| |

| Market Update |

| |

|

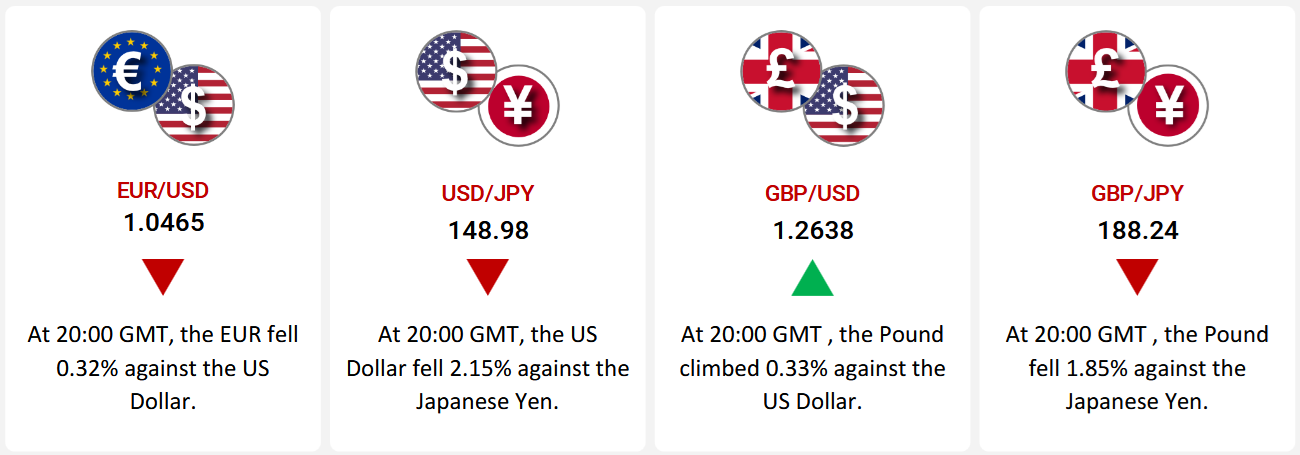

The euro weakened by 0.32% against the US dollar due to mixed Eurozone economic data and a strong USD, supported by the Federal Reserve’s hawkish stance. While Eurozone manufacturing PMI showed improvement, services PMI and economic uncertainty kept the euro under pressure.

The US dollar fluctuated, losing 2.15% against the Japanese yen as Japan’s inflation hit a 19-month high, raising expectations for Bank of Japan (BoJ) rate hikes. Stronger Japanese economic growth and rising consumer spending further bolstered the yen. Meanwhile, the US dollar faced pressure after President Trump announced new tariffs, sparking trade concerns.

The British pound strengthened against the US dollar, gaining 0.33% as UK inflation hit a 10-month high, reducing expectations for Bank of England (BoE) rate cuts. Strong UK retail sales and consumer confidence added support. However, GBP/JPY fell by 1.85% as weak UK manufacturing PMI and cautious BoE remarks weighed on sentiment, while the yen gained on rate hike expectations.

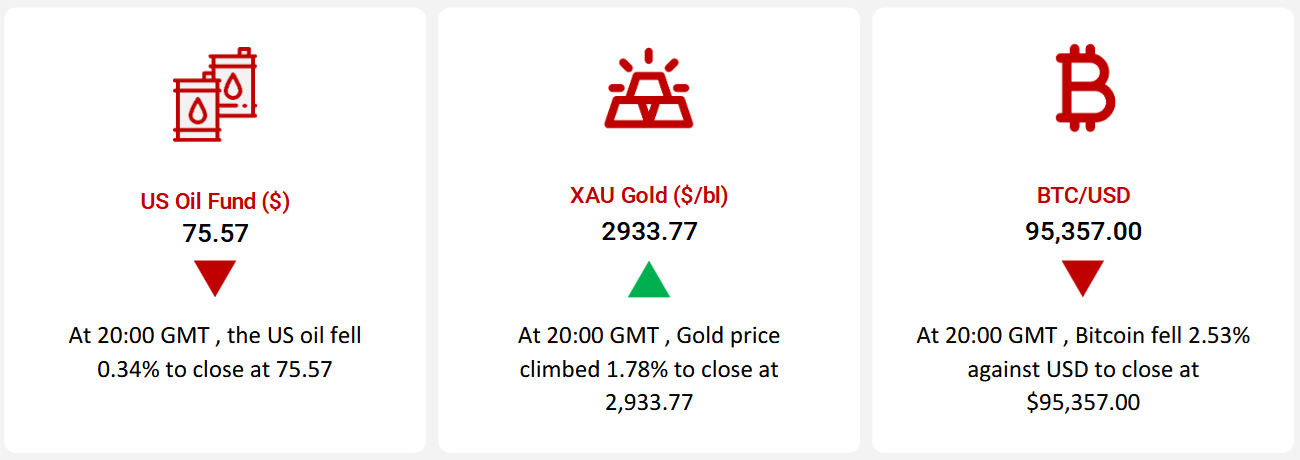

Oil prices fell amid supply disruptions caused by Ukrainian drone attacks and cold weather in the US. However, diplomatic talks between the US and Russia raised hopes of a de-escalation in the Ukraine war, limiting price gains. OPEC’s consideration of delaying supply increases also influenced market sentiment.

Gold prices climbed as trade tensions and Trump’s new tariffs fueled inflation fears, increasing demand for the safe-haven asset. However, potential Fed balance-sheet policy changes and Ukraine peace negotiations capped gains.

Bitcoin declined as the FOMC’s meeting minutes reaffirmed a cautious stance on rate cuts. Additionally, Trump’s proposed tariffs and immigration policies raised economic uncertainty. Meanwhile, the SEC dismissed its lawsuit against Coinbase, marking a positive development for the cryptocurrency sector.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

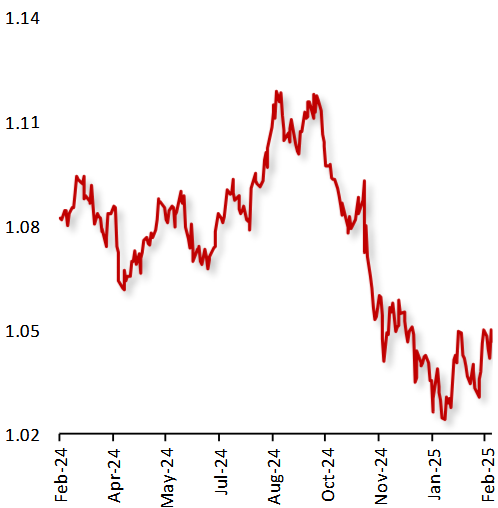

EUR/USD

|

|

|

Euro weakened Amid Trade Tensions and Diverging Monetary Policies

|

|

| |

|

|

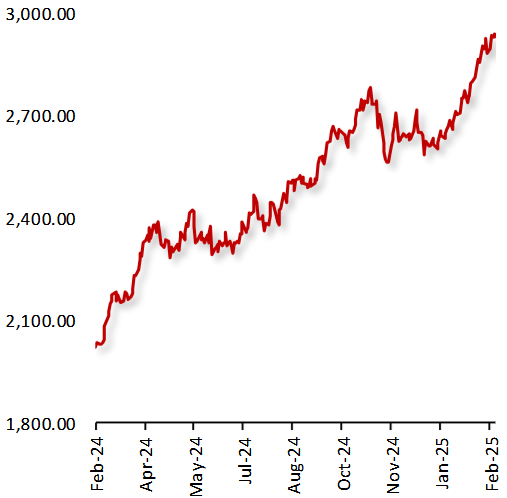

The Euro fell 0.32% against the USD during the week, as a combination of mixed Eurozone economic data and solid US economic performance.

In the Eurozone, manufacturing PMI rose to a nine-month high, indicating some recovery in the sector. However, Services PMI declined, reflecting weaker-than-expected growth. Consumer confidence improved, reaching its highest level in four months, suggesting a slightly better economic outlook.

Meanwhile, in the US, initial jobless claims rose to 219K, surpassing expectations, while the Philadelphia Fed manufacturing index fell to 18.1, signaling slowing growth. Despite weaker data, the Federal Reserve's hawkish stance kept the USD strong, limiting the Euro’s recovery. As market participants assess upcoming economic data and policy decisions, EUR/USD remains under pressure, with volatility expected to continue.

|

|

| |

| |

| |

|

|

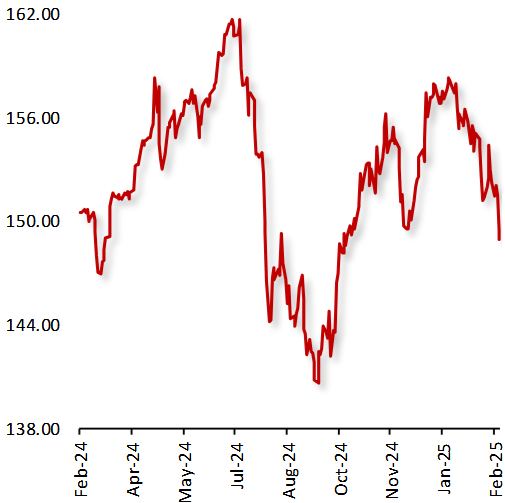

USD/JPY

|

|

|

Dollar Fluctuates Amid Rising Japanese Inflation and US Trade Uncertainty

|

|

| |

|

|

The USD closed 2.15% lower against the JPY, as the yen strengthened amid rising inflation and potential Bank of Japan (BOJ) rate hikes.

In Japan, core inflation surged to a 19-month high, increasing speculation that the BOJ may raise rates twice this year to curb yen depreciation. Additionally, Japan's economy expanded faster than expected in 4Q24, driven by improved business investments and an unexpected rise in consumer spending. Both, manufacturing and services PMI improved in February, signaling economic resilience.

Meanwhile, the US dollar faced pressure following President Donald Trump’s announcement of new tariffs on key imports, raising concerns over economic disruptions. Additionally, US initial jobless claims rose exceeding forecasts, but the Federal Reserve maintained its steady policy outlook, keeping the USD supported.

|

|

| |

| |

| |

|

|

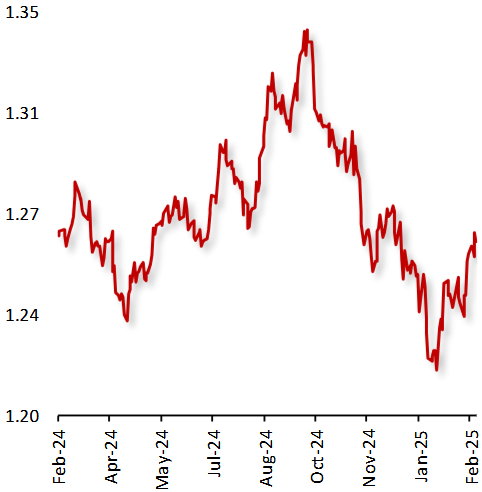

GBP/USD

|

|

|

GBP/USD Moves Higher As UK Inflation Data Reduces Rate Cut Expectations

|

|

| |

|

|

The GBP/USD pair climbed by 0.33% this week as more-than-expected UK inflation data dampened expectations for two rate cuts by the Bank of England (BoE) this year.

In the UK, consumer price inflation surged to a 10-month high in January, driven by rising airfares and food prices. Additionally, retail sales exceeded forecasts, GfK consumer confidence improved, and the services PMI unexpectedly strengthened in February, signaling economic resilience.

Meanwhile, the US dollar weakened as weekly jobless claims for February 14, 2025, rose to 219,000, surpassing expectations. Also, the US housing starts posted a sharp decline in January.

Further supporting GBP/USD, US President Donald Trump indicated progress in trade negotiations with China, while the FOMC minutes highlighted concerns over inflation, exerting pressure on the US dollar.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP/JPY Shifts Lower As Dismal UK Manufacturing PMI Data Weighs On Sentiment

|

|

| |

|

|

The GBP/JPY pair fell by 1.85% this week following disappointing UK manufacturing PMI data.

In the UK, the manufacturing PMI unexpectedly declined in February, raising concerns about the country’s economic outlook. Additionally, Bank of England (BoE) Governor Andrew Bailey cautioned that economic growth is likely to remain sluggish, with signs of a weakening labor market.

On the contrary, the Japanese Yen strengthened as market expectations for further rate hikes by the Bank of Japan (BoJ) increased. Also, Japan’s national core inflation surged to a 19-month high in January, reinforcing speculation of additional interest rate hikes. Furthermore, the Jibin Bank Services PMI edged up to 53.1 in February from 53.0 in the previous month, signaling steady expansion in the services sector.

|

|

| |

| |

| |

|

|

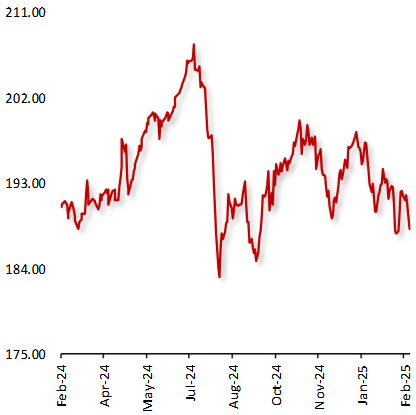

US Oil Fund ($)

|

|

|

Oil Prices Decline Amid Supply Disruptions and Diplomatic Developments

|

|

| |

|

|

Oil prices fell this week, as Ukrainian drone attacks on Russian oil pumping station in the Caspian Sea slowed oil flows from Kazakhstan to world markets and after cold US weather froze oil wells in North Dakota, fueling concerns over supply disruptions. However, gains were limited as oil prices faced downward pressure, amid diplomatic engagements between the US and Russian officials in Saudi Arabia, raising expectations for a potential de-escalation in the Ukraine war.

Moreover, the Organization of Petroleum Export Countries (OPEC) has indicated that it is considering delaying a series of monthly supply increases due to begin in April, despite calls from US President Donald Trump to lower prices. Meanwhile, the US Energy Information Administration (EIA) reported that crude oil inventories rose by 4.6 million barrels to 432.5 million barrels in the week ended 14 February 2025.

|

|

| |

| |

| |

|

|

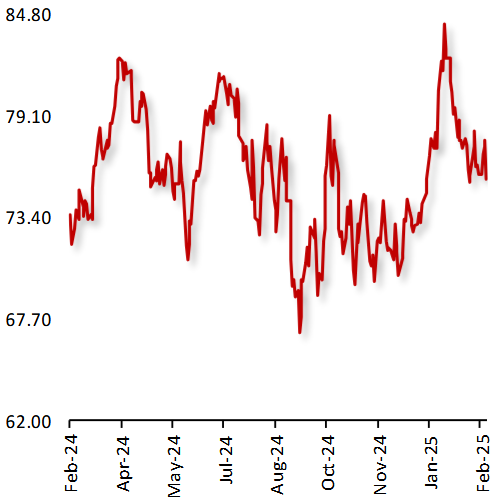

XAU Gold (XAU/USD)

|

|

|

Gold Prices Climb As Trade Tensions Boosted Demand for the Safe Haven

|

|

| |

|

|

Gold prices rose last week, amid weakness in the US Dollar and as US President Donald Trump’s fresh trade tariff plans stoked fears of higher inflation and a major global trade war, boosting demand for the haven metal. The metal’s upward momentum was further driven by expectations of prolonged macroeconomic instability and geopolitical risks.

Meanwhile, gains were limited as the Minutes of the US Federal Reserve's policy meeting revealed that policymakers discussed potentially pausing or slowing their balance-sheet reduction program amid debt-ceiling concerns, reinforcing the central bank’s stance to hold off on further rate cuts. Additionally, renewed focus on Ukraine peace negotiations introduced downside risks, as a potential resolution could ease global tensions, thereby limiting further upside in gold prices.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Fell As FOMC Minutes Revealed Hawkish Policy Stance

|

|

| |

|

|

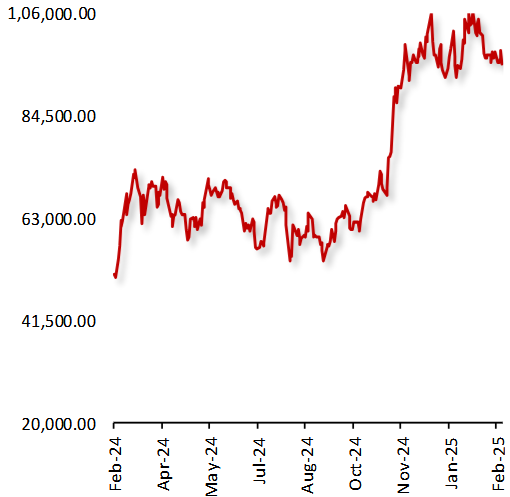

Bitcoin declined last week, as the Federal Open Market Committee’s (FOMC) January meeting minutes revealed that officials remain cautious about adjusting interest rates, emphasizing the need for further progress on inflation before making any changes. The minutes highlighted that “many participants noted that the committee could hold the policy rate at a restrictive level if the economy remained strong and inflation remained elevated.”

Furthermore, policymakers are monitoring Trump’s economic policy plans, including proposed increased tariffs on US trading partners and immigration restrictions, which could impact inflation, labor markets, and economic growth.

In major news, the US Securities and Exchange Commission (SEC) has agreed to dismiss a lawsuit against Coinbase, which had accused the cryptocurrency exchange of operating as an unregistered securities broker.

|

|

| |

|

| |

|

|

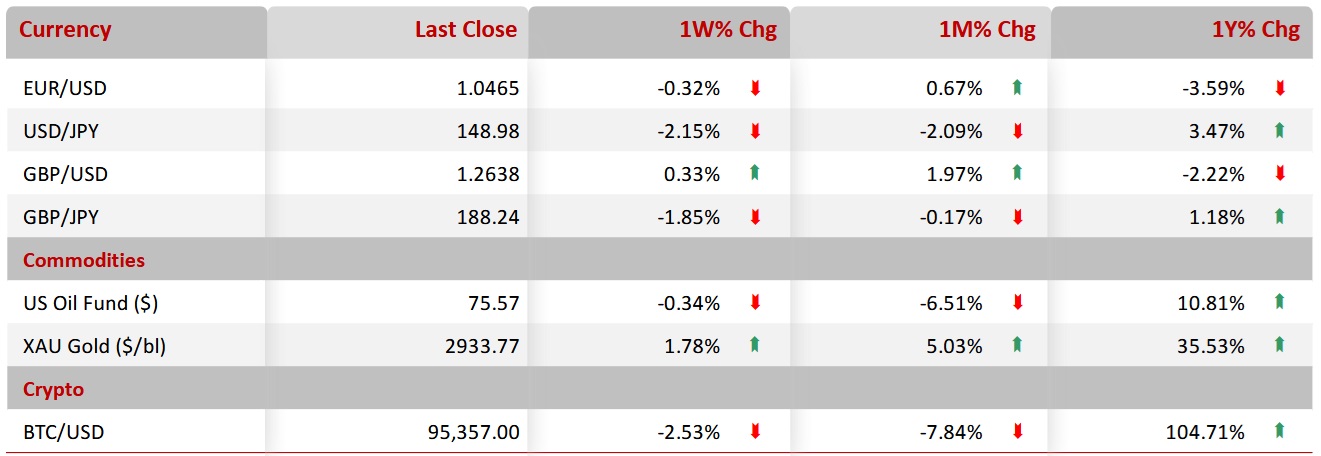

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|