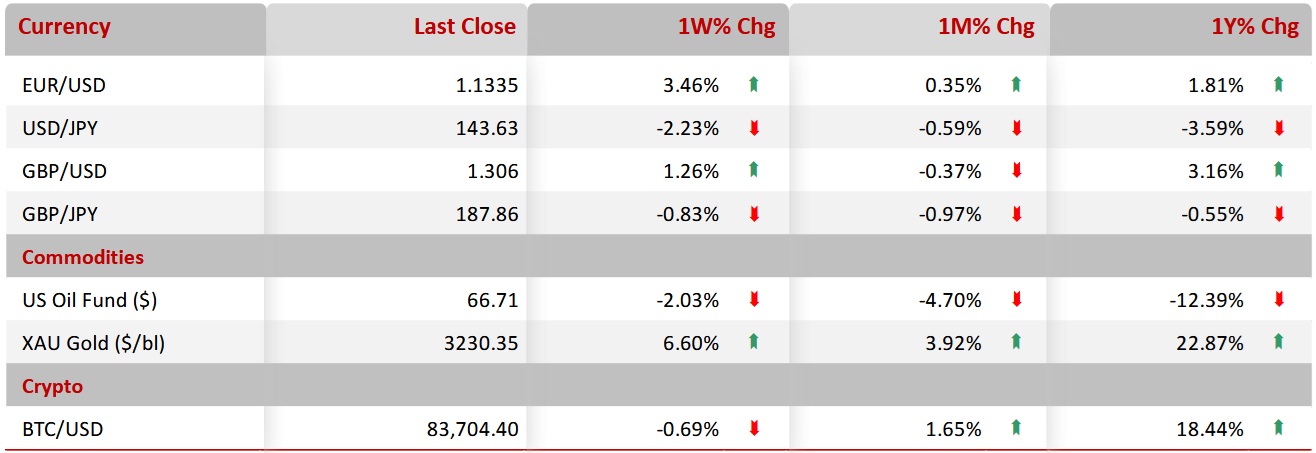

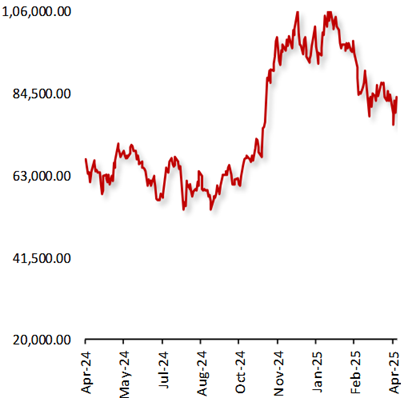

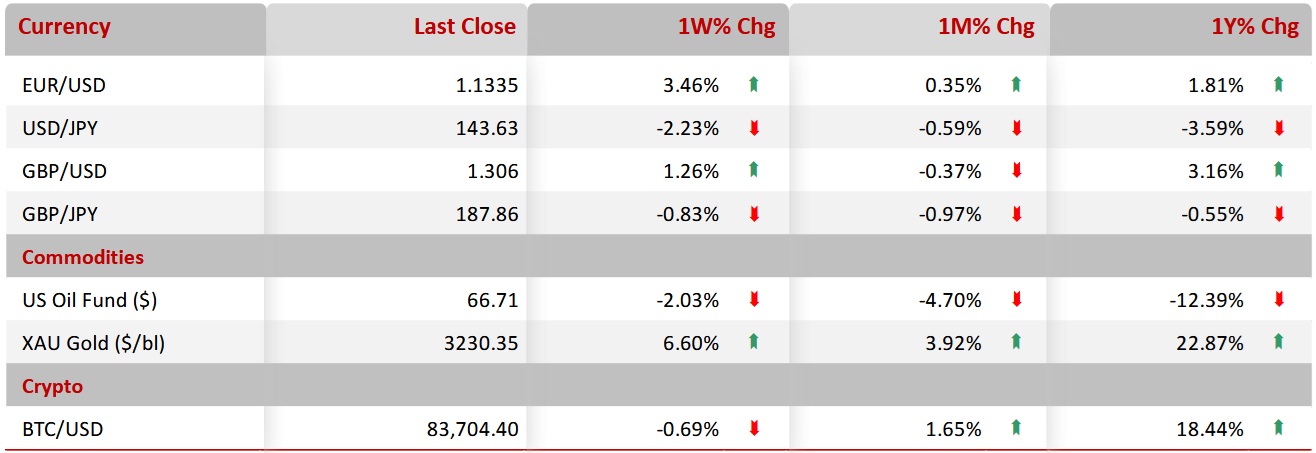

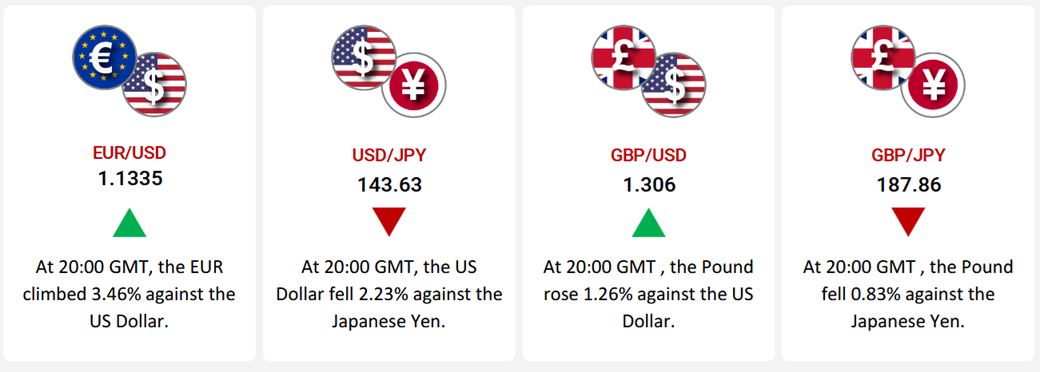

The EUR rose 3.46% this week, buoyed by easing trade tensions and signs of a weakening US economy. President Trump suspended tariffs on all imports except Chinese goods, prompting the European Commission to pause tariffs on US products, improving transatlantic sentiment. Simultaneously, US inflation eased due to falling gas and used vehicle prices, but jobless claims rose to 223,000, suggesting labor market softness. The Fed maintained a cautious tone, citing heightened uncertainty.

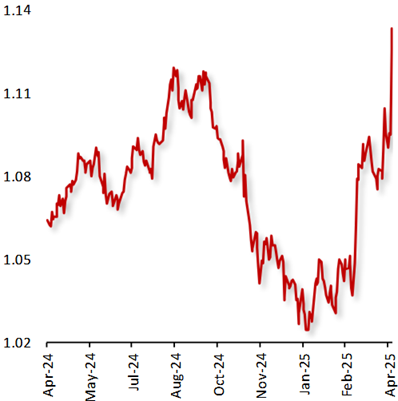

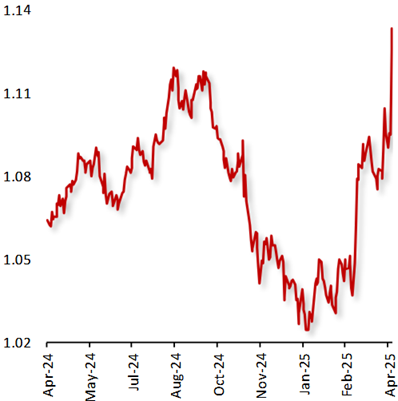

The US dollar fell 2.23% against the yen (JPY), as escalating trade tensions drove demand for safe-haven assets. Japan’s current account swung back into surplus and producer prices rose more than expected, indicating strong economic momentum. Meanwhile, the Fed’s cautious stance and weak US data weighed on the dollar.

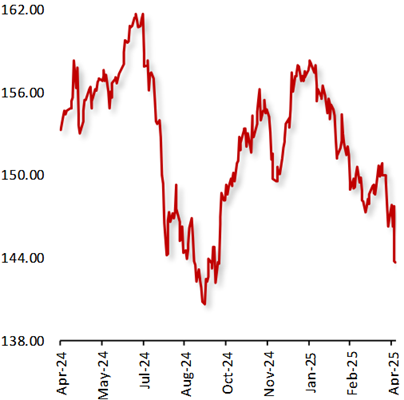

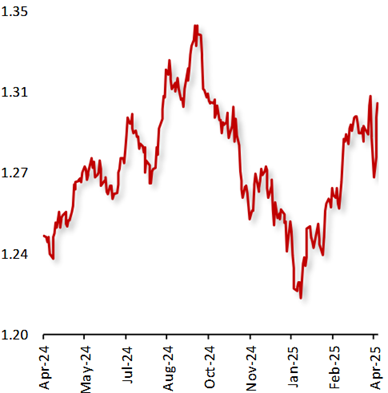

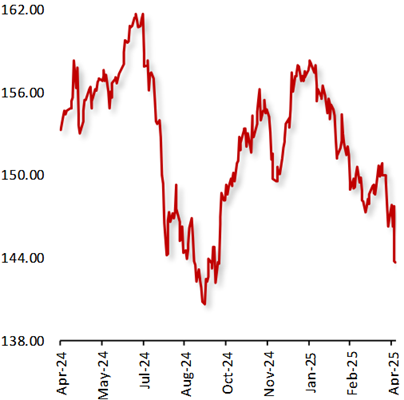

The British pound (GBP) gained 1.26% versus the dollar, supported by stronger-than-expected UK economic growth in February and rising 30-year gilt yields, which attracted yield-seeking investors. However, the pound slipped 0.83% against the yen as Japan’s trade and inflation data supported the yen’s strength.

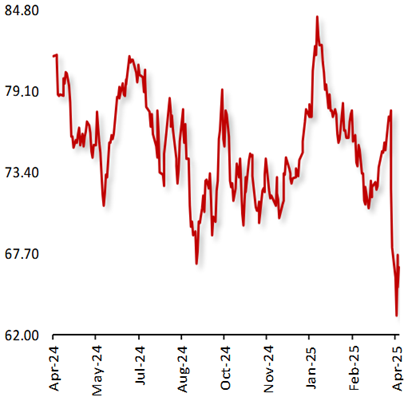

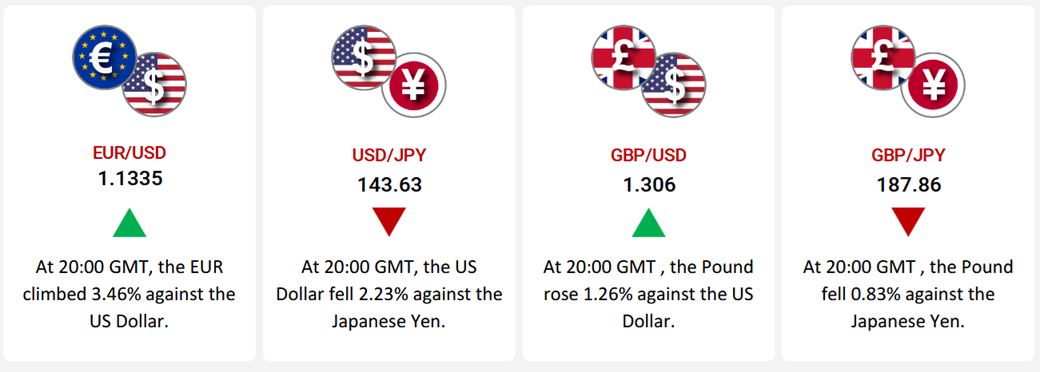

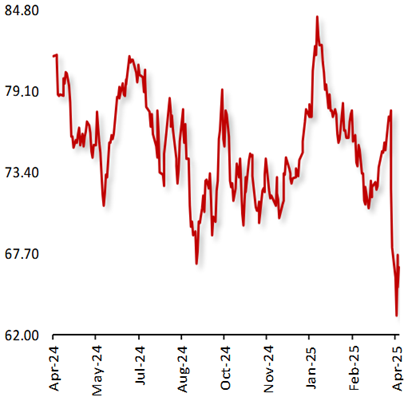

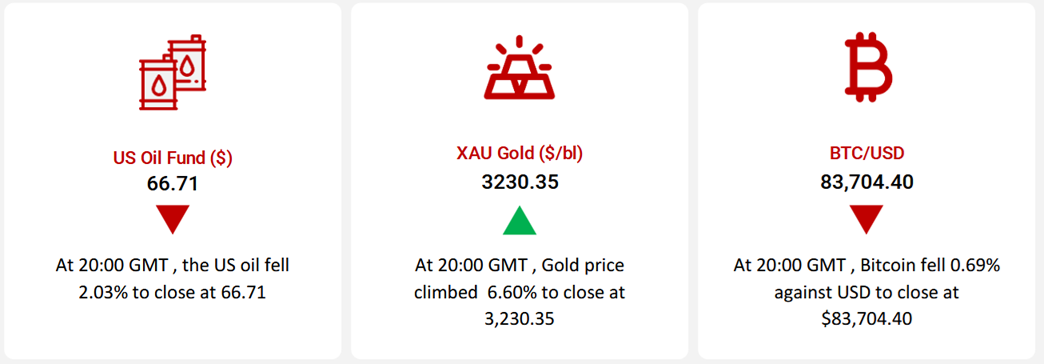

Oil prices declined on fears that rising US-China trade tensions could slow global economic growth and weaken fuel demand. Trump’s 125% tariff hike on Chinese goods and China’s retaliatory tariffs heightened market anxiety. OPEC+ also announced a 411,000-bpd output increase for May, while the EIA lowered its oil demand growth outlook for 2025–26.

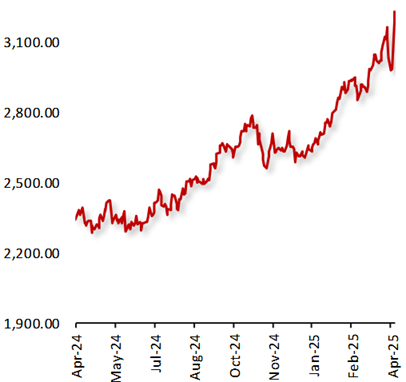

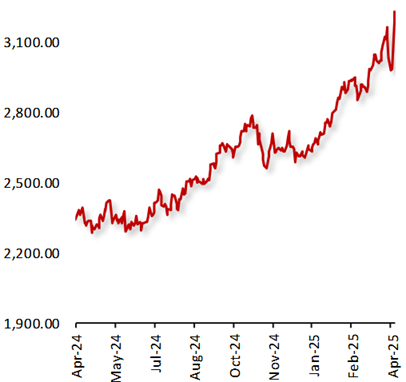

Gold prices climbed amid trade war concerns and market uncertainty. China’s central bank continued boosting its gold reserves, adding to safe-haven demand. Investors await US producer price data for further Fed cues.

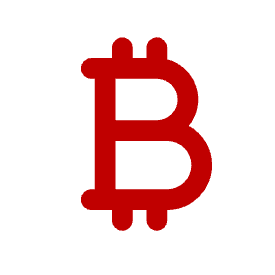

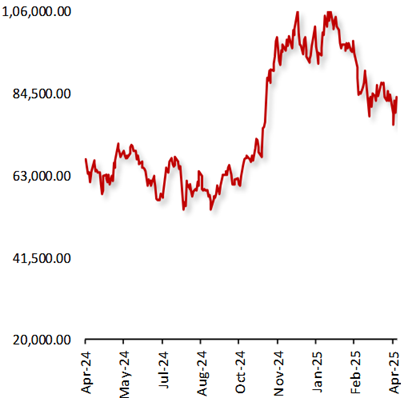

Bitcoin dropped due to broader risk-off sentiment and recession fears. While Redstone’s oracle launches and Cobe’s upcoming futures product showed progress, negative market sentiment outweighed crypto optimism, pressuring Bitcoin prices.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

EUR/USD

|

|

|

Euro Strengthens Against Dollar Amid Easing Trade Tensions and Soft US Economic Data

|

|

| |

|

|

The EUR rose by 3.46% this week, supported by easing trade tensions and signs of a weakening US economic outlook.

US President Donald Trump announced a 90-day suspension of tariffs on imports from all countries except China, where duties were sharply increased. This unexpected move improved market sentiment and lifted the euro. In a reciprocal gesture, the European Commission paused tariffs on US goods, signalling a notable de-escalation in transatlantic trade tensions and further boosting the euro.

Meanwhile, in the US, consumer prices declined unexpectedly in March due to lower gasoline and used vehicle prices, offering temporary relief from inflation. However, this was offset by a rise in weekly jobless claims to 223,000 in the week ended 4 April 2025, pointing to labour market softness. Additionally, the US Federal Reserve maintained a cautious stance in its latest policy update, citing increased economic uncertainty stemming from recent government actions.

|

|

| |

| |

| |

|

|

USD/JPY

|

|

|

Dollar Weakens Against Yen Amid Rising Trade Tensions and Mixed US Data

|

|

| |

|

|

The USD declined 2.23% against the JPY, as heightened trade tensions fueled demand for safe-haven assets.

In the US, the consumer price index edged lower in March, driven by declines in gasoline and used vehicle prices, contributing to a temporary easing in inflation. However, weekly jobless claims advanced to 223,000 in the week ended 4 April 2025, pointing to labour market softness. Furthermore, the US Federal Reserve reiterated a cautious approach in its latest policy statement, highlighting growing economic uncertainty linked to recent shifts in government policy.

In contrast, in Japan, the current account swung back into surplus, reflecting improved external balances and reinforcing the yen's attractiveness. Additionally, the Producer Price Index rose above expectations in March, signalling underlying inflationary pressures and stronger economic momentum. Japanese policymakers reaffirmed their support for market stability, boosting the yen.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

Pound Rises Against Dollar Amid Robust British Economic Data

|

|

| |

|

|

The GBP rose 1.26% against the USD this week, supported by stronger-than-expected UK economic data and a softer US macroeconomic backdrop. In the UK, the economy expanded more than expected in February, recording its strongest monthly expansion since late 2022. The upbeat economic data boosted investor confidence and added upward momentum to the pound. Additionally, British 30-year government bond yields climbed to their highest levels since May 1998, reflecting heightened fiscal concerns but also attracted yield-seeking investors, which further supported the pound. On the contrary, in the US, economic data painted a mixed picture. The consumer prices dropped in March, providing temporary relief from inflation. However, the weekly jobless claims rose to 223,000 in the week ended 4 April 2025, hinting at labor market softness.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound Weakens Against Yen as Japan’s Trade Surplus Signals Economic Rebound

|

|

| |

|

|

The GBP declined 0.83% against the JPY this week, amid Japan’s improving trade position and strong economic data.

In the UK, the economy expanded in February, offering a brief lift to the pound; however, broader gains were offset. Meanwhile, British 30-year gilt yields surged to their highest levels since May 1998, reflecting both fiscal uncertainty and demand from yield-seeking investors.

In contrast, Japan’s current account returned to surplus in February, marking a significant recovery from the prior month’s deficit. The turnaround was driven by robust exports in manufacturing and technology, alongside a rebound in investment income. Additionally, the Producer Price Index exceeded expectations, pointing to stronger wholesale inflation, while the trade balance also shifted back into surplus, reinforcing confidence in Japan’s external sector and boosting yen’s demand.

|

|

| |

| |

| |

|

|

US Oil Fund ($)

|

|

|

Oil Prices Declines On Demand Concerns

|

|

| |

|

|

Oil prices declined this week, amid worries that Trump Administration’s broad tariffs on most of the US imports would tip the world’s largest economy into recession and dampen fuel demand. Adding to the negative sentiment, US President Donald Trump announced a sweeping 125% levy on Chinese goods, in response China announced retaliatory tariffs of 84% on all US imports, further escalating tensions between the two largest economies and exacerbating fears of a global economic slowdown.

Moreover, the OPEC+ decision to increase oil output by 411,000 barrels per day in May, contributing to concerns of oversupply. Also, the US Energy Information Administration (EIA) has lowered its oil demand growth forecast for 2025 & 2026. The EIA expects global oil and fuel demand to grow by 900,000 barrels-per-day (bpd) from last year to around 103.6 million bpd this year.

|

|

| |

| |

| |

|

|

XAU Gold (XAU/USD)

|

|

|

Gold Rises As US-China Trade War Intensifies

|

|

| |

|

|

Gold prices gained this week, as uncertainty surrounding President Trump's tariff policies and concerns over its impact on the global economy, boosted demand for the safe have asset. The trade tensions between the US & China intensified further, after US President Donald Trump hiked tariffs on Chinese goods to around 125%. However, Trump paused hefty duties on several partner countries for a period of 90 days except China.

Adding to the positive sentiment, China’s central bank added gold to its reserves for a fifth straight month in March, deepening its bet on the precious metal as a haven asset. Moreover, investors await the US producer price data for insights into the Federal Reserve’s (Fed) monetary policy trajectory, after data indicated that the US consumer price inflation slowed more than expected in March.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Falls Amid Tariff Tensions and Market-Wide Risk-Off Sentiment

|

|

| |

|

|

Bitcoin declined this week, amid escalating tariff tensions and recession fears. The trade-related uncertainty led investors to move away from riskier assets like cryptocurrencies, putting additional pressure on Bitcoin.

In major news, RedStone has launched a high-speed oracle on MegaETH, designed to significantly reduce trading latency in blockchain markets with near-instant price updates every 2.4 milliseconds. Separately, Cboe Global Markets is planning to launch FTSE Bitcoin Index futures on 28 April, offering a new cash-settled product tied to VanEck’s XBTF ETF, pending regulatory approval. Also, Ripple is acquiring crypto-friendly prime broker Hidden Road to become the largest non-bank prime broker and expand its stable coin and XRP services.

|

|

| |

|

| |

|

|

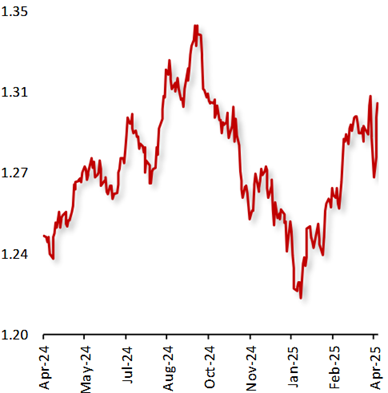

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|