| |

| Market Update |

| |

|

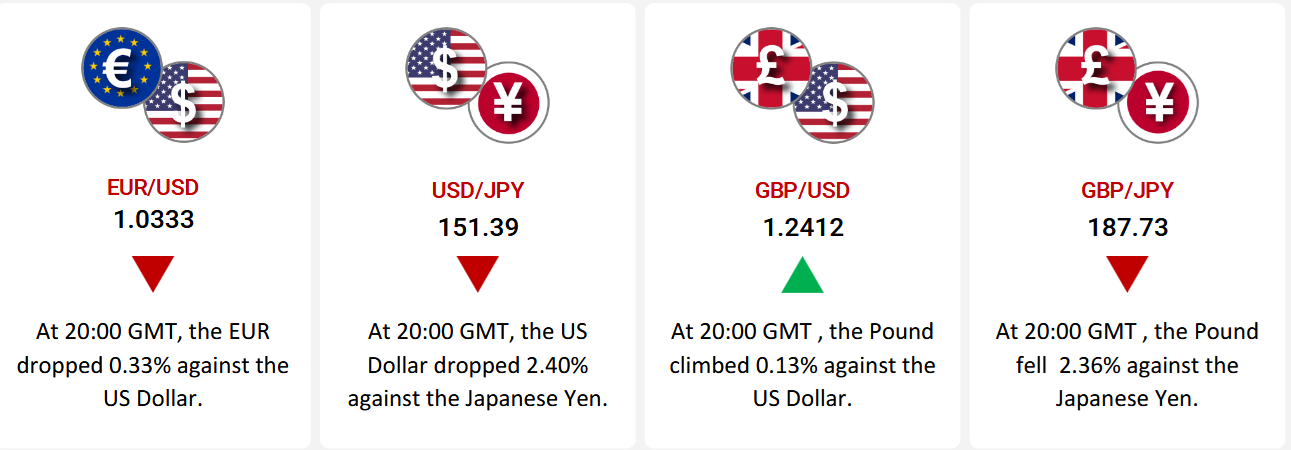

The Euro weakened by 0.33% against the dollar due to strong US economic data, while Eurozone inflation rose to 2.5% in January. Eurozone manufacturing showed improvement, but services declined, and retail sales fell. In the US, jobless claims increased, yet ADP employment data exceeded expectations.

The US dollar fell 2.40% against the Japanese yen as Japan’s economy showed strength. Inflation neared the central bank’s 2% target, household spending increased, and services PMI performed well. However, manufacturing PMI declined.

The British pound rose 0.13% against the dollar as US trade tariff decisions were delayed. The UK manufacturing sector rebounded, and housing prices exceeded expectations. Weak US economic data, including lower factory orders and slowing labor market growth, added to the dollar’s decline.

GBP/JPY fell 2.36% after the Bank of England cut interest rates to 4.5%, citing economic growth concerns. UK services PMI dropped, while Japan’s services PMI and wage data strengthened, supporting the yen.

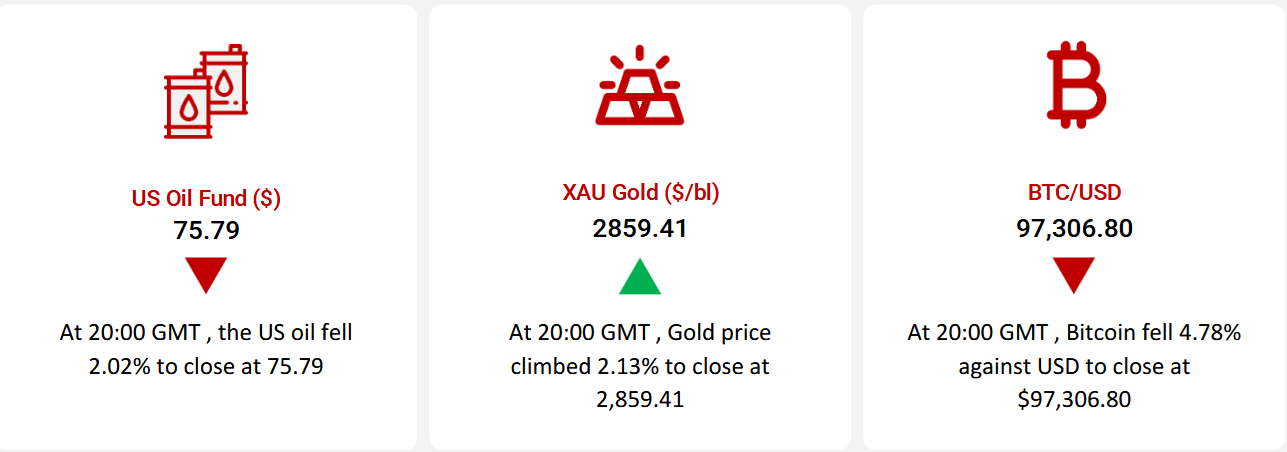

Oil prices declined for the third consecutive week as US crude inventories rose more than expected. China imposed tariffs on US crude imports, increasing demand concerns. However, Saudi Aramco’s price hike for Asian buyers helped limit losses.

Gold prices increased for the sixth straight week, driven by US-China trade tensions and inflation fears. China imposed new tariffs on US imports, boosting demand for the safe-haven metal. The Fed warned that inflation risks might delay interest rate cuts.

Bitcoin declined amid global trade tensions but limited losses after the US postponed tariffs on Mexico and Canada. Franklin Templeton filed for a crypto ETF, and NFT infrastructure provider Reservoir secured $14 million in funding.

The US added 143,000 jobs in January, below December’s 307,000. Unemployment dropped to 4%, while average hourly wages rose 4.1% to $35.87.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

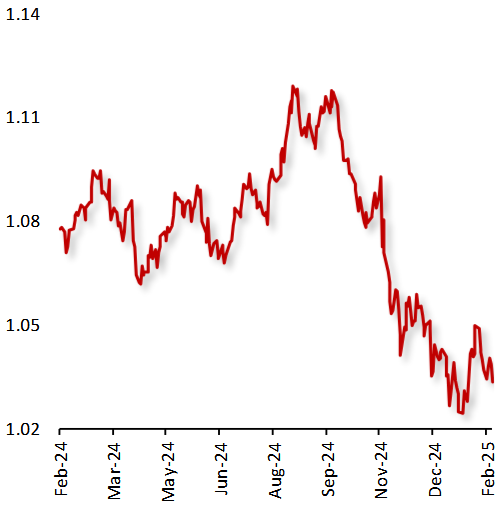

EUR/USD

|

|

|

Euro Weakens Against Dollar Amid Economic Uncertainty and Strong US Data

|

|

| |

|

|

The EUR declined 0.33% against the USD this week, driven by strong US economic performance.

In the Eurozone, inflation unexpectedly rose to 2.5% in January, marking the third consecutive month above the European Central Bank's 2% target. The HCOB Manufacturing PMI reached an eight-month high, while the producer price index (PPI) increased in December as energy costs fell at a slower pace. However, the HCOB Services PMI declined more than anticipated in January, and retail sales dropped more than expected in December.

Meanwhile, US economic data was mixed. The Chicago PMI advanced but remained in contraction, and jobless claims rose more than expected. However, the ADP employment surpassed forecasts. While services PMIs declined, ISM and S&P Global Manufacturing PMIs exceeded expectations.

|

|

| |

| |

| |

|

|

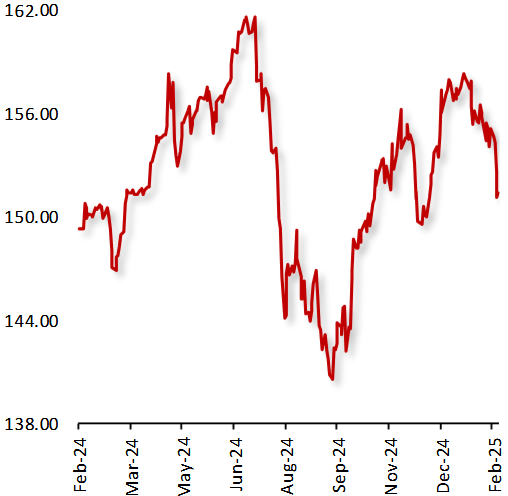

USD/JPY

|

|

|

Dollar Fell As Japanese Yen Strengthens Amid Strong Economic Indicators

|

|

| |

|

|

The USD fell 2.40% against the JPY this week, as the Japanese yen strengthened, supported by positive domestic data and global market trends. Japan’s Economy Minister Ryosei Akazawa noted that underlying inflation is approaching the 2% target, aligning with the central bank’s efforts to overcome stagnation. Additionally, household spending rose for the first time in five months year-over-year in December, while the Jibin Bank Services PMI exceeded expectations in January. However, the Jibin Bank Manufacturing PMI declined.

In contrast, the US economic data was mixed. The Chicago PMI advanced but remained in contraction, while initial jobless claims rose more than expected. However, the ADP employment report surpassed expectations, highlighting labor market strength, and MBA mortgage applications increased, signaling some housing market recovery.

|

|

| |

| |

| |

|

|

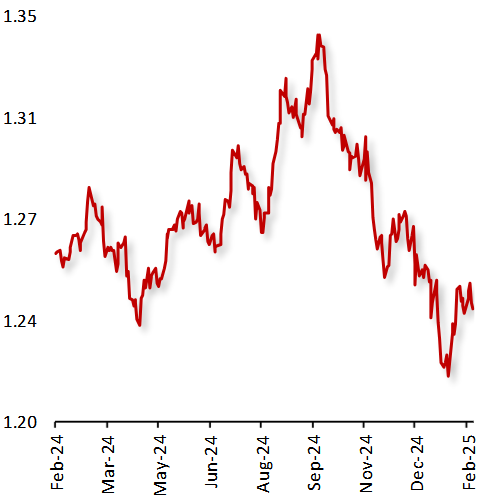

GBP/USD

|

|

|

GBP/USD Moves Higher As US Tariff Decision Delays

|

|

| |

|

|

The GBP/USD pair rose 0.13% this week, after US President Donald Trump delayed tariffs on Canadian and Mexican imports, easing trade tensions.

In the UK, the manufacturing sector rebounded sharply in January, while the Halifax house prices exceeded expectations, signaling resilience in the housing market.

Meanwhile, the US dollar weakened, amid expectations of further policy easing by the US Federal Reserve (Fed). Economic data reinforced this outlook, as US factory orders declined more than anticipated in December, driven by lower civilian aircraft bookings. Additionally, services sector activity slowed unexpectedly in January, easing price pressures. The labor market also showed signs of weakness, with JOLTS job openings posting the largest decline in 14 months weekly jobless claims rising more than expected, and nonfarm payrolls underperforming.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP/JPY Shifts Lower As BOE Lowers Rate

|

|

| |

|

|

The GBP/JPY pair declined 2.36% this week, after the Bank of England (BoE) lowered its benchmark interest rate to 4.5%, citing concerns over economic growth. Additionally, the UK services PMI unexpectedly fell in January, further weighing on the Pound Sterling.

In contrast, the Japanese Yen strengthened, as strong wage and services data fueled expectations of a more hawkish Bank of Japan (BoJ). Japan’s Jibin Bank Services PMI expanded for a third consecutive month in January, supported by rising export demand from Asia. Moreover, the country’s leading economic index and overall household spending index both exceeded expectations in December, signaling economic resilience.

Given this backdrop, further downside pressure on GBP/JPY is anticipated.

|

|

| |

| |

| |

|

|

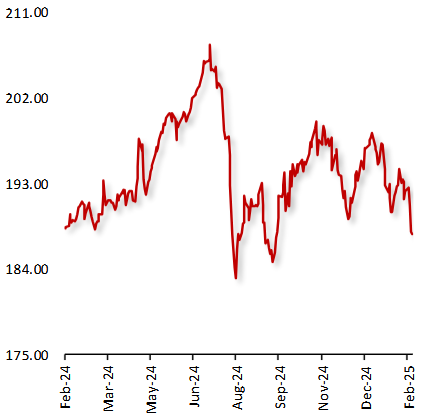

US Oil Fund ($)

|

|

|

Oil Prices Fell Amid Rise in the Crude Inventories

|

|

| |

|

|

Oil prices fell last week, marking the third straight weekly drop, as US President Donald Trump reaffirmed plans to boost domestic oil production and curb inflation. According to the Energy Information Administration (EIA), the US crude stocks climbed by 8.664mn barrels in the week ended 31 January 2025, surpassing expectations of a 3.20mn barrel build. Additionally, China imposed retaliatory tariffs on US crude imports, fuelling concerns over weaker demand and shifts in global trade flows.

However, losses were capped after Saudi Aramco raised its crude prices for Asian buyers, signalling confidence in demand recovery. Investors now await the broader impact of these sanctions on Iranian crude shipments to China, as well as ongoing trade negotiations between major economies.

|

|

| |

| |

| |

|

|

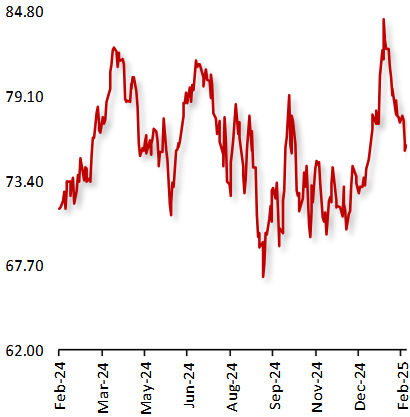

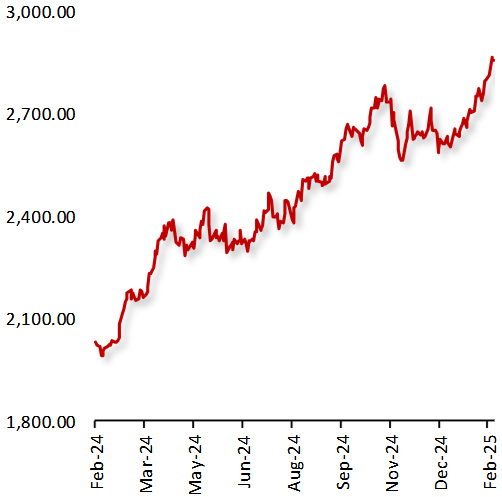

XAU Gold (XAU/USD)

|

|

|

Gold Rises for Sixth Straight Week Amid Trade Tensions and Inflation Concerns

|

|

| |

|

|

Gold rose last week, for the sixth consecutive week, as escalating trade tensions between the US and China, including China's retaliatory tariffs, fuelled concerns over global economic growth. In response to US President Donald Trump's tariffs, China imposed targeted levies on US imports and placed several American companies on notice for potential sanctions, boosting demand for the safe-haven metal.

Additionally, the US Federal Reserve officials cautioned that interest rate cuts could slow due to inflation risks linked to the Trump administration’s tariff policies. Overall, gold maintained its upward momentum, driven by macroeconomic volatility, inflation concerns, and persistent economic uncertainty.

|

|

| |

| |

| |

|

|

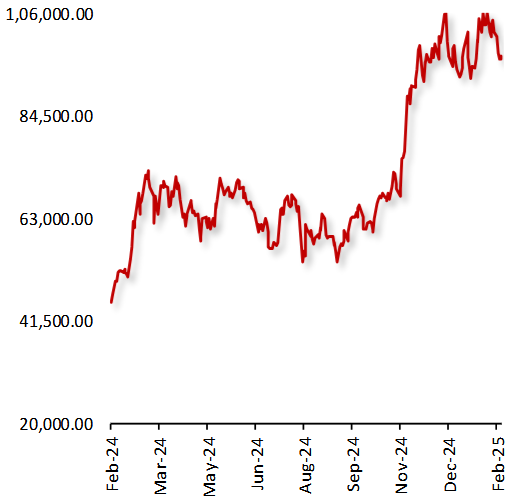

BTC/USD

|

|

|

Bitcoin Drops Amid Escalating Global Trade Tensions

|

|

| |

|

|

Bitcoin declined last week, as trade tensions between the world’s two largest economies intensified, with the US and China imposing fresh trade tariffs on each other. In response to Washington’s decision to impose a 10% tariff on all Chinese goods, China announced new tariffs on select US imports, including oil and liquefied natural gas. However, losses were limited after the US paused its proposed tariffs on Mexico and Canada for a month.

In major news, asset manager Franklin Templeton has filed for a multi-asset crypto exchange-traded fund (ETF) with the US securities regulator. Separately, Reservoir, the non-fungible token (NFT) infrastructure provider for Coinbase, MetaMask and Magic Eden, has closed a US$14-million funding round to expand its infrastructure to new marketplaces.

|

|

| |

| |

| |

| Nonfarm payrolls: 143K Jobs Added in January |

| |

|

The US economy added 143,000 in January, significantly lower than December’s upwardly revised 307,000 jobs. Healthcare added 44,000 jobs in January, followed by retail trade at 34,000 and social assistance at 22,000.

Meanwhile, the unemployment rate dropped from 4.1% in December to 4% in January, with the total number of unemployed people at 6.8 million. The labour participation rate remained largely unchanged at 62.6%. Average hourly wages rose 4.1% year-over-year to a new record of US$35.87, compared to forecasts for average hourly wages to increase by 3.8% to pay of US$35.80.

Government payrolls increased by 32,000, exceeding the forecast of 25,000. The latest data marks the first jobs report since President Donald Trump took office on 20 January, with an agenda focused on tax cuts, economic growth, and trade protectionism through higher tariffs on major US trading partners.

|

| |

|

| |

|

|

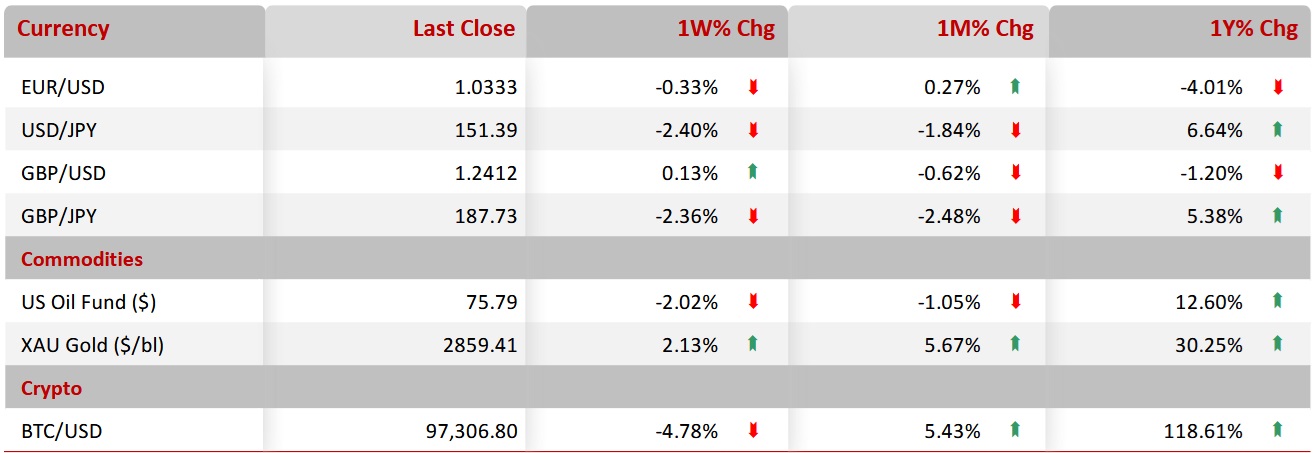

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|