| |

| Market Update |

| |

|

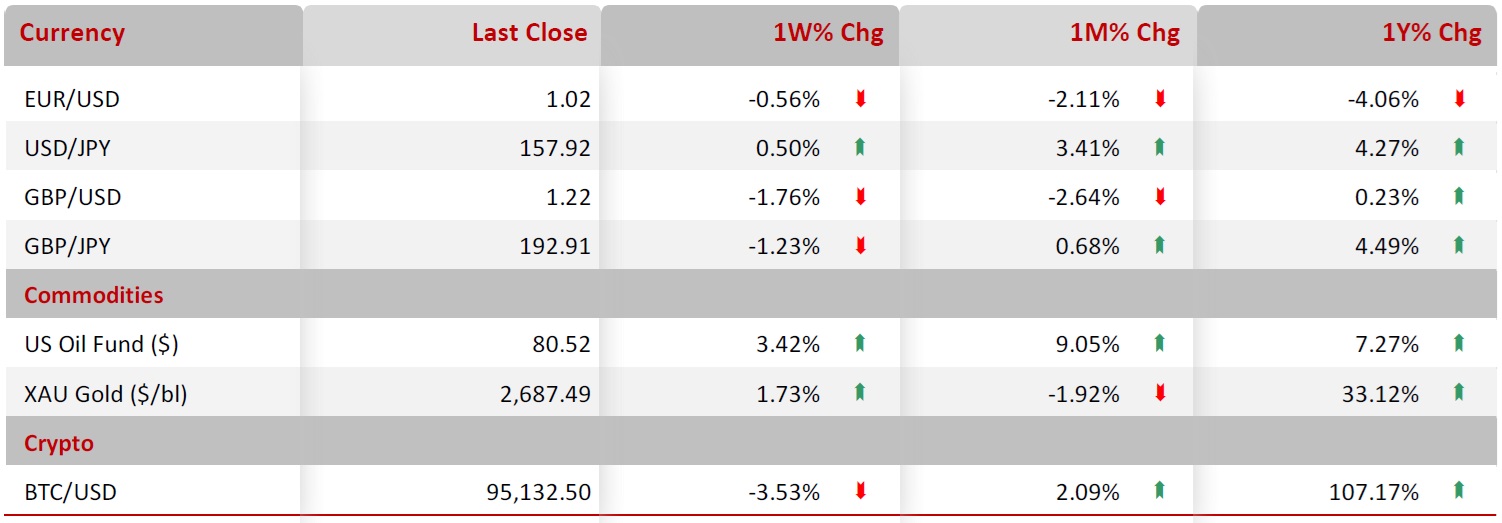

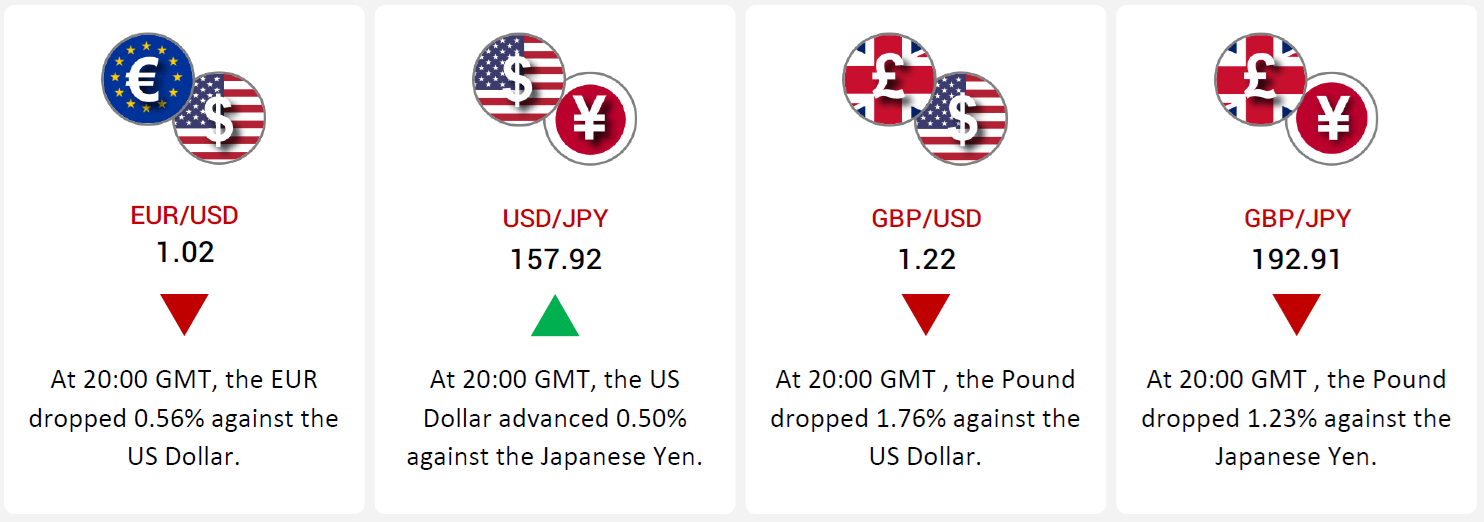

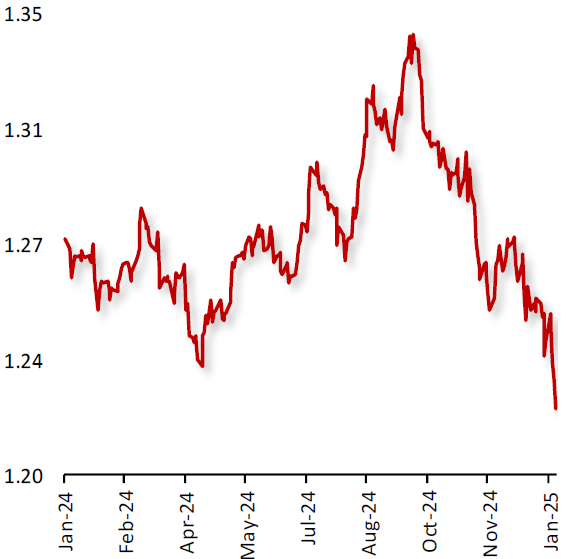

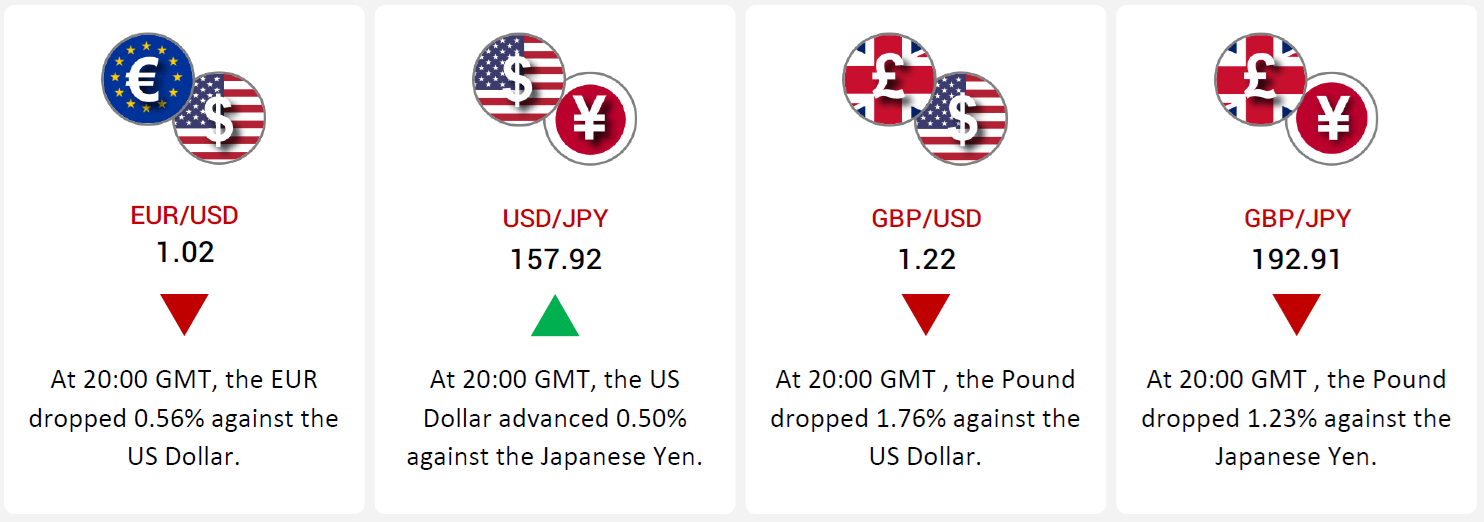

The EUR fell 0.56% against the USD amid mixed Eurozone data and strong US economic performance, leading to increased volatility. In the Eurozone, December’s economic sentiment index dropped to its lowest in over a year, signaling concerns in industrial, construction, and consumer sentiment. The eurozone’s producer price index surged in November, indicating persistent inflationary pressures despite weak demand in some sectors. Meanwhile, the US economy showed resilience with a strong ISM services PMI and a drop in jobless claims, boosting expectations for the Federal Reserve to maintain a hawkish stance, which supported the USD.

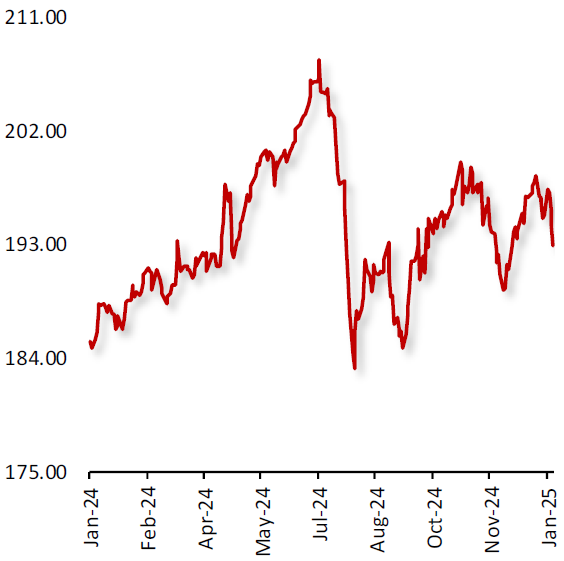

The GBP weakened 1.76% against the USD due to disappointing UK data. The UK's manufacturing PMI contracted, retail sales were below expectations, and the Bank of England maintained a cautious outlook, adding bearish pressure on the pound. In Japan, while services PMI showed slight growth, industrial production and trade data remained weak, affecting the yen despite ongoing stimulus measures.

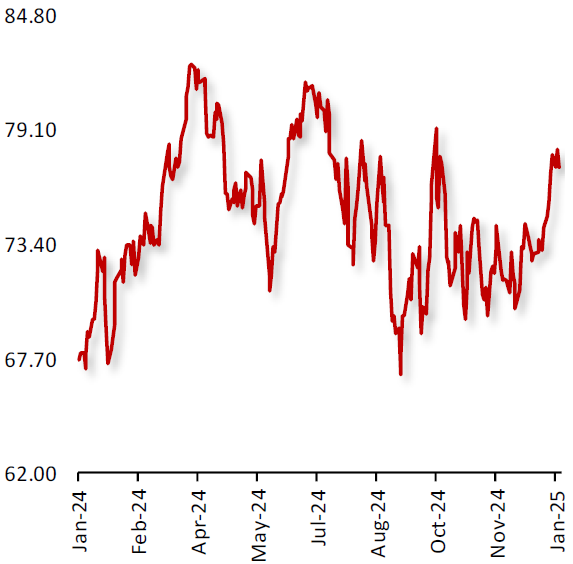

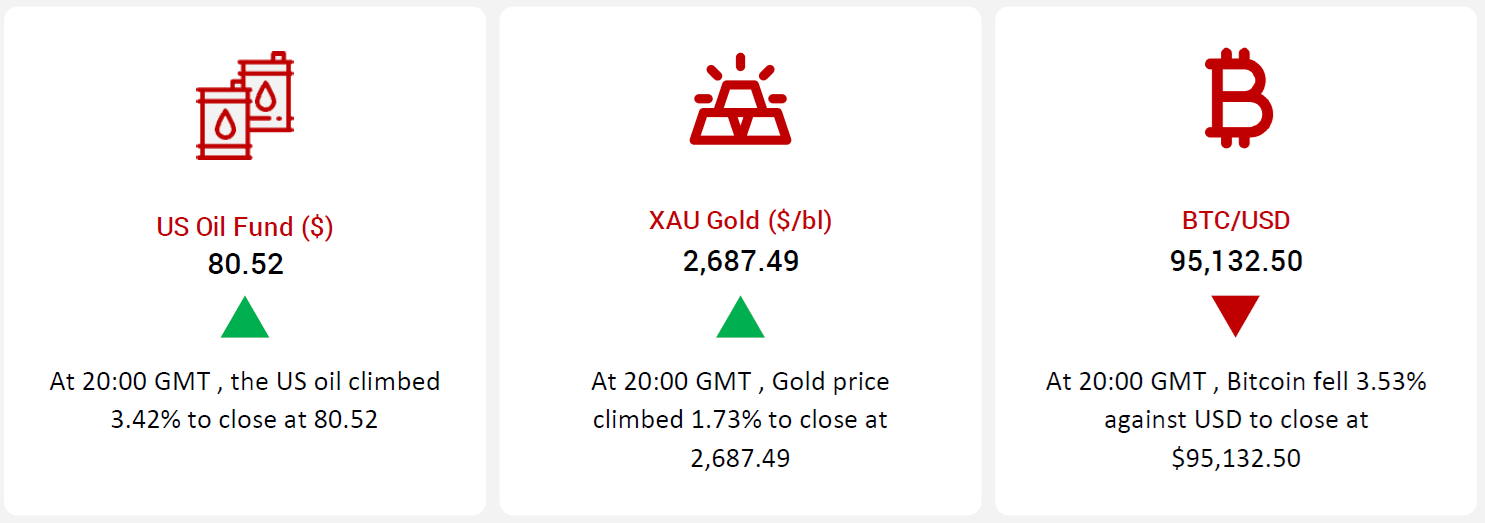

Oil prices surged amid concerns over potential supply disruptions from Russia and rising fuel demand due to colder-than-usual weather in the US and Europe. The Energy Information Administration reported a larger-than-expected fall in US crude inventories, further supporting oil prices.

Gold prices rose after China’s central bank expanded its gold reserves for the second consecutive month, contributing to higher demand for the metal. Meanwhile, Bitcoin declined as the US Fed’s meeting minutes indicated a slower pace of interest rate cuts, dampening market sentiment. Additionally, Bitcoin saw significant outflows, suggesting potential further declines.

In employment data, the US added 256,000 jobs in December, surpassing expectations. Key sectors such as healthcare, retail trade, and government saw strong growth, while leisure and hospitality showed minimal change. The unemployment rate dropped to 4.1%, and average hourly earnings rose by 0.3%.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

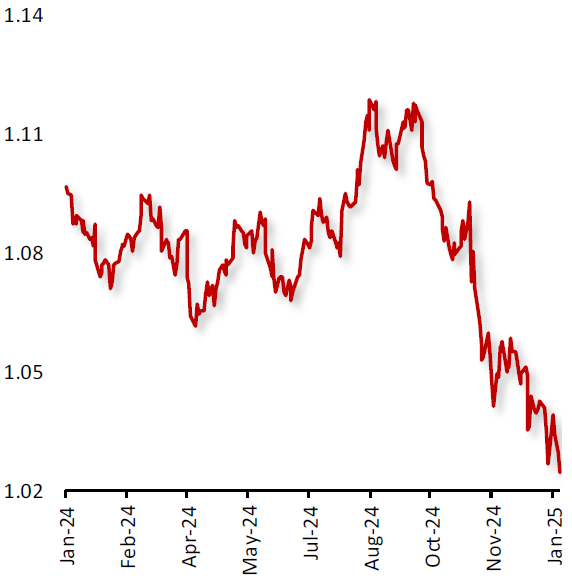

EUR/USD

|

|

|

EUR faces volatility amid mixed eurozone data and US Economic Strength

|

|

| |

|

|

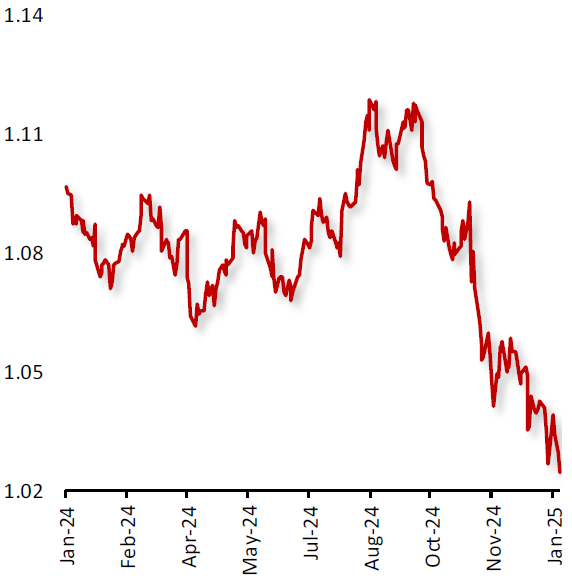

The EUR closed 0.56% lower against the USD during the week, as a combination of mixed economic data from the Eurozone and solid US economic performance led to increased volatility.

In the Eurozone, December’s economic sentiment index unexpectedly declined to its lowest level in over a year, highlighting concerns about industrial, construction, and consumer sentiment. Additionally, the eurozone's producer price index (PPI) surged in November, exceeding expectations, suggesting that inflationary pressures remain stubborn despite weaker demand in certain sectors. Consumer confidence also slipped in December, further indicating a cautious outlook across the region. The region’s weak retail sales data underscored the ongoing struggles in household spending, with food and fuel contributing most to the gains.

|

|

| |

| |

| |

|

|

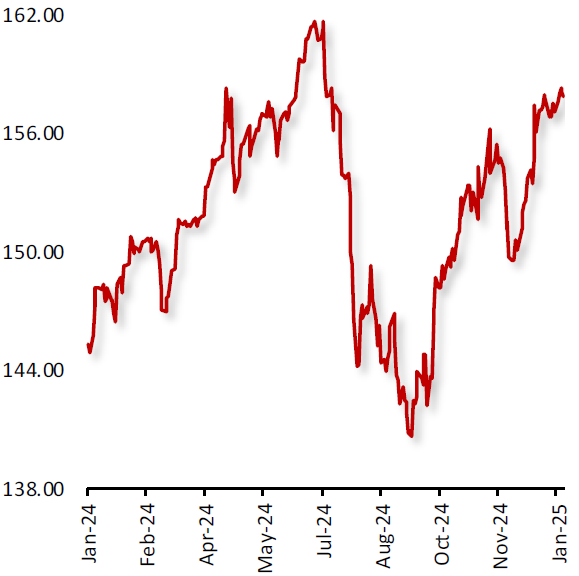

USD/JPY

|

|

|

Dollar rise supported by stronger US Economic data

|

|

| |

|

|

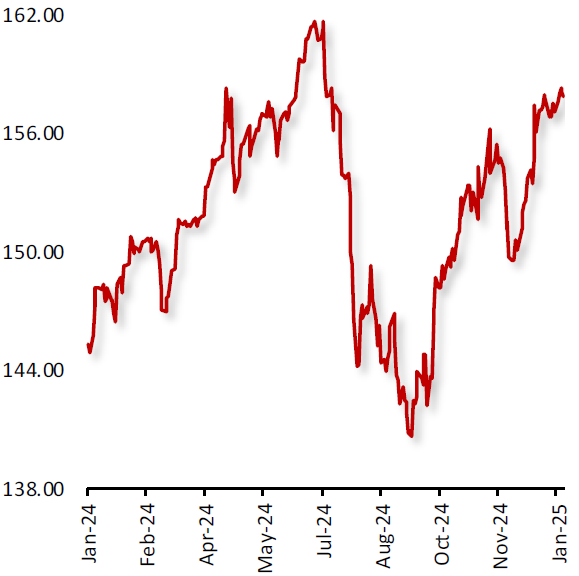

The USD rose 0.50% against the JPY during the week, supported by strong US economic data, despite mixed signals from Japan.

In the US, the ISM services PMI for December exceeded expectations, rising to 54.1, indicating a robust services sector. Additionally, initial jobless claims fell to an eleven-month low, signaling continued strength in the labor market. These positive economic indicators reinforced expectations for the Federal Reserve to maintain its hawkish stance, boosting the US dollar.

In Japan, the economic outlook was more mixed. While the Jibin Bank services PMI for December showed slight growth, it came in below expectations.

|

|

| |

| |

| |

|

|

GBP/USD

|

|

|

Pound struggles amid weak UK economic Data and US Dollar Resilience

|

|

| |

|

|

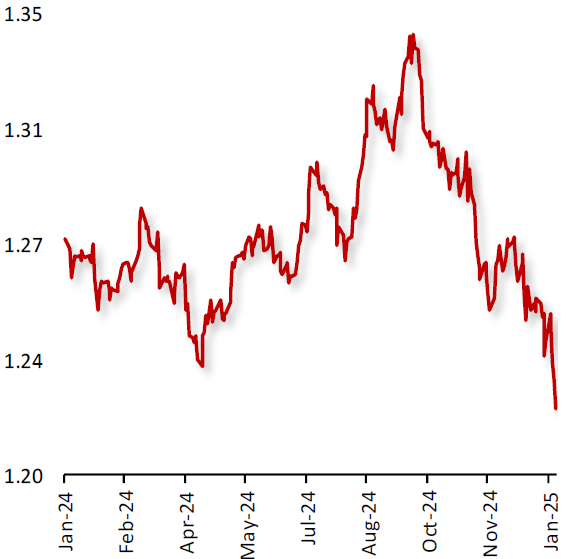

The GBP closed 1.76% lower against the USD during the week, pressured by disappointing UK economic data and the ongoing strength of the US dollar.

In the UK, December’s manufacturing PMI showed contraction, reaching its lowest level in nearly a year, signaling persistent weakness in the manufacturing sector. Retail sales data for November also missed expectations, reflecting continued struggles in consumer spending amid rising inflation. The Bank of England’s cautious outlook on interest rates added to the bearish sentiment around the pound.

Meanwhile, the US economy showed resilience, the US economy showed strength, with December non-farm payrolls surpassing expectations by adding 250,000 jobs. December’s ISM services PMI exceeded expectations and initial jobless claims fell to an eleven-month low, signaling a strong labor market.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound weakened amid weak UK Data

|

|

| |

|

|

The GBP closed 1.23% lower against the JPY during the week, as a combination of weak UK economic data.

In the UK, the manufacturing PMI in December showed contraction, reaching its lowest level in nearly a year, signaling persistent weakness in the manufacturing sector. Retail sales in November also missed expectations, reflecting ongoing struggles in consumer spending. The Bank of England’s cautious outlook added further bearish pressure on the pound.

In Japan, services PMI for December showed marginal growth, but it came in below market expectations, signaling a slower-than-anticipated recovery in the services sector. Additionally, Japan’s industrial production and trade data remained subdued, highlighting ongoing challenges in the country’s manufacturing sector and export-driven economy.

|

|

| |

| |

| |

|

|

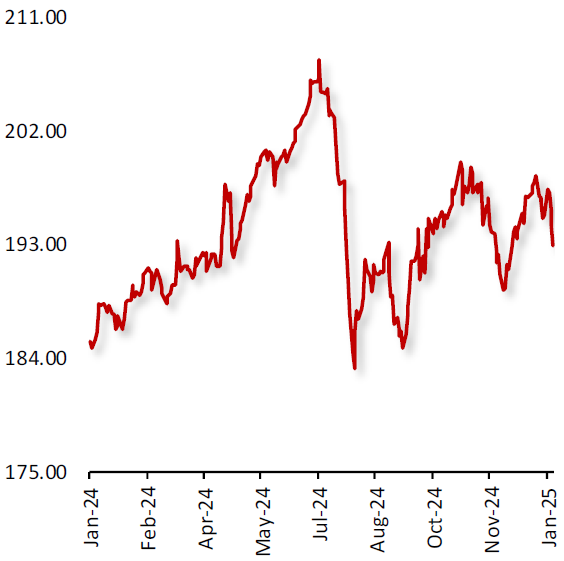

US Oil Fund ($)

|

|

|

Oil Prices Surge Amid Supply Fears and Extreme Winter Conditions

|

|

| |

|

|

Oil prices advanced during the week, amid concerns over potential supply disruptions from Russia as the US plans to impose additional sanctions targeting Russia oil revenues, including action against tankers carrying Russian crude.

Additionally, cooler-than-normal weather in the US and Europe boosted fuel demand from the region and contributed to the rise in oil prices during the week. Each degree of temperature drop led to an estimated increase of 113,000 barrels per day (bpd) in heating oil demand.

Further, supporting the oil prices the Energy Information Administration reported that US crude inventories fell more than expected in the last week.

|

|

| |

| |

| |

|

|

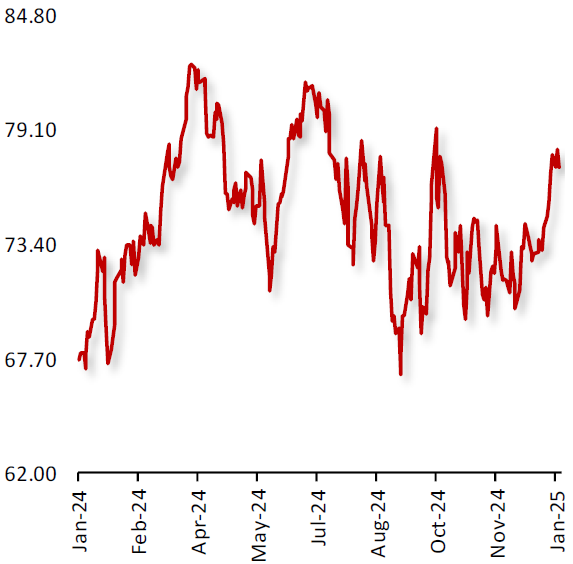

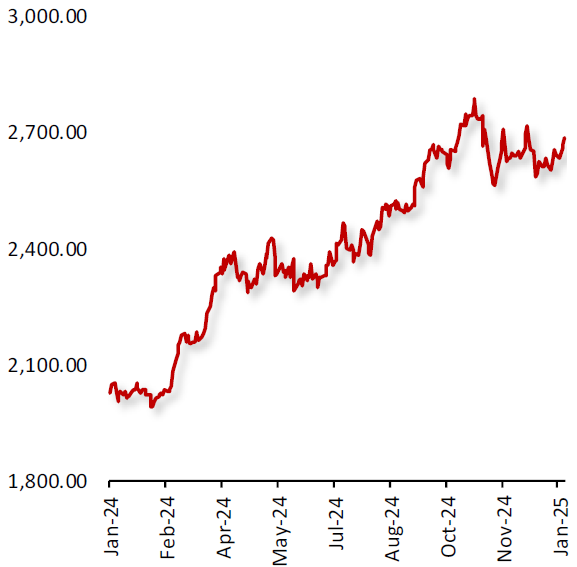

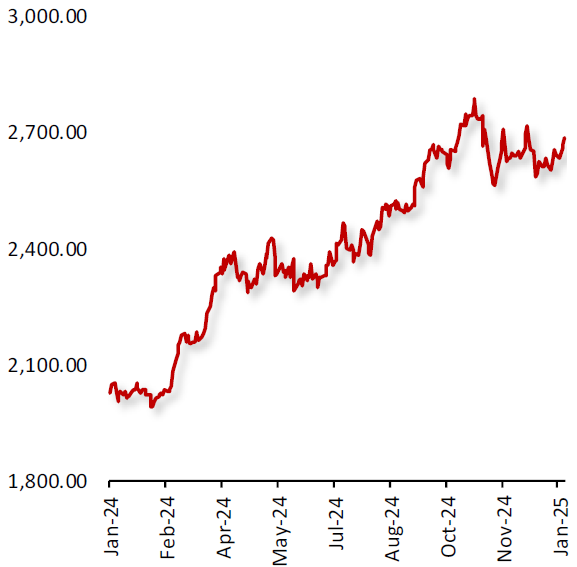

XAU Gold (XAU/USD)

|

|

|

Gold Prices Rise After China’s Central Bank Expands Its Gold Reserves for a Second Month

|

|

| |

|

|

Gold prices advanced during the week, after China’s central bank expanded its gold reserves for the second consecutive month in December. The ongoing gold purchases by the Chinese central bank contributed to the rise in gold prices during the week. Additionally, uncertainty surrounding the US President-elect Donald Trump's policies boosted demand for the safe-haven asset.

Additionally, investors looked ahead to the US consumer and producer inflation data as well as the Federal Reserve’s (Fed) Beige book, to be released in the next week, for further clues on the Fed’s rate path.

|

|

| |

| |

| |

|

|

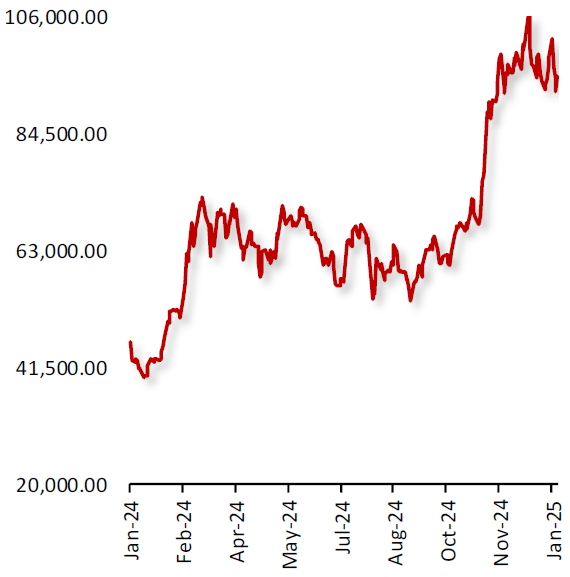

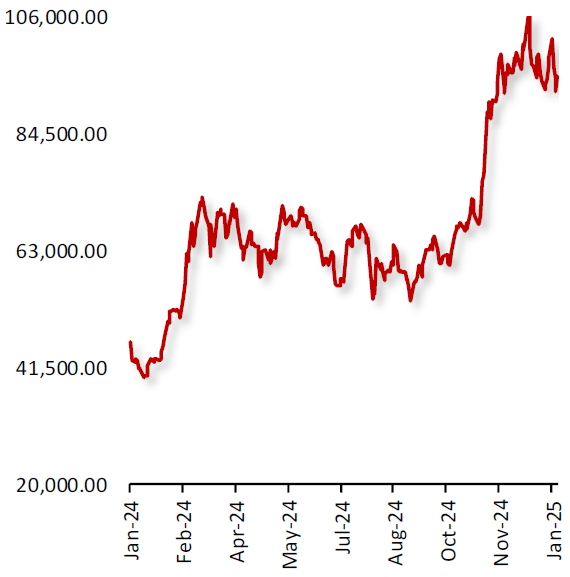

BTC/USD

|

|

|

Bitcoin Declines as Fed Minutes Fuel Inflation Fears

|

|

| |

|

|

Bitcoin’s price dropped last week, after the US FOMC meeting minutes signalled that the Fed would slowdown in the pace of interest rate cuts amid elevated inflation risks. The slower-than-expected pace of monetary easing implied in the FOMC minutes dampened crypto market sentiment as high interest rates increase the opportunity cost of holding cryptocurrencies that do not typically yield interest. Additionally, strength in the US Dollar and rise in the Treasury yields weighed on Bitcoin price.

Moreover, the Crypto Fear & Greed Index, a measure of Bitcoin and the broader crypto market sentiment, fell 19 points in a day to its lowest score since 14 October 2024

|

|

| |

| |

| |

| Nonfarm payrolls: 256K Jobs Added in December |

| |

|

The US economy added 256,000 jobs in December, surpassing market expectations of 160,000 by a wide margin. Employment growth in December was led by gains in health care, retail trade and government, while leisure and hospitality showed minimal change.

Health care added 46,000 jobs, continuing its consistent upward trajectory, while retail trade recovered from a loss of 29,000 jobs in November, posting a gain of 43,000 jobs in December.

Government employment was also robust, adding 33,000 positions last month. Social assistance contributed an additional 23,000 jobs, reflecting steady demand in support services. Employment in leisure and hospitality showed little movement, with a modest increase of 43,000 jobs.

|

| |

|

| |

|

|

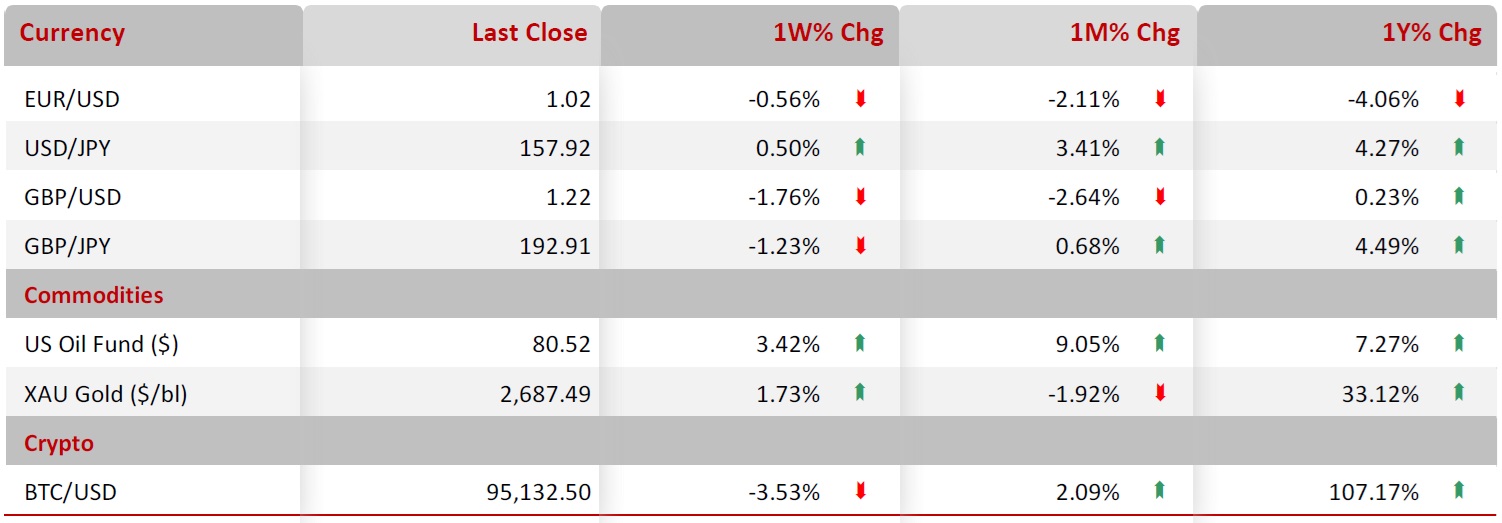

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|