| |

| Market Update |

| |

|

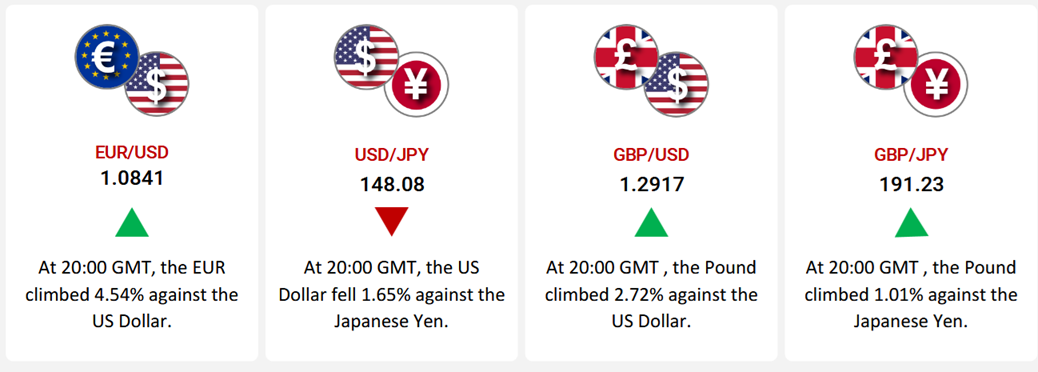

The EUR surged by 4.54% against the USD, driven by eurozone stimulus measures, with a 25bps rate cut by the European Central Bank (ECB) aimed at stimulating economic recovery. This came alongside stronger-than-expected manufacturing data and persistent inflation pressures, despite weaker consumer spending as retail sales unexpectedly declined. In contrast, weak US labor data, including disappointing ADP employment figures (77K jobs added) and a widening trade deficit, pressured the dollar. However, positive signals like a strong ISM services PMI and declining jobless claims helped maintain confidence in the US economy.

The USD also weakened against the JPY, closing 1.65% lower, amid US labor market concerns. Meanwhile, the yen appreciated to a five-month high, prompting Japan’s finance minister to express concerns over speculative activities. In the UK, the GBP rose by 2.72% against the USD, supported by easing fears over US tariffs. Mixed economic data in the UK reflected weak demand in manufacturing but stronger services growth, while the Bank of England's cautious approach to policy easing and strong wage growth provided support.

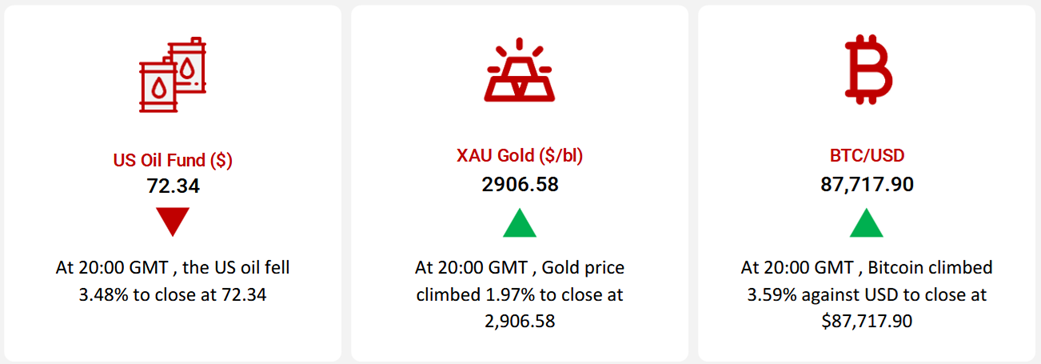

Oil prices fell following a larger-than-expected rise in US crude inventories and an OPEC+ decision to increase output by 138,000 barrels per day from April. A reintroduction of US tariffs on imports from Canada, Mexico, and China further fueled concerns about a global economic slowdown and reduced energy demand. Meanwhile, gold prices rose amid the weakening US dollar and escalating trade tensions. Bitcoin also surged following President Trump’s announcement of a US strategic cryptocurrency reserve, reflecting increased investor interest in digital assets. Additionally, the US added 151,000 jobs in February, led by healthcare, while the unemployment rate edged up to 4.1%.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

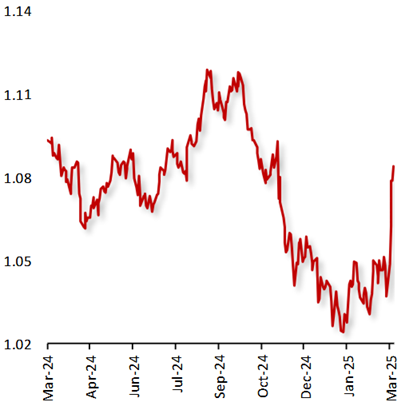

EUR/USD

|

|

|

EUR jumps Driven by Eurozone Stimulus

|

|

| |

|

|

The EUR rose 4.54% against the USD this week, helped by eurozone stimulus, while escalating US trade tensions and weak labor data pressured the dollar.

In the Eurozone, the HCOB manufacturing PMIexceeded expectations, signaling a recovery in factory activity. The European Central Bank’s 25bps rate cut was introduced to stimulate growth and support economic recovery. Meanwhile, a stronger-than-expected PPI increase pointed to persistent inflationary pressures despite sluggish demand. However, retail sales unexpectedly declined, reflecting ongoing weakness in consumer spending.

US ADP employment data showed only 77K jobs added, below the 140K forecast, raising labor market concerns. A widening trade deficit added to worries. However, the ISM services PMI exceeded expectations, along with declining jobless claims and an improving manufacturing PMI, supporting confidence in the US economy.

|

|

| |

| |

| |

|

|

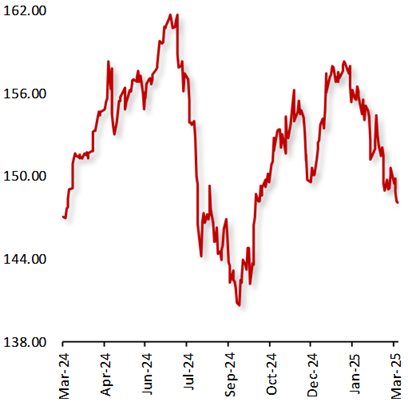

USD/JPY

|

|

|

US Dollar Weakens Amid Soft Labor Market Data and Yen’s Resilience

|

|

| |

|

|

The USD closed 1.65% lower against the JPY, amid US labor market concerns.

In Japan, Finance Minister Katsu Nobu Kato expressed concerns over the yen's rapid appreciation to a five-month high, attributing the movement partly to speculative activities. He indicated that authorities are prepared to take appropriate measures to address excessive foreign exchange volatility. Additionally, Japan's largest labor union, Rengo, is seeking the most significant salary increase in over 30 years, potentially supporting further interest rate hikes by the central bank.

Conversely, in the US, disappointing ADP employment data fueled concerns about a weakening labor market. Additionally, a widening goods trade deficit added pressure on the dollar. However, better-than-expected ISM services PMI, lower jobless claims and an uptick in manufacturing PMI helped sustain some optimism about US economic strength.

|

|

| |

| |

| |

|

|

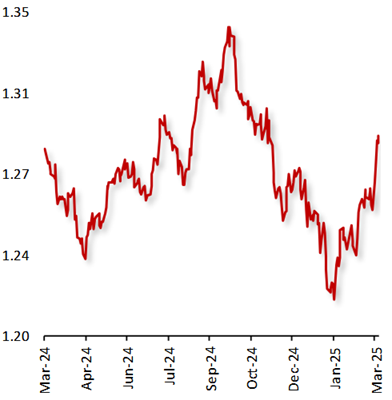

GBP/USD

|

|

|

Pound Rises Amid Easing US Tariff Concerns

|

|

| |

|

|

The GBP advanced 2.72% against the USD this week, as easing fears over US President Donald Trump’s tariffs provided support to the British pound.

In the UK, economic data presented a mixed picture. The manufacturing PMI declined at its sharpest pace in fourteen months in February, reflecting weak demand and rising cost pressures. Meanwhile, the services PMI rose less than expected in. Despite this, the broader outlook for the pound remains firm, as investors anticipate a gradual monetary expansion from the Bank of England (BoE), supported by strong wage growth and persistent inflationary pressures.

Conversely, the US dollar weakened amid expectations of more aggressive Federal Reserve rate cuts due to concerns over US economic growth. The ISM manufacturing PMI and ADP employment data missed forecasts, while jobless claims declined more than expected.

|

|

| |

| |

| |

|

|

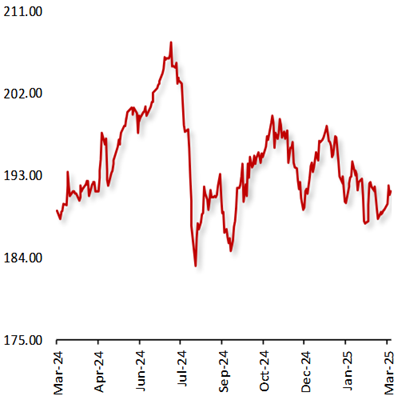

GBP/JPY

|

|

|

Pound Rises Amid BoE Policy Outlook and US Tariff Concerns

|

|

| |

|

|

The GBP climbed 1.01% against the JPY this week, as traders evaluated the impact of US President Donald Trump’s tariffs on Canada, Mexico, and China amid signs of a slowing US economy.

In the UK, economic data was mixed. The manufacturing PMI saw its sharpest decline in 14 months, reflecting weak demand and rising costs. Meanwhile, the services PMI rose but missed expectations, and Halifax house prices unexpectedly fell. Bank of England (BoE) officials reaffirmed a "gradual and cautious" approach to policy easing.

Conversely, the Japanese yen weakened, as hawkish expectations for the Bank of Japan (BoJ) grew. Japan’s consumer confidence fell, but manufacturing and services PMI exceeded forecasts. However, unemployment unexpectedly rose in January.

With diverging monetary policies and global uncertainties, the GBP/JPY pair remains supported by BoE signals and a weaker yen.

|

|

| |

| |

| |

|

|

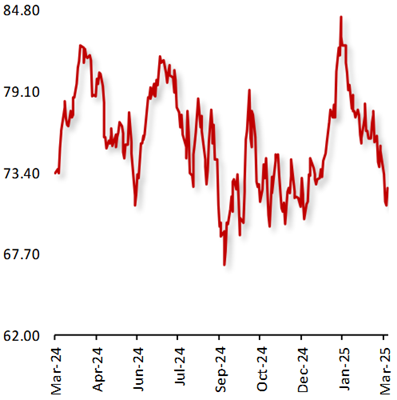

US Oil Fund ($)

|

|

|

Oil Prices Decline Amid OPEC+ Output Increase and Concerns Over Demand Outlook

|

|

| |

|

|

Oil prices declined last week, following a larger-than-expected rise in the US crude inventories and after the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, decided to increase output for the first time since 2022. The group will make a small increase of 138,000 barrels per day from April, the first step in planned monthly increases to unwind its nearly 6-million bpd of cuts, equal to almost 6% of global demand. Adding to the negative sentiment, the reintroduction of US tariffs on imports from Canada, Mexico, and China, coupled with retaliatory measures from these countries, further fueled concerns over potential global economic slowdown and raised fears of reduced energy demand.

The Energy Information Administration's (EIA) indicated that crude oil inventories rose by 3.6-million barrels to 433.8-million barrels in the last week, exceeding analysts’ expectations for a rise of 341,000-barrel.

|

|

| |

| |

| |

|

|

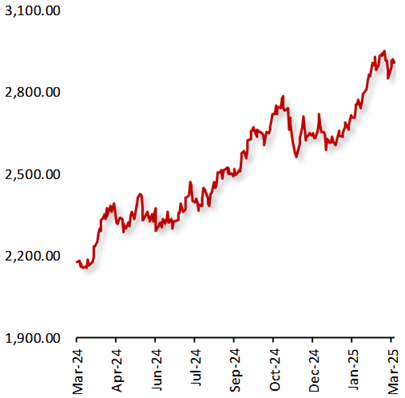

XAU Gold (XAU/USD)

|

|

|

Gold Rises Amid Weakness in the US Dollar and Trade Concerns

|

|

| |

|

|

Gold rose this week, amid weakness in the US Dollar and as uncertainty around US President Donald Trump’s tariff plans boosted demand for the safe haven asset.

The US imposed a 25% tariff on imports from Mexico and Canada and further duties on Chinese goods. However, the White House confirmed it would exempt automakers from Canadian and Mexican tariffs for a month, subject to their compliance with existing free trade rules. Moreover, China announced additional 10%-15% tariffs on certain the US imports from 10 March and a series of new export restrictions for designated the US entities, further escalating trade tensions. Trump also warned of reciprocal duties on countries imposing tariffs on US products from 2 April. These tariff measures are expected to drive inflation, further escalating demand for Gold.

|

|

| |

| |

| |

|

|

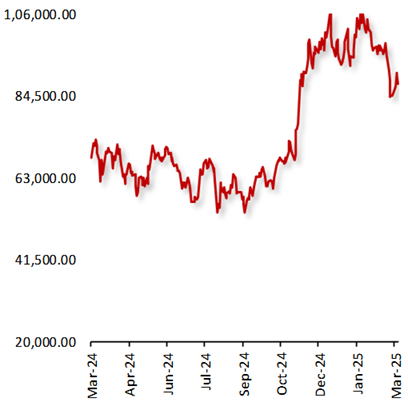

BTC/USD

|

|

|

Bitcoin Surges Following Trump's Announcement of US Strategic Cryptocurrency Reserve

|

|

| |

|

|

Bitcoin climbed last week, following US President Donald Trump's announcement of a US strategic reserve of cryptocurrencies. President Trump outlined that Bitcoin, Ether, XRP, Solana, and Cardano would be included in the reserve. Amid this news, the market capitalization for cryptocurrencies surged, reflecting heightened investor enthusiasm.

Additionally, the development signals a shift in the US government’s approach to digital assets, suggesting increased participation in the crypto economy. The move could potentially accelerate institutional adoption, enhance regulatory clarity, and strengthen the US's position as a leader in digital asset innovation. However, the gains were limited, as worries surrounding US trade tariff uncertainties weighed on investor sentiment.

|

|

| |

| |

| |

| Nonfarm Payrolls: 151K Jobs Added in February |

| |

|

The US economy added 151,000 jobs in February, better than the downwardly revised 125,000 jobs in January. Healthcare led the way in job creation, adding 52,000 jobs, about in line with its 12-month average. Other sectors posting gains included financial activities (21,000), transportation and warehousing (18,000) and social assistance (11,000).

Meanwhile, the unemployment rate edged higher to 4.1% in February from 4.0% in January. The annual wage inflation, as measured by the change in the Average Hourly Earnings, rose to 4% from 3.9% (revised from 4.1%).

|

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|