| |

| Market Update |

| |

|

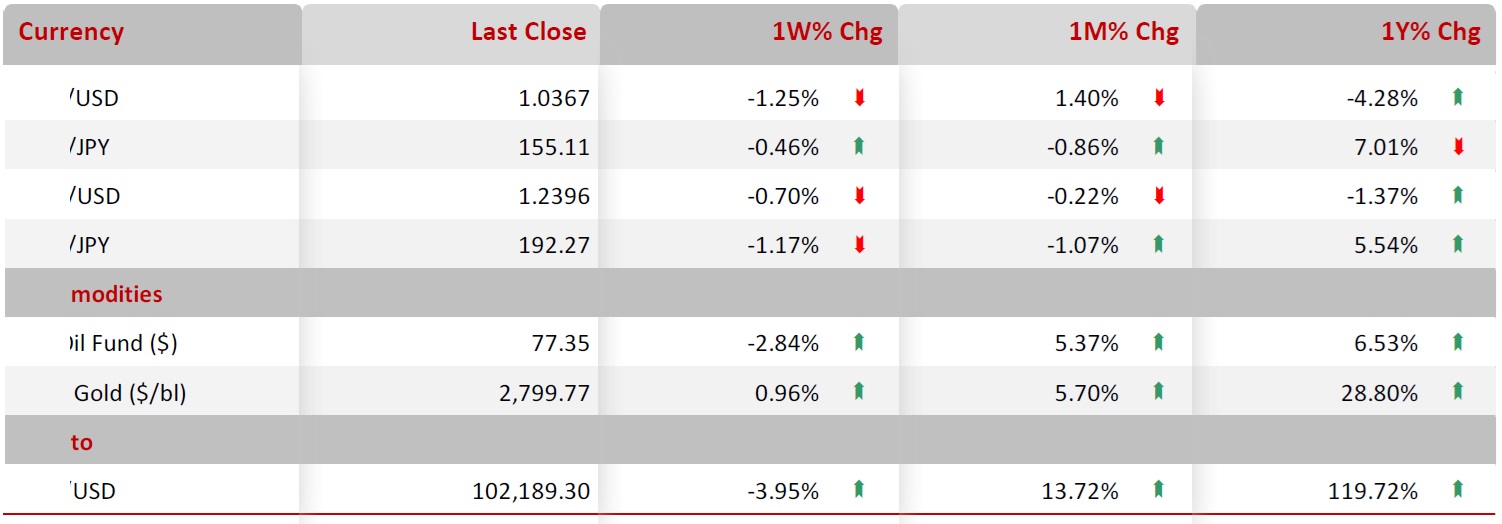

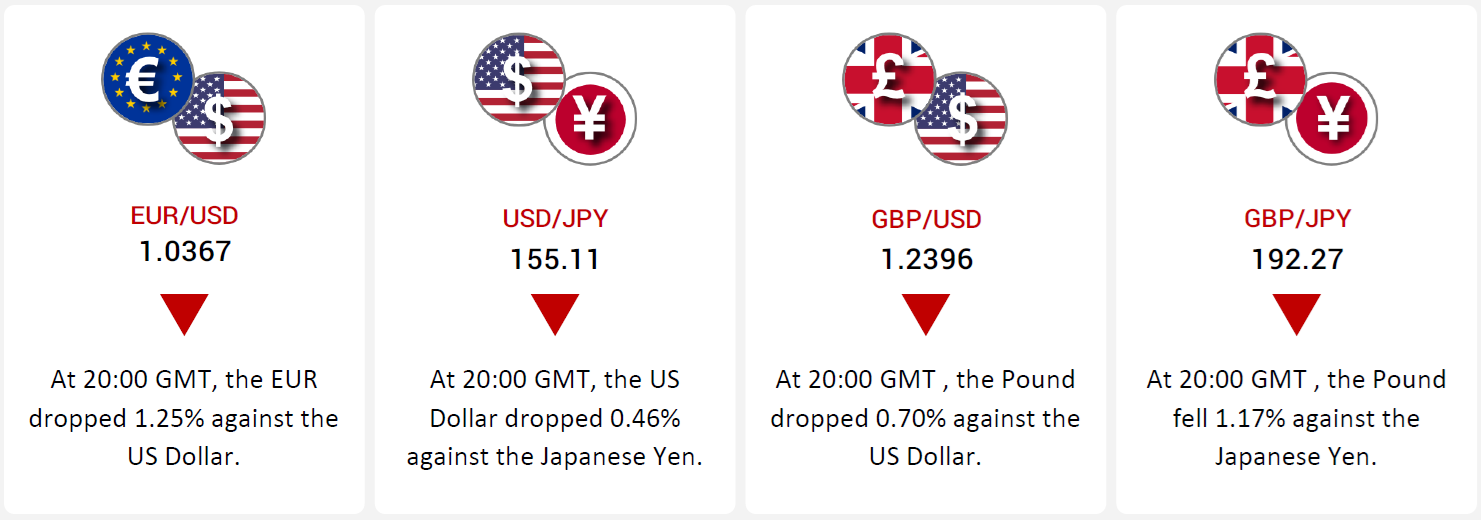

The US Dollar strengthened last week, driven by strong economic data and the Federal Reserve's cautious stance on interest rates, weighing on major currencies. The EUR fell 1.25% against the USD as weak Eurozone growth, rising unemployment, and declining services PMI fueled economic concerns. Similarly, the GBP dropped 0.70% against the USD due to weaker UK economic data, declining private sector activity, and slowing house price growth.

Against the JPY, the USD declined 0.46% as the Fed held rates at 4.5%, while the Bank of Japan reaffirmed its commitment to loose monetary policy. Japan’s economic data showed resilience, with strong PMI readings and a stable unemployment rate of 2.4%. The GBP also fell 1.17% against the JPY, reflecting contrasting economic conditions between the UK and Japan.

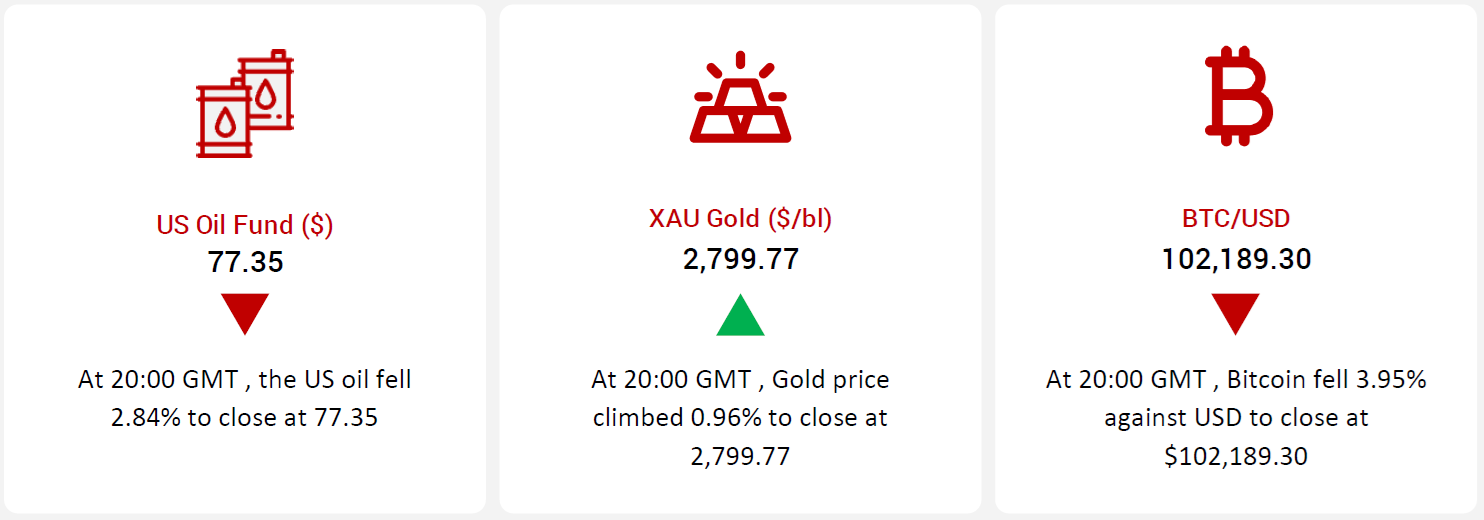

Oil prices dropped amid a larger-than-expected rise in US crude inventories and pressure from US President Donald Trump on OPEC+ to boost production. However, losses were limited after the US imposed a 25% tariff on Canadian and Mexican exports, raising trade concerns. Winter storms in the US also contributed to weaker refinery activity, adding to supply-side pressures.

Gold prices rose as Trump’s proposed tariffs fueled inflation fears and boosted safe-haven demand. The Fed’s decision to maintain rates at 4.5% further supported gold by reinforcing a low-rate environment. Investors are now awaiting the US PCE price index report for further inflation insights.

Bitcoin declined despite rising institutional interest and a weaker USD. The Fed’s pause on monetary easing and Jerome Powell’s comments on regulatory clarity fueled expectations of crypto-friendly policies under Trump. Meanwhile, investment firms continued pushing for SEC approval of new crypto ETFs, including those focused on meme coins.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

EUR/USD

|

|

|

Dollar Weakens Amid Fed's steady Stance and Japan’s resilient economic data

|

|

| |

|

|

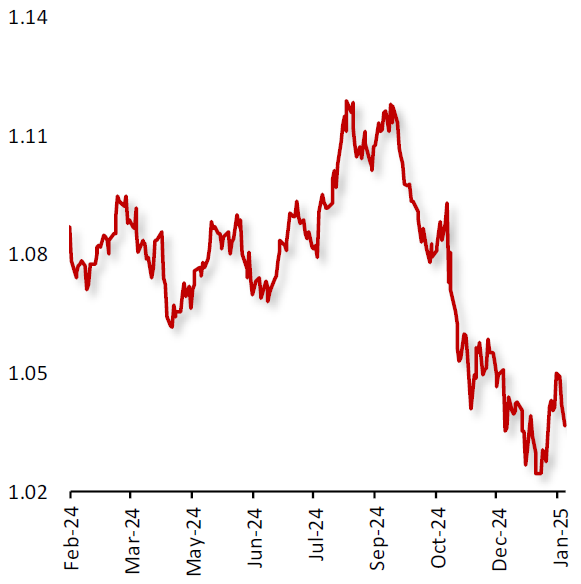

The EUR closed 1.25% lower against the USD during the week, as weak Eurozone economic growth and strong US data increased market volatility.

In the Eurozone, Q4 2024 GDP remained flat, reflecting ongoing concerns about industrial output and consumer spending. Consumer confidence remained weak, as inflationary pressures and high borrowing costs weighed on household sentiment. The Eurozone’s unemployment rate rose in December as expected. Meanwhile, the services PMI declined to a two-month low in January, indicating potential weakness in the services industry.

On the other hand, the US economy continued to show resilience. US initial jobless claims fell more than expected. The Chicago Fed national activity index turned positive in December. However, pending home sales declined in December, highlighting potential weakness in the housing sector. The US Federal Reserve (Fed) held its key interest rate at 4.5%.

|

|

| |

| |

| |

|

|

USD/JPY

|

|

|

Dollar Weakens Amid Fed's steady Stance and Japan’s resilient economic data

|

|

| |

|

|

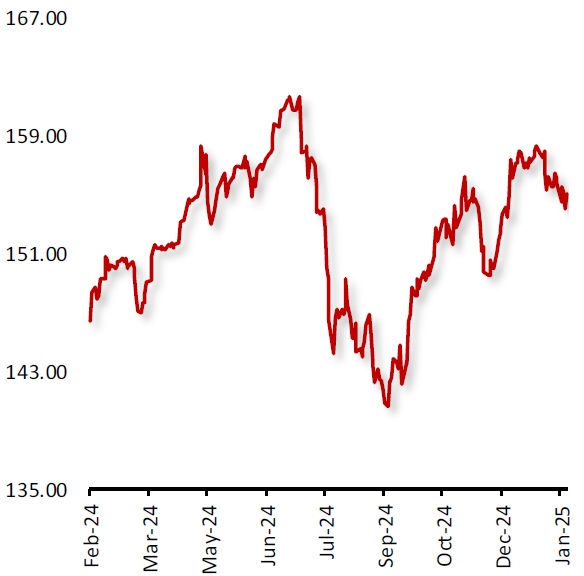

The USD closed 0.46% lower against the JPY during the week, due to Fed's cautious stance on interest rate.

The Michigan consumer sentiment index dropped to 71.10 in January. The Federal Reserve maintained its key interest rate at 4.5%, as expected, signaling a commitment to managing inflation while supporting economic growth. The housing market showed signs of slowing, with pending home sales declining by 5.5% in December.

On the other hand, in Japan, Bank of Japan (BoJ) Governor Kazuo Ueda emphasized the need to maintain the BOJ’s loose monetary policy to ensure inflation gradually accelerates toward the central bank's 2% target. Despite inflation briefly exceeding the target, it was primarily driven by rising food and fuel prices, which are expected to dissipate later in the year. Japan's economic data showed resilience, with manufacturing PMI exceeding expectations, and services PMI rising to 51.20. The unemployment rate fell to 2.4%.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

Pound Weakened Amid Economic Concerns and Stronger US Dollar

|

|

| |

|

|

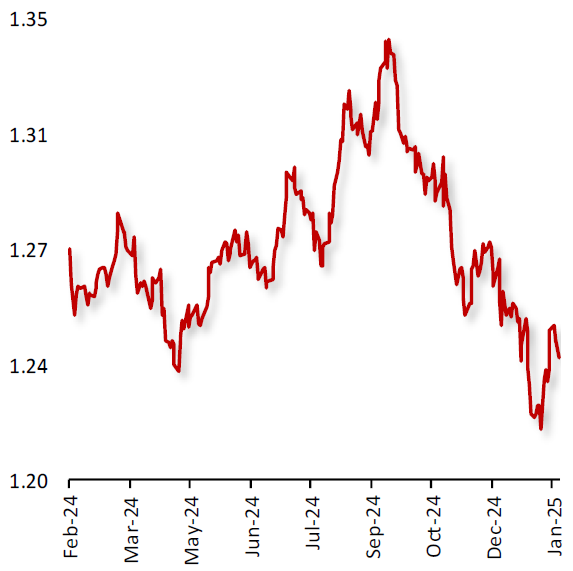

The GBP closed 0.70% lower against the USD during the week, amid weaker-than-expected UK economic data and a stronger US dollar.

In the UK, private sector activity continued to decline in the three months to January. The manufacturing PMI showed a stronger-than-expected improvement in January and the S&P Global services PMI rose to 51.20, indicating modest growth. Meanwhile, UK house price growth slowed more than anticipated in January, largely due to the impact of high mortgage rates.

Dollar maintained strength, supported by solid economic indicators. The US GDP grew in Q4 2024, slightly below expectations. The labor market remained resilient, with initial jobless claims dropping more than expected. The Fed kept its key interest rate unchanged to support its goals of maximum employment and keeping inflation at 2% in the long term.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

GBP drops amid UK Economic Weakness and Japan's Resilient Data

|

|

| |

|

|

The GBP closed 1.17% lower against the JPY during the week, with a volatile performance driven by the contrasting economic conditions in the UK and Japan.

In the UK, economic concerns continued to weigh on the pound. Private sector activity contracted again in the three months to January, highlighting ongoing economic challenges. The manufacturing PMI showed an improvement in January, exceeding expectations, but this was offset by a slowdown in house price growth and high mortgage rates.

Meanwhile, Japan’s economic data showed resilience. Manufacturing PMI showed stronger-than-expected improvement in January, and the S&P Global services PMI rose to 51.20, indicating modest growth in services. Japan's unemployment rate remained stable at 2.4%. The Bank of Japan (BoJ) Governor Kazuo Ueda emphasized the need to maintain the BOJ’s loose monetary policy to ensure inflation gradually accelerates toward the central bank's 2% target.

|

|

| |

| |

| |

|

|

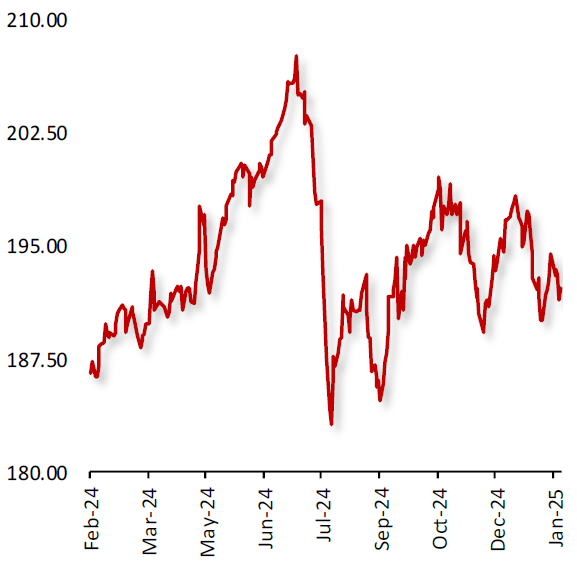

US Oil Fund ($)

|

|

|

Oil Prices Fell Amid Rise in the Crude Inventories

|

|

| |

|

|

Oil fell last week, amid larger-than-expected rise in the US crude inventories and after the US President Donald Trump urged the OPEC+ to lower crude prices by increasing production. According to the Energy Information Administration (EIA), the US crude stocks climbed by 3.463mn barrels in the week ended 24 January 2025, surpassing expectations of a 3.2mn barrel build.

However, losses were limited after the US Administrations confirmed US President Trump’s decision to impose a 25% tariff on Canadian and Mexican exports to the US, potentially disrupting North American trade. Moreover, winter storms in the US also contributed to weaker refinery activity, further aggravating supply-side pressures. Furthermore, investors await the Organization of the Petroleum Exporting Countries (OPEC) and allies’ policy meeting next week.

|

|

| |

| |

| |

|

|

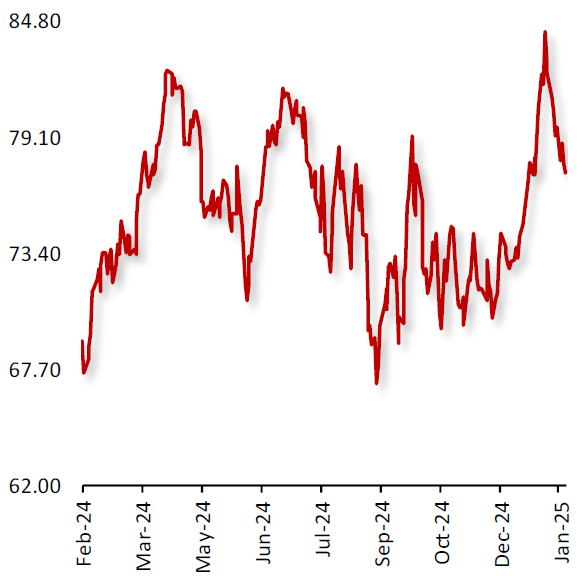

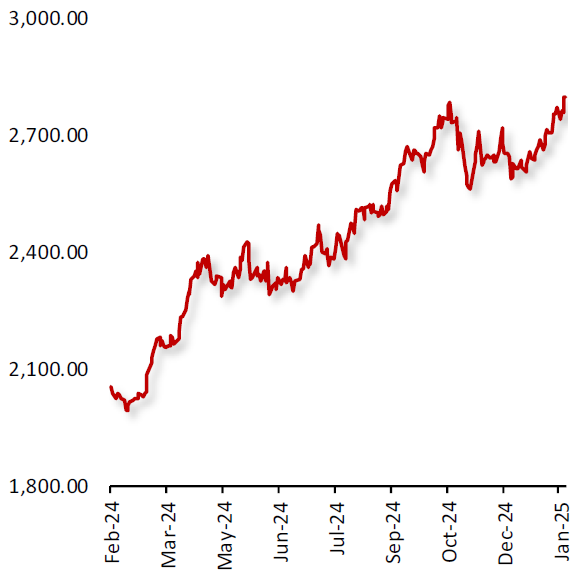

XAU Gold (XAU/USD)

|

|

|

Gold Prices Rose Amid Trump Tariff Uncertainties

|

|

| |

|

|

Gold rose last week, driven by concerns over US President Trump's proposed tariffs, which heightened inflation expectations and fueled safe-haven interest. Trump administrations confirmed that the US would impose a 25% duty on imports from Mexico and Canada and the US considering new tariffs on Chinese goods.

Additionally, the US Federal Reserve (Fed), in its latest monetary policy meeting, kept its interest rate unchanged at 4.5% and maintained its cautious policy stance. This reinforced the low-interest-rate environment, which typically supports gold prices. Overall, gold maintained its upward momentum, supported by macroeconomic volatility, inflation concerns, and ongoing economic uncertainty.

Moreover, investors await the December US personal consumption expenditures price index report, the Fed’s favored gauge of inflation for further direction.

|

|

| |

| |

| |

|

|

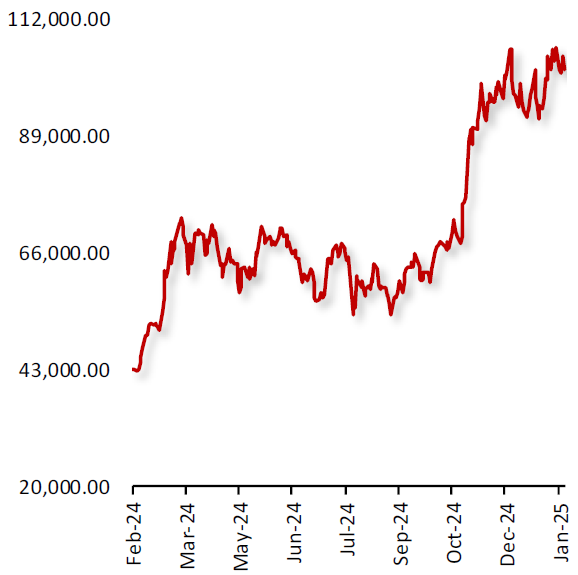

BTC/USD

|

|

|

Bitcoin Declines Despite USD Weakness, Fed Stance, and Rising Institutional Interest

|

|

| |

|

|

Bitcoin fell last week, amid weakness in the US Dollar and growing institutional interest. Adding to the positive sentiment, the US Federal Reserve (Fed) officials paused monetary easing and chair Jerome Powell in his customary briefing signaled that the central bank would need to see more progress on inflation before considering any further reduction in interest rates. He affirmed that banks are “perfectly able” to serve crypto customers, provided they understand and manage the associated risks. These comments fueled expectations for crypto-friendly regulations under President Donald Trump’s administration

Additionally, investment firms are actively submitting proposals to the Securities and Exchange Commission (SEC) to launch various crypto exchange-traded funds (ETFs), including those focused on meme coins, further boosting crypto prices.

|

|

| |

| |

| |

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|