Navigating Divergence: Global Markets in Transition

As the curtain closed on Q1 2025, markets were left grappling with a global environment marked by policy divergence, shifting leadership in equities, cooling inflation, and geopolitical rebalancing. The optimism that carried over from late 2024 gave way to a more sobering reality: while recession fears have not fully materialized, the path forward appears increasingly shaped by government action, central bank recalibration, and a wave of thematic transformations ranging from AI acceleration to the global energy transition.

Macroeconomic Landscape: Diverging Growth Paths

United States: The new U.S. administration’s turn toward protectionism and fiscal austerity in early 2025 dampened business confidence and raised fresh uncertainty. With tariffs reinstated on key trade partners and a targeted $1 trillion in government spending cuts planned, investors are now pricing in a cooler economic outlook. Growth projections for 2025 have been revised downward to the 1.5–1.7% range. Inflation, however, has moderated, with CPI falling to 2.8% by February, providing the Federal Reserve space to pause further tightening and hint at rate cuts should conditions deteriorate.

Europe: In contrast, the Eurozone is showing surprising resilience. Massive fiscal stimulus packages, particularly Germany’s proposed €500 billion infrastructure and defence plan, have breathed life into what was a sluggish region. The European Central Bank (ECB) responded with two rate cuts in Q1, helping boost domestic demand. Business sentiment, particularly in Germany, has improved, and forecasts now suggest a potential upside to the OECD’s 1.0% Eurozone growth target for 2025.

China and Asia: China met its 2024 growth target of 5%, pivoting in 2025 toward domestic consumption and innovation to drive momentum. Policy remains accommodative, with fiscal and monetary support aimed at stabilizing the property sector and boosting retail activity. Broader Asia benefited from this stability, though performance varied widely by country.

Inflation and Central Bank Response

Central banks began 2025 with a cautious yet optimistic stance. The Fed, while holding rates steady, acknowledged downside risks and flagged the possibility of rate cuts later in the year. The ECB and Bank of England took more proactive steps, each initiating rate cuts in response to stagnant growth and improving inflation data. Emerging market central banks also joined the global easing cycle, offering rate relief to support growth as inflation cooled.

Notably, the Bank of Japan has yet to shift away from its ultra-loose stance but faces mounting pressure as domestic inflation persists above target. If global yields continue to fall and the yen strengthens, policy changes may follow.

Equity Market Recap: Regional Divergence

United States: U.S. equities took a breather after strong 2024 gains. The S&P 500 declined 4.37% in Q1, dragged down by uncertainty around trade policy, Fed ambiguity, and valuation pressures. Mega-cap tech names that led previous rallies saw volatility, with the "Magnificent Seven" giving up ground amid earnings concerns and competitive pressures.

Europe: European equities outperformed meaningfully, lifted by fiscal stimulus, rate cuts, and improving sentiment. The Euro Stoxx index rose high single digit (7.78%), while UK equities delivered strong returns (6.11%) despite a surprise budget announcement. Investors rotated into cyclicals and value stocks in anticipation of a regional growth resurgence.

Asia and Emerging Markets: China’s equity market rallied sharply (14.27%), buoyed by AI optimism, policy support, and reduced trade fears. South Korea also posted gains, while India saw a pullback after extended outperformance. Emerging markets broadly fared well, with the MSCI EM Index finishing Q1 in positive territory, aided by a softer U.S. dollar and stable commodity prices.

Q1 2025 Index Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 March 2025.

Sector Rotation and Market Themes

Value Takes the Lead: Q1 saw a clear rotation from growth to value and defensives. Energy, financials, and materials outperformed as investors sought safety and cash flow. Gold mining stocks rallied alongside the metal, while banks benefited from stable-to-steepening yield curves, especially in Europe.

Tech & AI in Flux: The tech sector faced headwinds as high valuations and intensifying competition raised concerns. Semiconductor stocks were volatile, particularly following the emergence of competitive AI models from China. However, companies with clear AI monetization strategies (e.g., Meta) were rewarded, underscoring the market's selective approach within tech.

Industrials & Cyclicals: Defence and capital goods companies in Europe surged on anticipated fiscal outlays. Conversely, U.S. industrials underperformed due to tariff fears and domestic growth concerns. Automotive stocks globally faced pressure amid EV transition costs and policy-related demand uncertainty.

Q1 2025 Sector Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 March 2025.

Fixed Income: A Return to Relevance

After a bruising 2024, fixed income regained its defensive credentials. In the U.S., falling Treasury yields drove solid returns (+2.9% for 10Y Treasurys), offering ballast to equity-heavy portfolios. European bonds were more mixed: German Bunds sold off on issuance fears, while UK Gilts held steady. Japanese Government Bonds underperformed as policy speculation intensified.

Fixed Income Government Bond Returns

Source: Bloomberg, LSEG Datastream, J.P. Morgan Asset Management. All indices are Bloomberg benchmark government indices. Total returns are shown in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 March 2025.

Credit markets remained stable, with U.S. investment-grade bonds posting modest gains. High-yield saw some weakness on rising recession concerns, but defaults remained low. European credit fared better, with spreads tightening amid investor demand. EM debt, particularly local-currency bonds, gained from currency appreciation and peaking global rates.

Commodities and Currencies

Gold: A standout performer, gold rose 18.21% to exceed $3,000/oz, driven by falling real yields, geopolitical tensions, and safe-haven demand.

Oil: Crude prices stayed range-bound in the mid-$70s. OPEC+ output increases and geopolitical supply risks balanced each other, resulting in relative price stability.

Base Metals: Copper and other industrial metals saw modest gains, supported by China’s stimulus and infrastructure demand.

Q1 2025 Index Performance

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 March 2025.

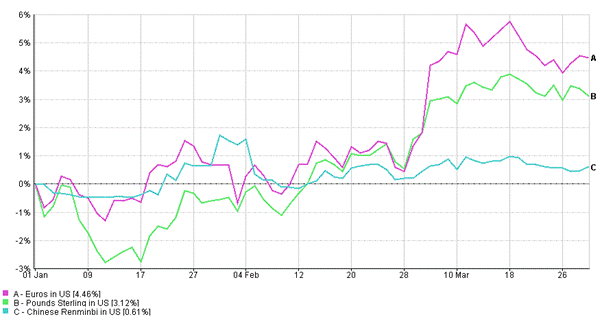

FX: The dollar weakened modestly as the Fed paused and global yield gaps narrowed. The euro and pound appreciated, while the yen gained significantly amid rising BoJ speculation. EM currencies were broadly stable to strong, helped by capital inflows and improved macro conditions.

Q1 2025 Currency Dynamics

Source: FE Analytics. All indices are total return in US dollars. Past performance is not a reliable indicator of future performance. Data as of 31 March 2025.

Emerging Investment Themes

AI Acceleration: Breakthroughs in AI (e.g., China’s DeepSeek model) and heavy investment from tech giants drove both opportunity and volatility in Q1. Investors are beginning to differentiate between hype and durable growth within the AI ecosystem.

Energy Transition: ESG and clean energy investment continued apace. Regulatory developments (IMO emissions rules, EU carbon border taxes) and corporate commitments suggest further tailwinds for renewable infrastructure, battery tech, and carbon credit markets.

Geopolitics: Trade frictions and defence spending reshaped investor expectations. Regional blocs (North America, Europe, Asia) are realigning supply chains and trade dependencies. This could spark longer-term structural shifts in commodity flows, FX demand, and sector rotation.

Outlook: Staying Nimble Amid Volatility

As we enter Q2, the market narrative is transitioning from a singular focus on inflation and central bank tightening to a multi-dimensional outlook shaped by policy, innovation, and geopolitical evolution. The rise of global fiscal stimulus, the recalibration of monetary policy, and real-time AI adoption are collectively redrawing the map for investors.

Key considerations:

- Policy divergence will remain a core driver of asset allocation. Europe is stimulating as the U.S. tightens fiscally, creating relative value across regions.

- Monetary easing cycles are underway but contingent on incoming data. A dovish tilt is supportive for both equities and bonds, but central banks remain data-dependent.

- Sector selection will be increasingly critical. Growth is no longer monolithic; value sectors and globally diversified strategies offer downside protection.

- Thematic investing in AI, clean energy, and cybersecurity presents secular growth potential, albeit with volatility.

In this environment, maintaining diversified portfolios, revisiting strategic asset allocation, and keeping a pulse on evolving risks will be key to navigating what remains an unsettled but opportunity-rich landscape.

Conclusion

Q1 2025 reminded us that markets are forward-looking, dynamic, and sensitive to both policy shifts and long-term themes. While volatility is likely to persist, so too are the opportunities for those positioned ahead of the curve. A flexible, informed investment strategy that adapts to new macro realities while remaining anchored in fundamentals will be essential as the year unfolds.

As we look toward Q2 2025, macro and market dynamics continue to evolve:

- Global growth remains moderate but uneven, with emerging markets outperforming developed economies.

- Central banks have shifted toward easing, but data dependency means rate cuts will be cautious and region-specific.

- U.S. equities may face continued volatility amid protectionist policy and high valuations, while Europe stands to benefit from fiscal stimulus and improving sentiment.

- In Asia, China's domestic-led rebound could gain traction if policy support sustains momentum, while EMs overall remain attractive given currency strength and real yields.

- Fixed income markets are showing renewed resilience. Bonds are playing their traditional diversifying role once again, especially as inflation cools.

- Sector-wise, value and cyclicals continue to offer balance, while tech remains a high-beta play on AI innovation.

The Q2 landscape demands a balanced, globally diversified approach – one that captures evolving leadership while remaining mindful of structural and geopolitical risks. Flexibility, vigilance, and valuation discipline will be key to capitalizing on opportunity without falling prey to complacency.