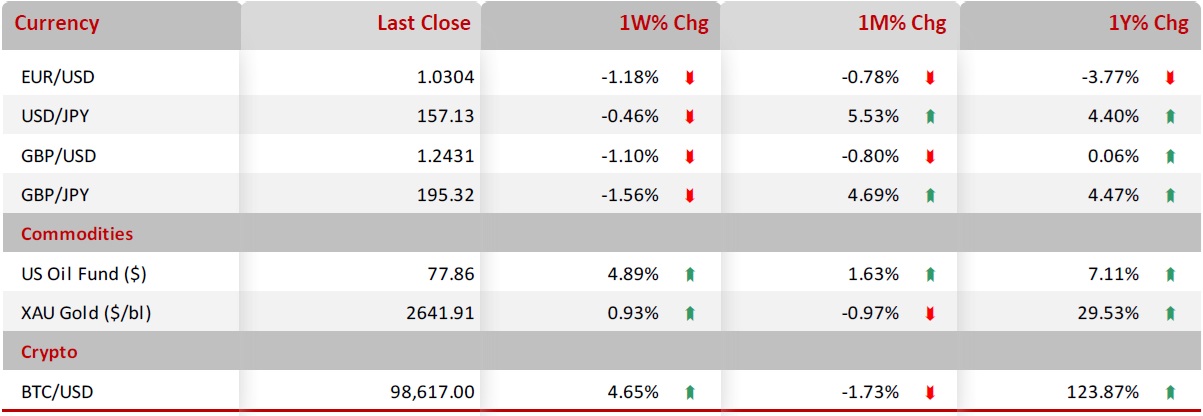

| |

| Market Update |

| |

|

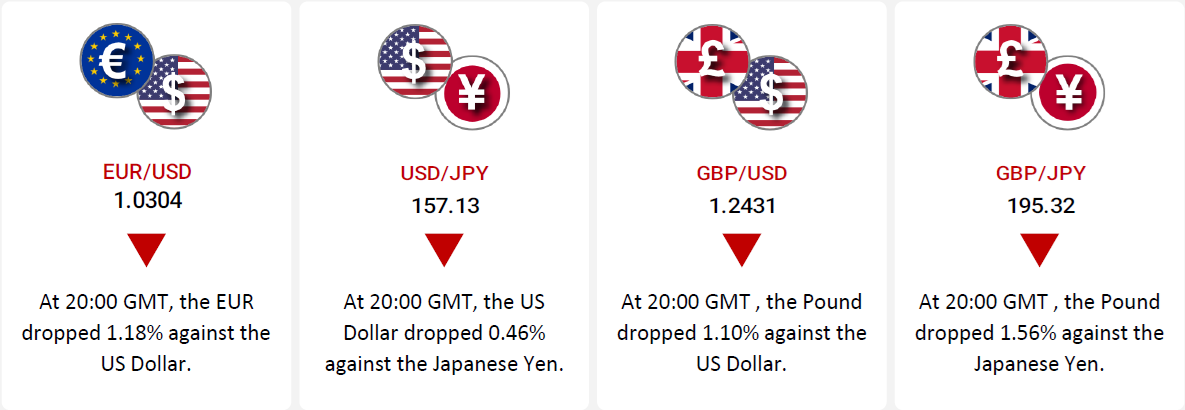

The Euro weakened significantly against the US dollar, falling 1.18% during the week. This decline was attributed to mixed economic data in the Eurozone, including a contraction in the HCOB manufacturing PMI, with Germany’s PMI dropping to 42.50. Despite a rise in Spain's consumer price index, it failed to offset the broader manufacturing slowdown. Meanwhile, the US dollar gained strength due to strong economic indicators, including a decline in jobless claims to an eight-month low and a 2.2% rise in pending home sales.

The Dollar, however, weakened slightly against the Japanese yen, falling 0.46%. Robust US economic data reinforced expectations of further Federal Reserve tightening, supporting the dollar broadly. The yen struggled due to global uncertainties, including weak Chinese manufacturing data and economic concerns in Europe. Despite these pressures, Japan's dovish interest rate policies kept the yen relatively stable.

The British pound faced notable pressure, declining 1.10% against the USD and 1.56% against the JPY. Weak UK economic data, including a drop in December's manufacturing PMI and underwhelming retail sales, coupled with the Bank of England's cautious monetary stance, weighed on the pound.

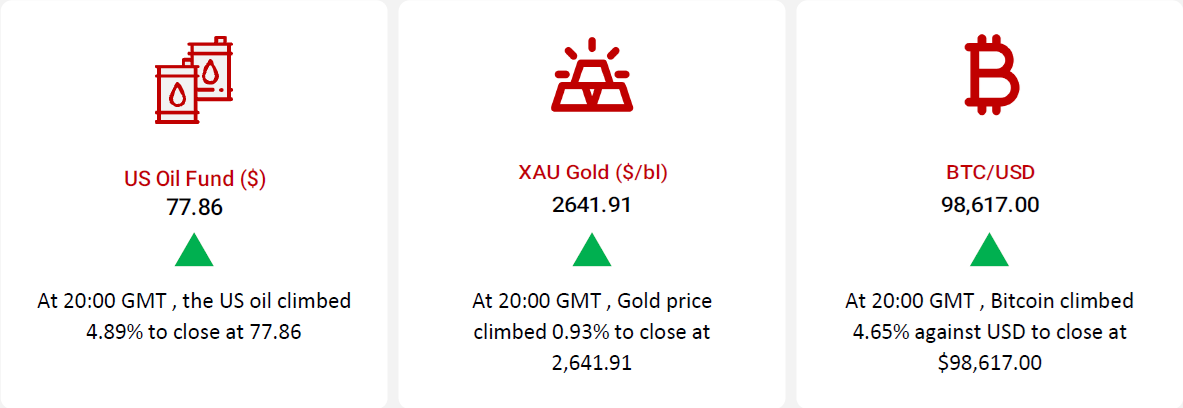

Oil prices rose during the week amid optimism about global demand. Chinese President Xi Jinping pledged proactive economic policies for 2025, boosting demand expectations. Meanwhile, US crude inventories fell by 1.2 million barrels, contributing to the bullish sentiment.

Gold prices also advanced, driven by diminishing risk appetite, geopolitical uncertainties, and central bank purchases. Investors closely monitored incoming US President Donald Trump’s trade policies and the Federal Reserve's 2025 interest rate path.

In the cryptocurrency market, Bitcoin saw gains amid optimism for a more favorable regulatory environment under the new Trump administration. Anticipation of crypto-focused legislation and key acquisitions, such as Falcon's purchase of Arbeloa Markets, fueled market confidence.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

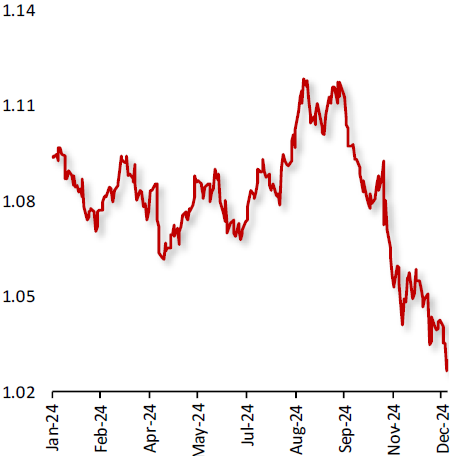

EUR/USD

|

|

|

Euro weakens amid mixed economic data, Dollar Strengthens

|

|

| |

|

|

The EUR closed 1.18% lower against the USD during the week, amid a combination of mixed economic data from the Eurozone.

In the Eurozone, the HCOB manufacturing PMI fell in December, signaling ongoing contraction across the region. Germany's PMI recorded a drop to 42.50, reflecting a slowdown in the largest Eurozone economy. In Spain, the consumer price index rose in December, surpassing market expectations but failing to offset the overall manufacturing weakness. Meanwhile, in the US, initial jobless claims dropped to their lowest level in eight months, while the housing market showed signs of strength with pending home sales rising by 2.2% in November.

|

|

| |

| |

| |

|

|

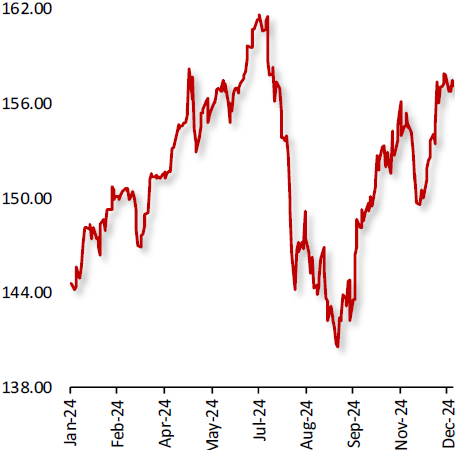

USD/JPY

|

|

|

Dollar Weakens Amid US Economic Resilience; Yen Pressured by Global Uncertainties

|

|

| |

|

|

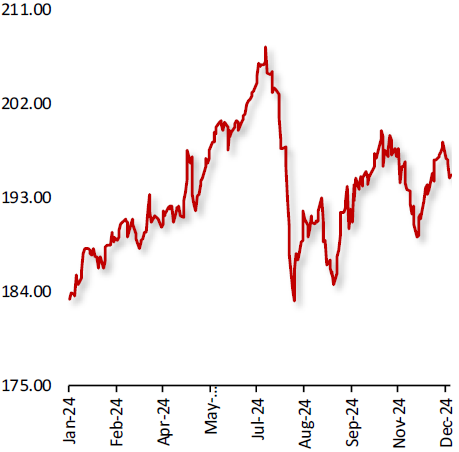

The USD fell 0.46% against the JPY during the week, driven by strong US economic data and Japan's continued dovish stance on interest rates.

In the US, initial jobless claims fell to 211,000 in the week ending 27 December 2024, marking the lowest level in eight months. The US manufacturing PMI showed a more modest contraction than expected, while pending home sales rose by 2.2% in November. These developments underscored the resilience of the US economy and reinforced expectations of further Federal Reserve tightening, strengthening the US dollar.

Meanwhile, the Japanese yen remained under pressure due to global economic uncertainties, including weakness in China’s manufacturing PMI and ongoing concerns over the economic outlook in Europe. The yen also struggled to gain ground amid the broader strength of the US dollar.

|

|

| |

| |

| |

|

|

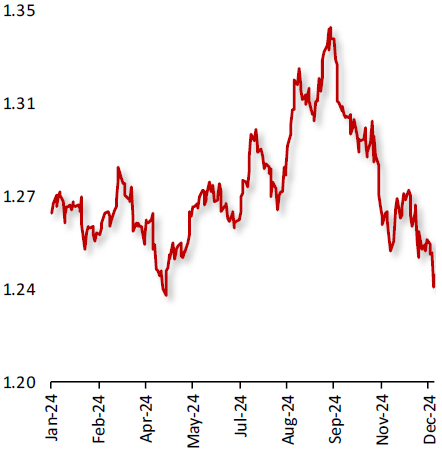

GBP/USD

|

|

|

Pound under pressure amid weak UK economic Data and strong US economic performance

|

|

| |

|

|

The GBP closed 1.10% lower against the USD during the week, as a combination of weak UK economic data and a robust US labor market report weighed on the pound.

In the UK, December's S&P Global manufacturing PMI dropped its lowest level in nearly a year, signaling continued contraction in the sector. Retail sales data for November also came in weaker than expected, reflecting ongoing struggles in consumer spending. The Nationwide housing prices showed a modest rise in December, slightly above expectations. The Bank of England's dovish stance, indicating caution on future rate hikes, added further bearish pressure on the pound.

Meanwhile, in the US, initial jobless claims unexpectedly fell to their lowest level in eight months, signaling resilience in the labor market.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Pound Weakens Amid UK Economic Concerns and Stable Japanese Yen

|

|

| |

|

|

The GBP closed 1.56% lower against the JPY during the week, as a combination of disappointing UK economic data and a stable Japanese Yen weighed on the British pound.

In the UK, key economic reports were weak, with the December manufacturing PMI falling to 47.5, signaling continued contraction in the sector. UK retail sales for November also underperformed, reflecting persistent challenges in consumer spending. The Bank of England’s cautious stance on interest rates further dampened sentiment, with markets pricing in limited tightening in the coming months.

Meanwhile, the Japanese Yen remained relatively stable, supported by Japan’s continued low-interest rate environment and the Bank of Japan's commitment to maintaining ultra-loose monetary policy. While Japan's economic data was mixed, the yen's status as a safe-haven currency in times of global uncertainty helped it hold firm against the pound.

|

|

| |

| |

| |

|

|

US Oil Fund ($/bl)

|

|

|

Oil Prices Rise Amid Hopes Surrounding Global Demand Outlook

|

|

| |

|

|

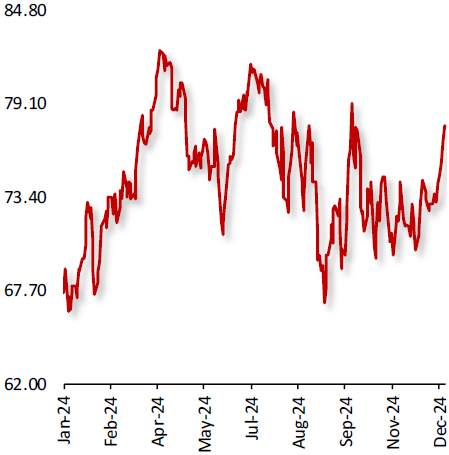

Oil prices climbed this week, amid optimism over global oil demand outlook. Moreover, the world’s largest crude importer, China’s President Xi Jinping pledged to implement more proactive policies to promote economic growth in 2025, that would lift fuel demand. Additionally, investors await cues on the Federal Reserve's interest rate path for 2025 and the incoming Donald Trump administration's policies.

Meanwhile, the US crude oil inventories fell less than expected last week, while stocks of gasoline and distillate fuels saw large builds with refineries maintaining high-capacity use, according to data released by the US Energy Information Administration (EIA). Commercial crude oil stocks excluding the Strategic Petroleum Reserve fell by 1.2 million barrels to 415.6 million barrels in the week ended 27 December 2024.

|

|

| |

| |

| |

|

|

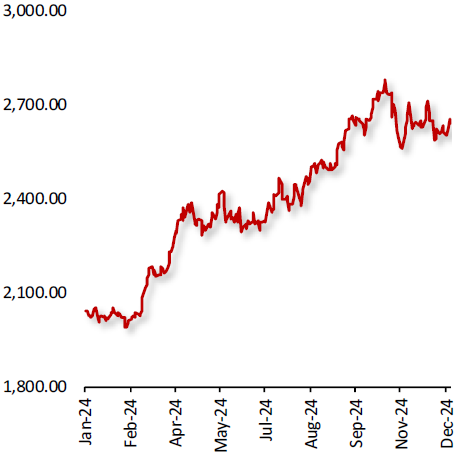

XAU Gold ($/oz)

|

|

|

Gold Prices Rise as Investors Await Insights into Incoming US President Trump’s Trade Policies

|

|

| |

|

|

Gold prices advanced last week, as risk appetite diminished among investors boosting demand for the safe haven asset. Moreover, key economic data from the US will be closely monitored. Additionally, investors await cues on the Federal Reserve's (Fed) interest rate path for 2025 and the incoming Donald Trump administration's policies. Also, sustained geopolitical risks and a wave of purchases by global central banks further supported the bullion.

Meanwhile, investors anticipate the Fed to adopt a slow and cautious approach to further rate cuts in 2025, as inflation continues to exceed its 2% target.

On the outlook front, the World Gold Council expects prices will rise more slowly in 2025, tempered by variables such as growth and inflation.

|

|

| |

| |

| |

|

|

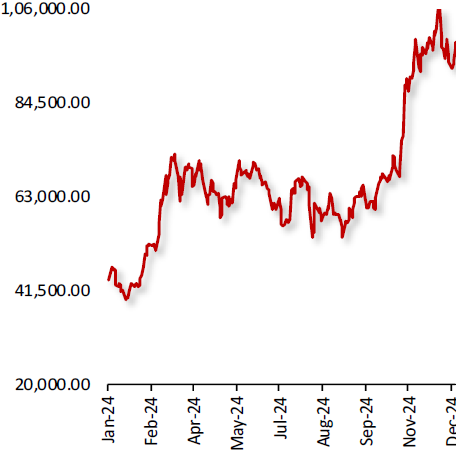

BTC/USD

|

|

|

Bitcoin Climbs Amid Hopes Over More Favourable Regulatory Environment

|

|

| |

|

|

Bitcoin’s price climbed last week, amid hopes surrounding more friendly regulatory environment for crypto this year with Donald Trump’s incoming Presidency. Investors anticipate that the Congress will pass its first ever crypto focused legislation, which could be centred around stablecoins or market structure. Also, investors await the key US economic data to provide further direction on the Federal Reserve's (Fed) interest rate path for 2025.

In major news, digital asset brokerage, Falcon has acquired crypto derivatives platform Arbeloa Markets for an undisclosed amount, marking one of the first major crypto acquisition deals of 2025. Separately, crypto exchange, Ku Coin introduced a point-of-sale (Pos) system allowing its users to pay businesses using their exchange balances.

|

|

| |

| |

|

|

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|

|