| |

| Market Update |

| |

|

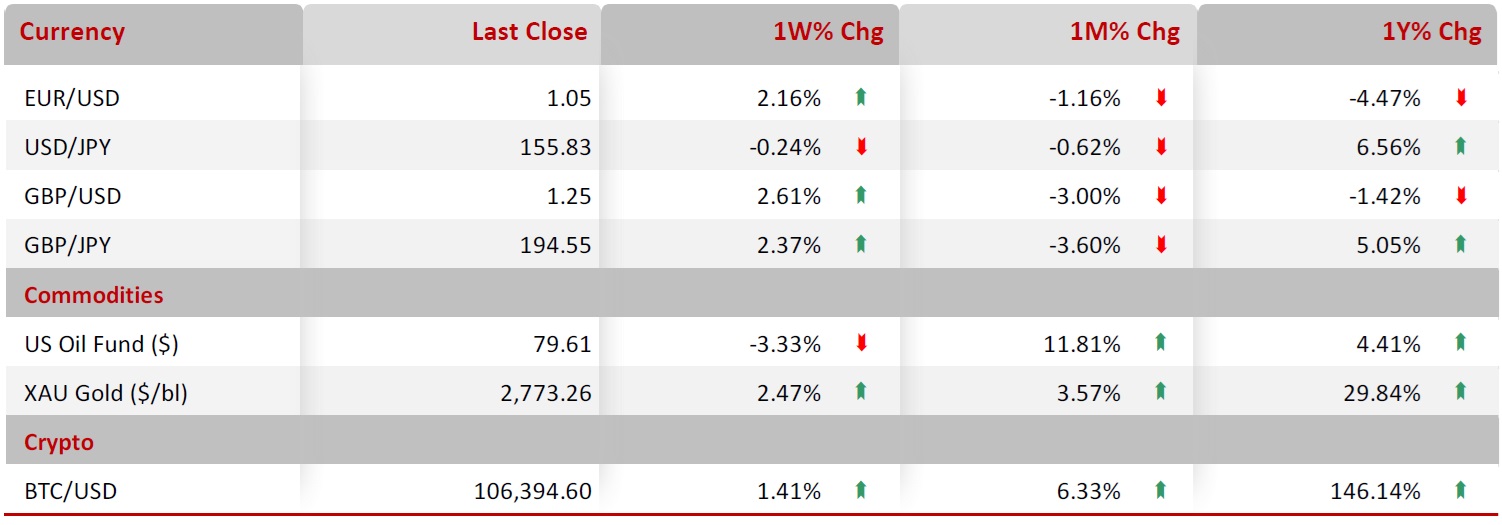

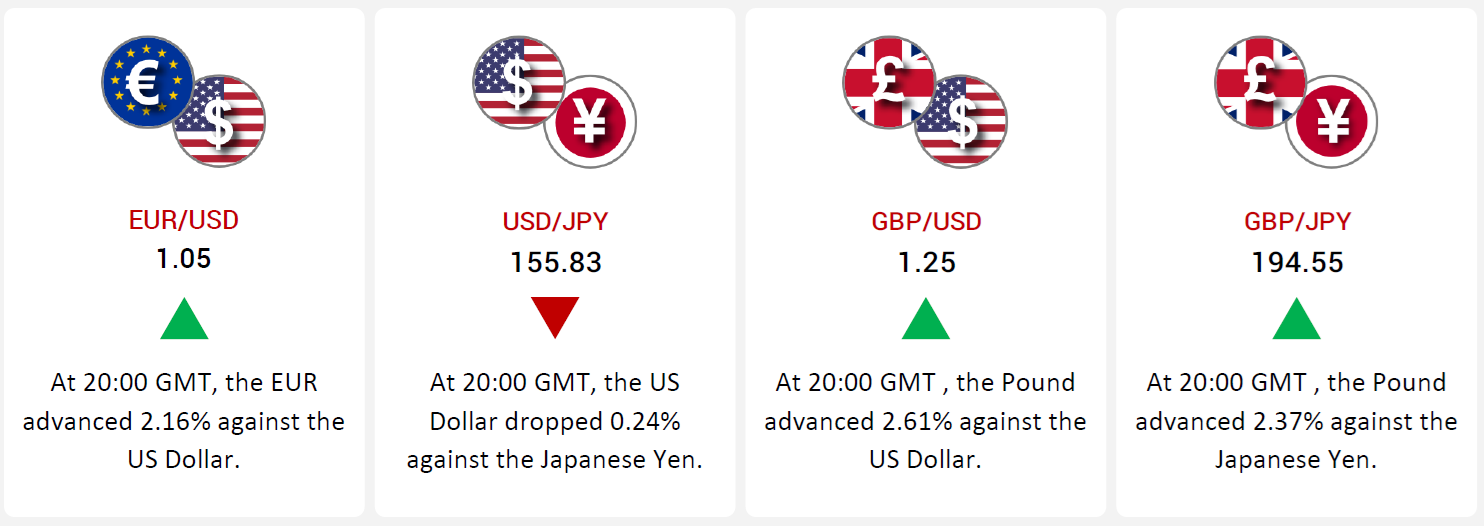

Global markets saw notable currency, commodity, and cryptocurrency movements last week. The euro gained 2.16% against the USD, buoyed by strong Eurozone PMI data and improved consumer confidence. Inflation concerns persisted as the CPI slightly exceeded expectations, reinforcing the ECB's tightening stance. Meanwhile, strong US economic data supported the dollar, with housing starts and industrial production surpassing forecasts.

The USD weakened 0.24% against the JPY despite robust US economic indicators, as the Bank of Japan raised rates to a 15-year high and revised inflation forecasts upward. The yen remained under pressure due to the BoJ’s overall accommodative stance.

The GBP rose 2.61% against the USD, reflecting mixed UK data. Retail sales declined sharply, with food sales posting their worst results since 2013, and consumer confidence dropped further. However, rising wage growth and house prices highlighted resilience in some sectors. Against the JPY, the GBP climbed 2.37% amid solid UK data and the BoJ's dovish policies. Japan’s CPI increased, but manufacturing PMI fell, contrasting with stronger services PMI.

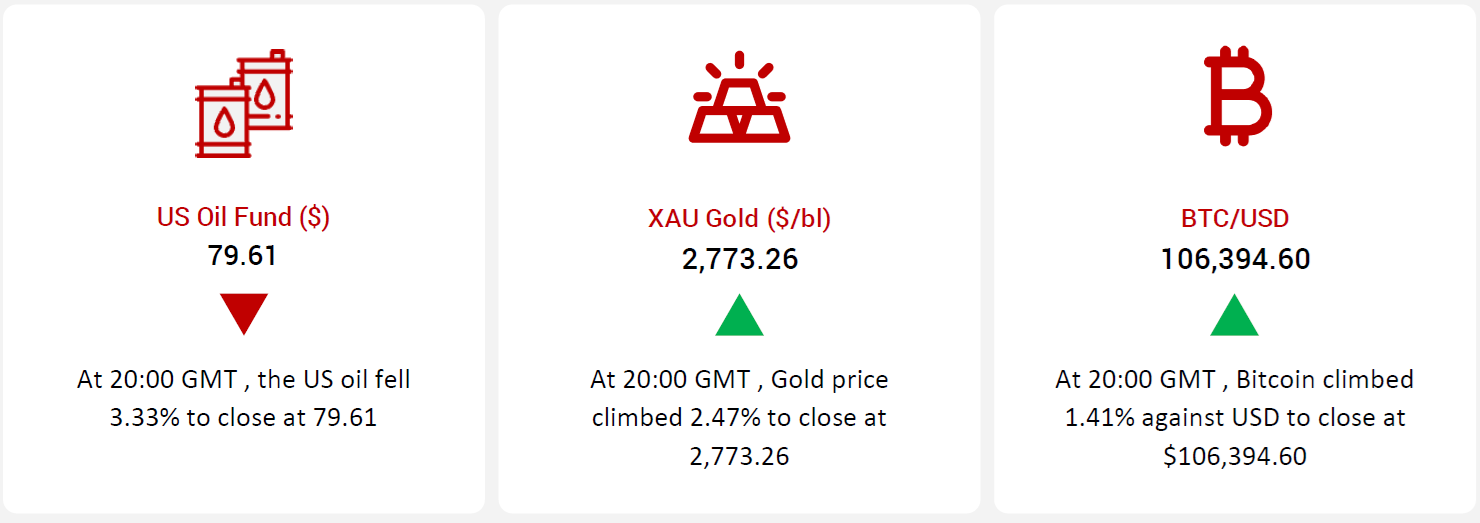

Oil prices declined as President Trump’s tariff policies fueled global growth concerns. Trump’s demand for OPEC to lower crude prices and a US energy emergency declaration added to the bearish sentiment, despite US crude inventories hitting multi-year lows.

Gold prices rose, driven by dollar weakness and market uncertainty over Trump’s trade policies. Investors anticipated central bank rate decisions amid calls for lower interest rates.

Bitcoin advanced after the US SEC launched a task force to develop a regulatory framework for digital assets. President Trump signed executive orders boosting cryptocurrency and AI initiatives, potentially fostering growth in both sectors.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

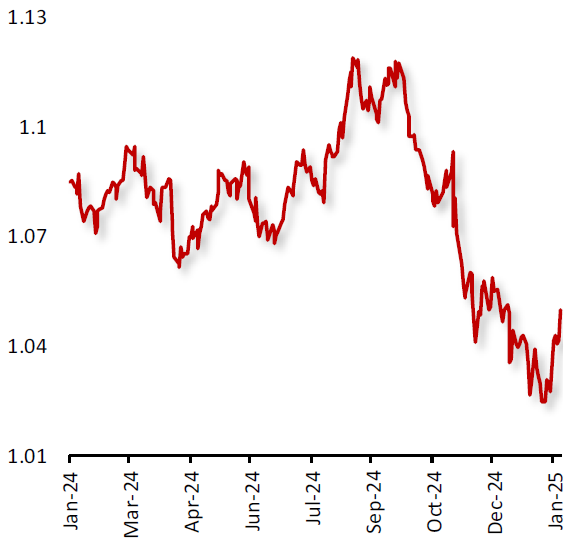

EUR/USD

|

|

|

Euro jumps amid strong Eurozone economic data

|

|

| |

|

|

The EUR closed 2.16% higher against the USD during the week, following upbeat PMI data from Germany and the Eurozone, which showed an expansion in the private sector's business activity in January.

In the Eurozone, the consumer confidence improved for the first time in three months in January. In the eurozone, the ZEW economic sentiment improved in January. In the Eurozone, inflation remained stubbornly high, with the December CPI rising slightly above market expectations, keeping pressure on the European Central Bank (ECB) to maintain its tightening bias.

In the US, solid economic data bolstered the dollar. Housing starts surpassed expectations in December, and industrial production also increased more than forecasted, signaling a strong economy.

|

|

| |

| |

| |

|

|

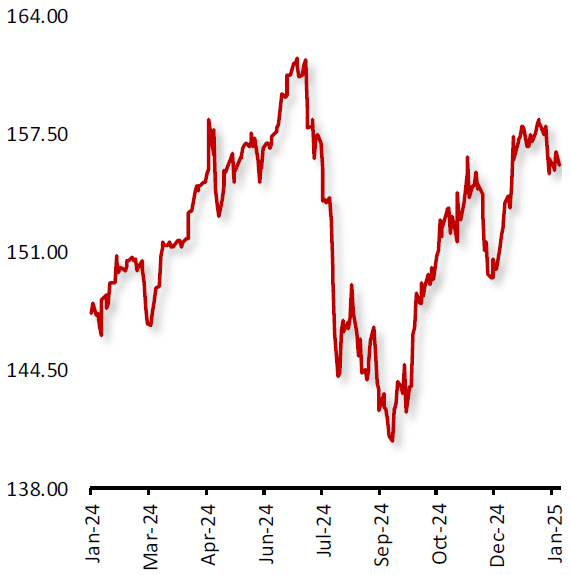

USD/JPY

|

|

|

USD Weakens Against JPY Amid Strong US Data and BoJ Rate Hike

|

|

| |

|

|

The USD closed 0.24% lower against the JPY during the week, as strong US economic data continued to support the dollar, while the Bank of Japan (BoJ) reaffirmed its accommodative stance, keeping the yen under pressure.

In the US, initial jobless claims rose to 212K in the week ending 17 January 2025. Housing starts exceeded expectations in December, while industrial production also advanced more than anticipated. However, building permits declined during the same period. Meanwhile, MBA mortgage applications increased in the week ending 16 January 2025, reflecting resilient activity in the housing sector.

On the other hand, the Bank of Japan raised interest rates to their highest level since the 2008 global financial crisis and revised its inflation forecasts upward.

|

|

| |

| |

| |

|

|

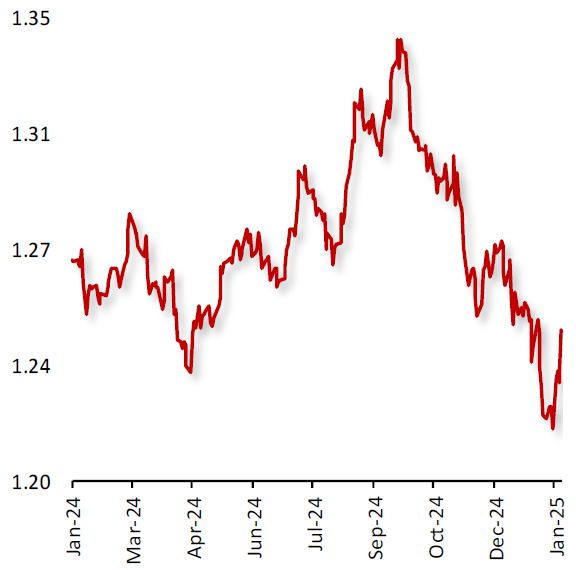

GBP/USD

|

|

|

GBP Rises Against USD Despite Mixed UK Data and Strong US Performance

|

|

| |

|

|

The GBP closed 2.61% higher against the USD during the week, as strong US economic performance bolstered the dollar, while mixed data from the UK weighed on the pound.

In the UK, retail sales unexpectedly declined in December, with food sales recording their worst performance since 2013, contributing to concerns about weakening consumer demand. The GfK Consumer Confidence Index also dropped more than anticipated in January. Additionally, the ILO unemployment rate rose in November, indicating some softness in the labor market. However, wage growth continued to rise. Furthermore, the Rightmove House Price Index climbed in December.

In the US, strong economic data supported the dollar. Housing starts exceeded expectations in December, while industrial production also rose more than anticipated, pointing to a robust economy.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound jumps amid resilient UK Data and continued Yen weakness

|

|

| |

|

|

The GBP closed 2.37% higher against the JPY during the week, as solid UK economic data and the Bank of Japan’s (BoJ) dovish stance continued to weigh on the yen.

In the UK, the ILO unemployment rate rose in November. However, UK labor market data highlighted a positive economic outlook, with wage growth continuing to increase. Additionally, the Rightmove House Price Index climbed in December. Meanwhile, UK retail sales unexpectedly declined in December, with food sales recording their worst performance since 2013. The GfK Consumer Confidence Index also fell more than expected in January.

Conversely, in Japan, the Consumer Price Index (CPI) rose in December. While the Jibin Bank Services PMI improved in January, the Manufacturing PMI unexpectedly declined during the same period.

|

|

| |

| |

| |

|

|

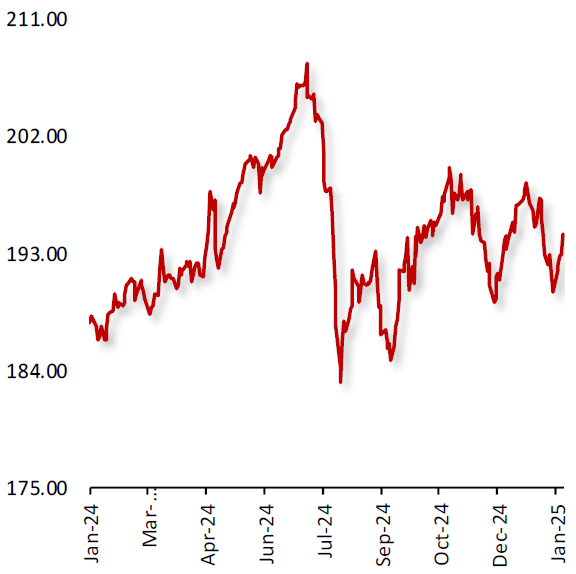

US Oil Fund ($)

|

|

|

Oil Prices Fall Amid US President Trump’s International Tariff Policy Uncertainty

|

|

| |

|

|

Oil prices fell during the week, amid concerns over the potential impact of US President Trump’s international tariff policies on global economic growth and energy demand. Adding to the negative sentiment, President Trump declared a national energy emergency on his first day in office.

Additionally, US President Trump, during his speech at the World Economic Forum (WEF) in Davos, Switzerland, stated that he would demand OPEC and Saudi Arabia to bring down the cost of crude barrels, while issuing a plan to boost US production.

Meanwhile, according to the US Energy Information Administration (EIA), US crude inventories last week hit their lowest level since March 2022.

|

|

| |

| |

| |

|

|

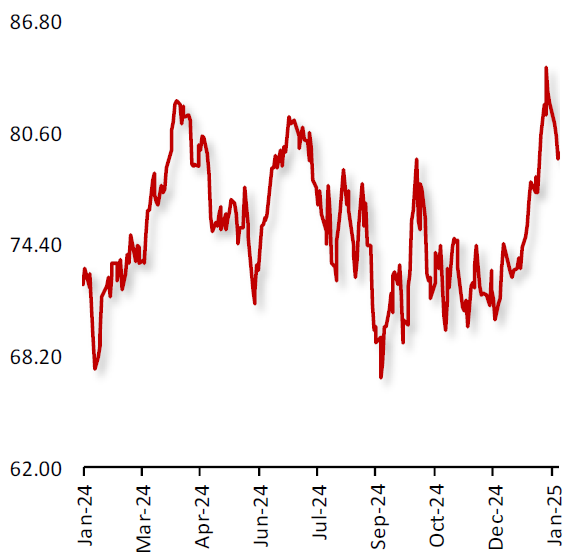

XAU Gold (XAU/USD)

|

|

|

Gold Prices Rise Amid Weakness in the US Dollar

|

|

| |

|

|

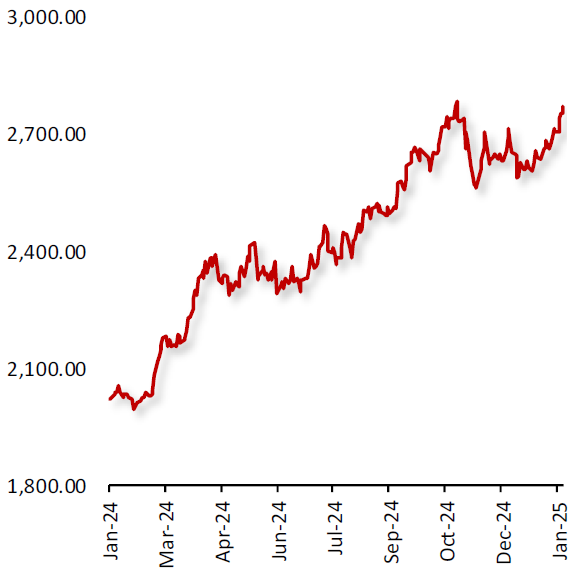

Gold prices advanced during the week, amid weakness in the US Dollar and as worries surrounding absence of clarity on US President Donald Trump's trade policy plans boosted demand for the haven metal.

Additionally, US President Trump, during his speech at the World Economic Forum (WEF) in Davos, Switzerland, called for lower interest rates, with market attention remaining focused on the broader implications of his policies. Moreover, Donald Trump emphasized his commitment to reversing inflation. He also urged other nations to adopt similar measures to address global economic challenges. Meanwhile, investors await interest rate decisions from major global central banks for further cues.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Climbed Following US SEC’s Move to Start Regulatory Task Force

|

|

| |

|

|

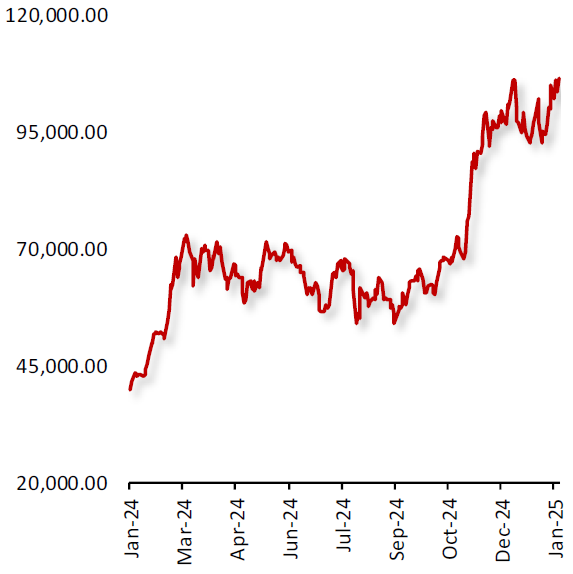

Bitcoin’s price advanced last week, following the launch of a Securities and Exchange Commission task force on US digital-asset regulations, part of President Donald Trump’s wider embrace of the sector. The task force will aim to come up with a “comprehensive and clear” regulatory framework, according to the SEC.

Additionally, President Donald Trump signed executive actions related to cryptocurrency and artificial intelligence, moves that could further boost two nascent industries. The crypto order creates a working group to advise the White House on digital asset policies and will include the involvement of key federal agencies, like the Treasury Department, Justice Department, Securities and Exchange Commission and the Commodity Futures Trading Commission.

|

|

| |

| |

| |

| |

|

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|