| |

| Market Update |

| |

|

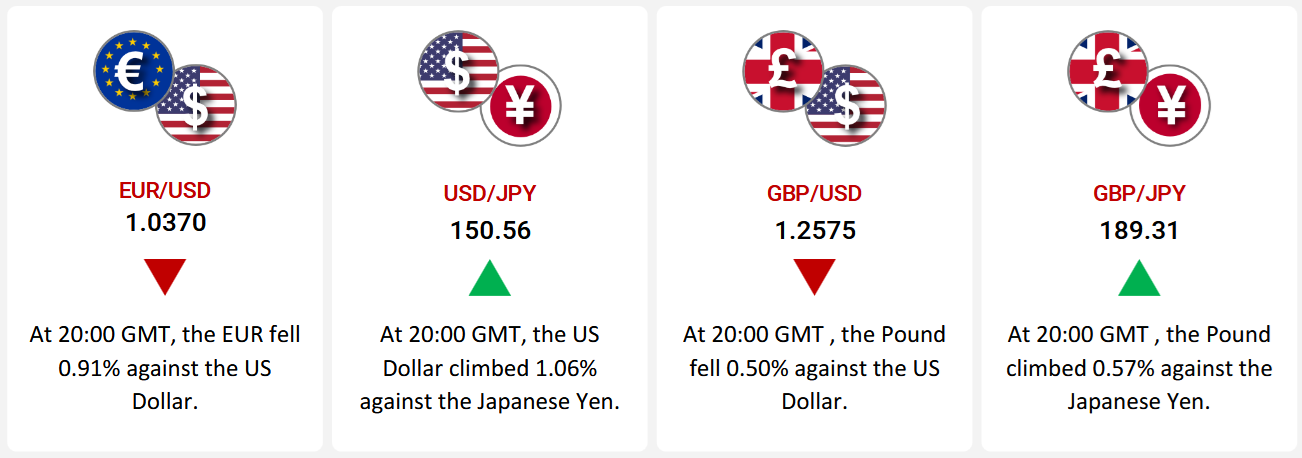

The Euro weakened against the USD by 0.91% due to weak Eurozone data and rising US-EU trade tensions. Eurozone inflation moderated, but the services sector underperformed, raising concerns over economic growth. Despite mixed US economic data, the USD remained strong, bolstered by safe-haven demand and trade tensions, especially after President Trump’s tariff threats on European imports, further impacting the euro.

The USD also gained 1.06% against the JPY, as Japan’s weak inflation raised doubts over the Bank of Japan's policy stance. A drop in Tokyo’s inflation and mixed US data weighed on the dollar, though a strong manufacturing PMI and steady Federal Reserve policies supported the currency. Meanwhile, the GBP/USD fell by 0.50% due to Trump’s tariff threats and their potential to impact the British economy. The market’s uncertainty around trade negotiations contributed to the volatility, despite the US GDP and durable goods orders exceeding expectations.

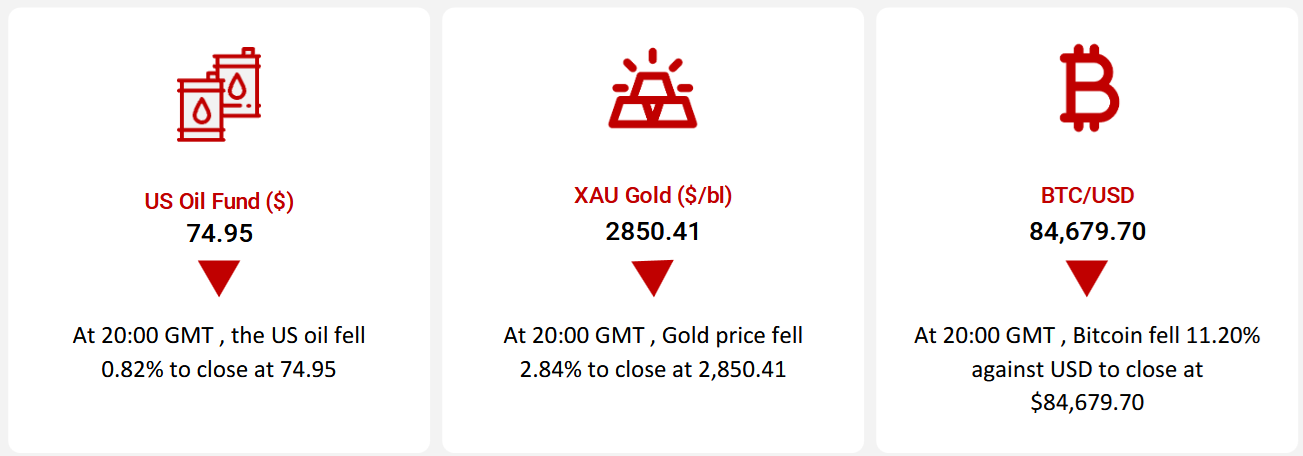

The GBP/JPY rose by 0.57% as the Bank of England’s moderate policy stance and better-than-expected UK housing prices supported the Pound. On the other hand, the Japanese Yen weakened due to a decline in Japan’s inflation and industrial production data. Oil prices also dropped due to concerns over global economic growth, trade uncertainties, and a potential peace deal between Russia and Ukraine reducing supply risks. Meanwhile, gold prices declined amid a stronger US Dollar and investor caution ahead of the US Federal Reserve’s PCE data.

Bitcoin slumped as US tariff threats reduced risk appetite, and a security breach at the By bit exchange further heightened investor concerns. The SEC also dropped litigation against Coinbase, signaling a shift in regulatory stance towards digital assets.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

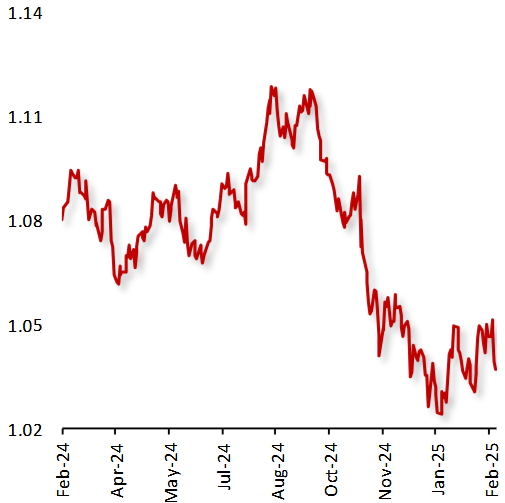

EUR/USD

|

|

|

Euro Weakens Against USD Amid Weak Eurozone Data and Rising US-EU Trade Tensions

|

|

| |

|

|

The Euro fell 0.91% against the USD this week, influenced by mixed Eurozone economic data and escalating US-EU trade tensions.

In the Eurozone, January's Consumer Price Index (CPI) showed a slight moderation in inflation, aligning with expectations. While manufacturing activity showed slight improvement, the services sector unexpectedly weakened, raising concerns about overall economic momentum. Business sentiment improved marginally, and consumer confidence showed signs of recovery, but growth remained sluggish.

Conversely, the US economy presented a mixed picture. The Consumer Confidence Index dropped in February, to its lowest since April 2024, reflecting growing consumer concerns. Despite this, the US dollar remained resilient, bolstered by safe-haven demand amid President Donald Trump's announcement of impending 25% tariffs on European imports, including automobiles. This development heightened fears of a transatlantic trade war, further weighing on the euro.

|

|

| |

| |

| |

|

|

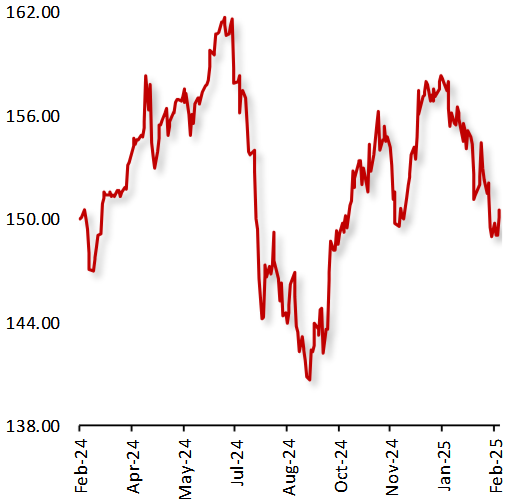

USD/JPY

|

|

|

USD Closed Higher Against JPY Amid Market Volatility and Rising Yields

|

|

| |

|

|

The USD closed higher 1.06% against the JPY, as the dollar remained resilient despite mixed US economic data, while Japan’s inflation slowdown raised doubts over the Bank of Japan’s (BOJ) policy path.

The yen weakened after Tokyo’s inflation rate declined in February, fueling speculation that the BOJ may delay further policy tightening. However, an unexpected jump in industrial production signaled resilience in Japan’s economy, lending some support to the currency.

In the US, weak housing data and a drop in consumer confidence weighed on the dollar. While rising initial jobless claims highlighted labor market concerns. However, a strong manufacturing PMI and the Federal Reserve’s steady policy outlook kept the greenback supported, maintaining upward momentum for the currency pair.

|

|

| |

| |

| |

|

|

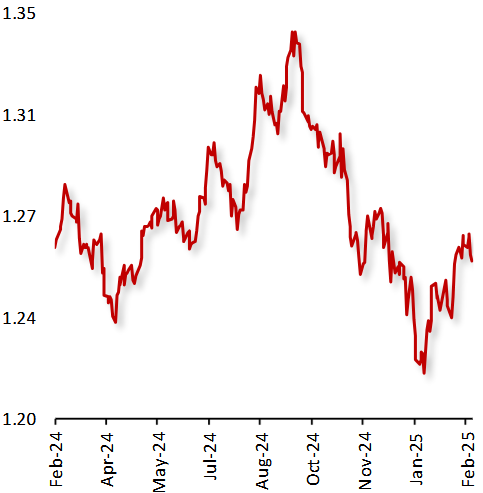

GBP/USD

|

|

|

GBP/USD Declines as US Tariff Uncertainty Weighs on the Pound

|

|

| |

|

|

The GBP/USD pair fell this week 0.50%, as US President Donald Trump’s tariff threats pressured the Pound Sterling. Following his meeting with UK Prime Minister Keir Starmer, Trump warned of potential tariffs unless ambiguous trade deal terms are resolved within an unspecified deadline. This uncertainty has fueled market volatility. Additionally, Bank of England (BoE) policymaker Swati Dhingra noted that higher US tariffs could strengthen the US Dollar, raising UK prices.

Meanwhile, the US dollar strengthened, following US President Donald Trump's latest tariff comment. Supporting its strength, the US GDP grew as expected in Q4 2024, while the durable goods orders exceeded forecasts in January, driven by rising aircraft demand. Investors remain watchful of trade negotiations and economic data for further market direction.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP/JPY Rises Amid BoE Policy Hopes and Weaker Yen

|

|

| |

|

|

The GBP/JPY pair rose this week 0.57%, driven by optimism surrounding expectations of a more moderate monetary easing cycle from the Bank of England (BoE) this year. Additionally, UK Nationwide housing prices increased more than expected in February, further supporting the Pound.

In contrast, the Japanese Yen weakened, following a decline in Tokyo’s inflation rate in February. Moreover, in Japan, the Tokyo consumer price index dropped in February, while the nation’s annualized housing starts declined in January. Moreover, industrial production fell more than expected, while the leading economic index advanced less than anticipated in December, further contributing to the Yen’s weakness.

|

|

| |

| |

| |

|

|

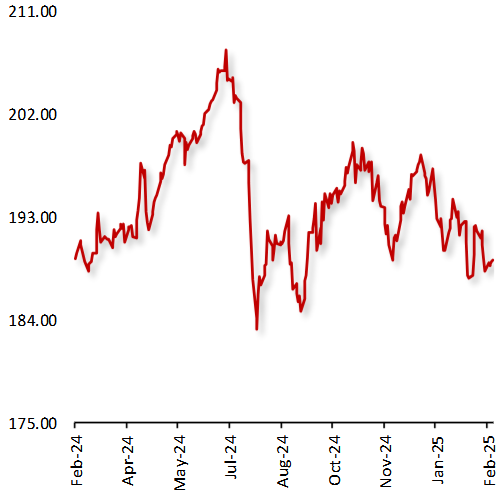

US Oil Fund ($)

|

|

|

Oil Prices Decline Amid Worries Over Demand Outlook

|

|

| |

|

|

Oil prices fell this week, as uncertainty over global economic growth and fuel demand from Washington’s tariff threats and further signs of a US economic slowdown outweighed supply concerns. Also weighing on investor sentiment, data showed US jobless claims jumped more than expected in the previous week, while disappointing consumer confidence data reiterated that economic growth slowed in the fourth quarter.

Moreover, prospects for a peace deal between Russia and Ukraine eased concerns about supply disruptions from the region. Adding to the negative sentiment, the Organization of the Petroleum Exporting Countries (OPEC) and allied countries is debating whether to raise oil output in April as planned or freeze it, amid uncertainty around US sanctions on Venezuela, Iran and Russia.

|

|

| |

| |

| |

|

|

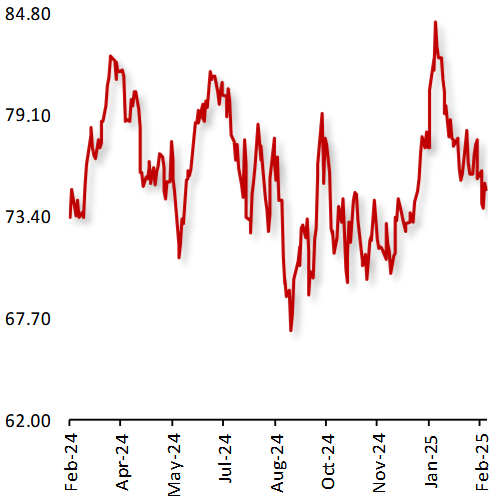

XAU Gold (XAU/USD)

|

|

|

Gold Declined Amid Strength in the US Dollar

|

|

| |

|

|

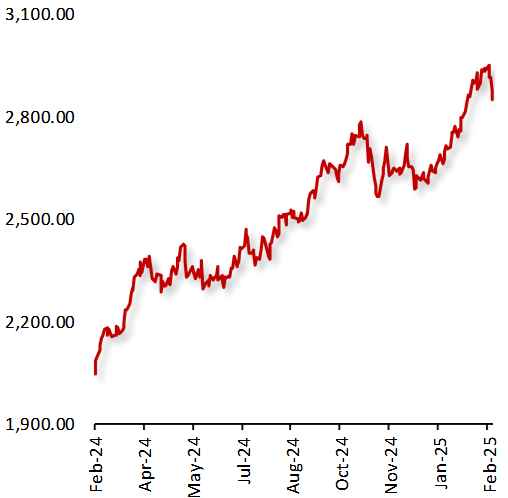

Gold declined last week, amid strength in the US Dollar and as investors await the Personal Consumption Expenditures (PCE) data, the Federal Reserve’s (Fed) preferred inflation measure, for further direction on monetary policy outlook.

Adding to the negative sentiment, the US Federal Reserve’s latest monetary policy meeting minutes revealed that Trump’s initial policy proposals stoked concerns over rising inflation, reinforcing the central bank’s stance to hold off on further interest rate cuts. Also, data indicated that, the world's leading consumer of gold, China’s total gold imports via Hong Kong dropped 44.8% in January compared to December. The decline in gold imports marks a significant shift from the December imports, indicating subdued demand.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Slumped As Risk Appetite Diminished Among Investors

|

|

| |

|

|

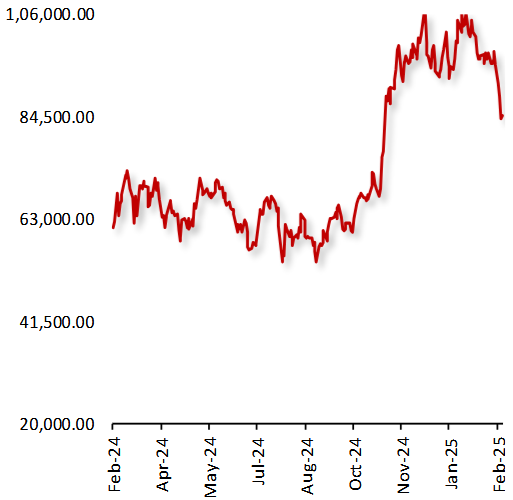

Bitcoin declined last week, as US President Donald Trump’s latest tariff threats diminished risk appetite among investors. President Trump reaffirmed plans to impose a 25% tariff on goods from Mexico and Canada and an additional 10% tariff on Chinese imports as early as 4 March. The fresh tariff plans raised concerns over broader economic impact.

Adding to the negative sentiment, a security breach at the By bit exchange, resulting in the theft of approximately $1.5 billion worth of Ether, further intensified concerns over the security of digital assets.

In major news, the US Securities and Exchange Commission (SEC) has agreed to voluntarily dismiss all litigation tied to Coinbase and Coinbase Global with prejudice, which included withdrawing from its initial June 2023 lawsuit and its request for an interlocutory appeal with the US Court of Appeals.

|

|

| |

|

| |

|

|

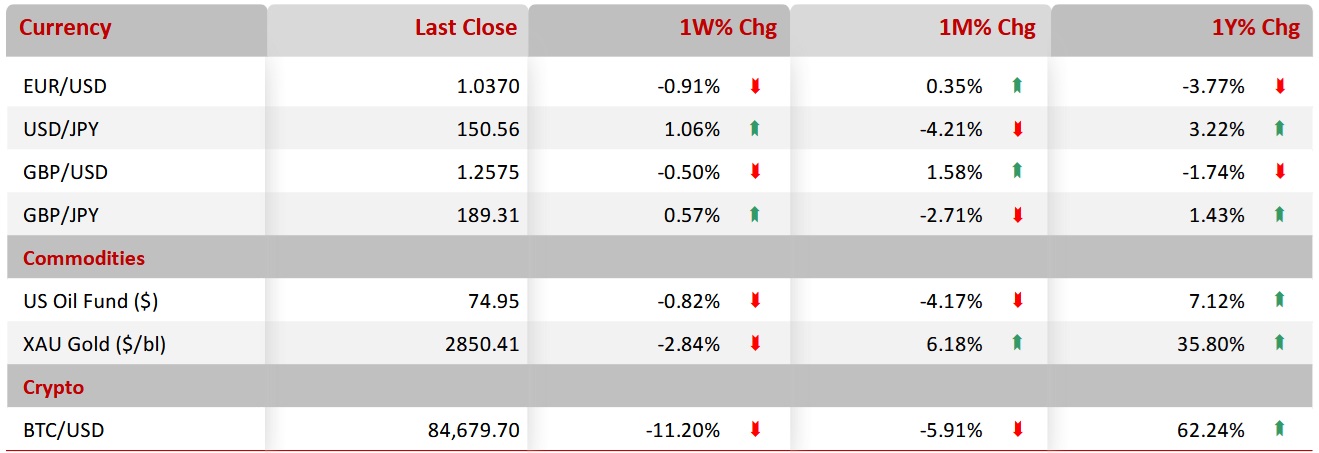

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|