| |

| Market Update |

| |

|

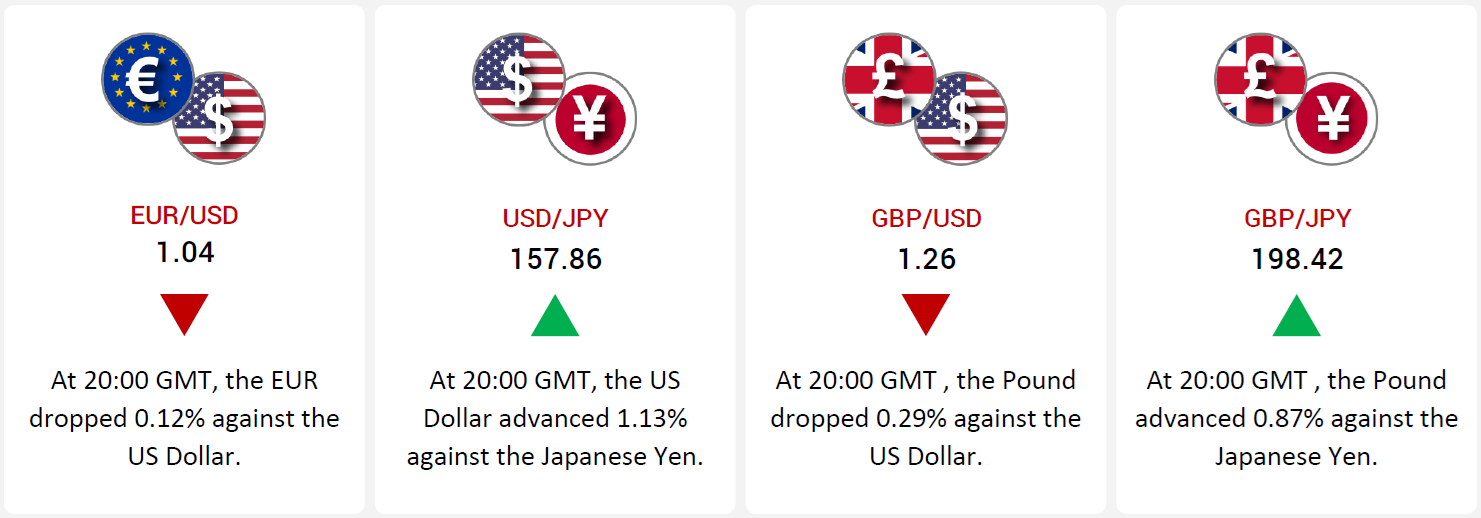

The EUR/USD fell 0.12% last week due to divergent monetary policy trends. In the Eurozone, inflation eased to 2.2%, nearing the ECB’s 2% target, but services inflation remained high at 3.9%. The ECB cut rates cautiously in December to 3.0%. Meanwhile, robust U.S. economic data, including a drop in jobless claims to 219,000 and a rebound in November’s new home sales, along with the Fed’s hawkish stance, strengthened the dollar.

The USD gained 1.13% against the JPY, closing at 157.86, driven by strong U.S. jobless claims and housing data. The Fed reduced planned 2025 rate cuts from four to two after a third consecutive rate cut. Japan’s weak housing starts, and industrial production data weighed on the yen, though its unemployment rate held steady at 2.5%.

The GBP/USD declined 0.29%, with weak UK Q3 GDP figures and subdued business confidence impacting the pound, while robust U.S. economic performance supported the dollar. However, the GBP rose 0.87% against the JPY, reaching 198.42, aided by an improved UK current account deficit, while Japan’s economic concerns persisted.

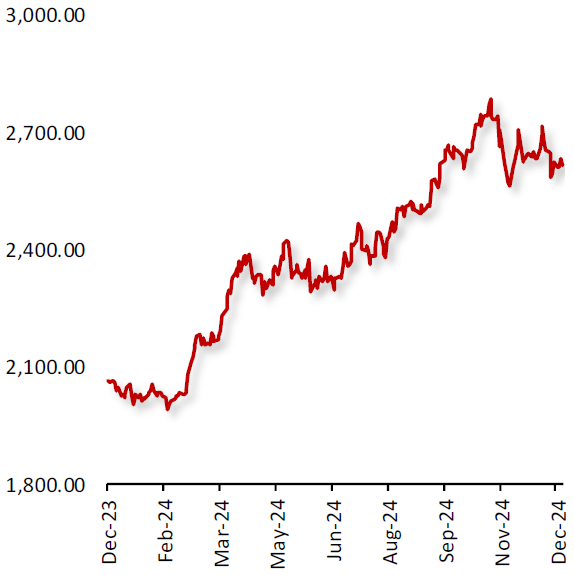

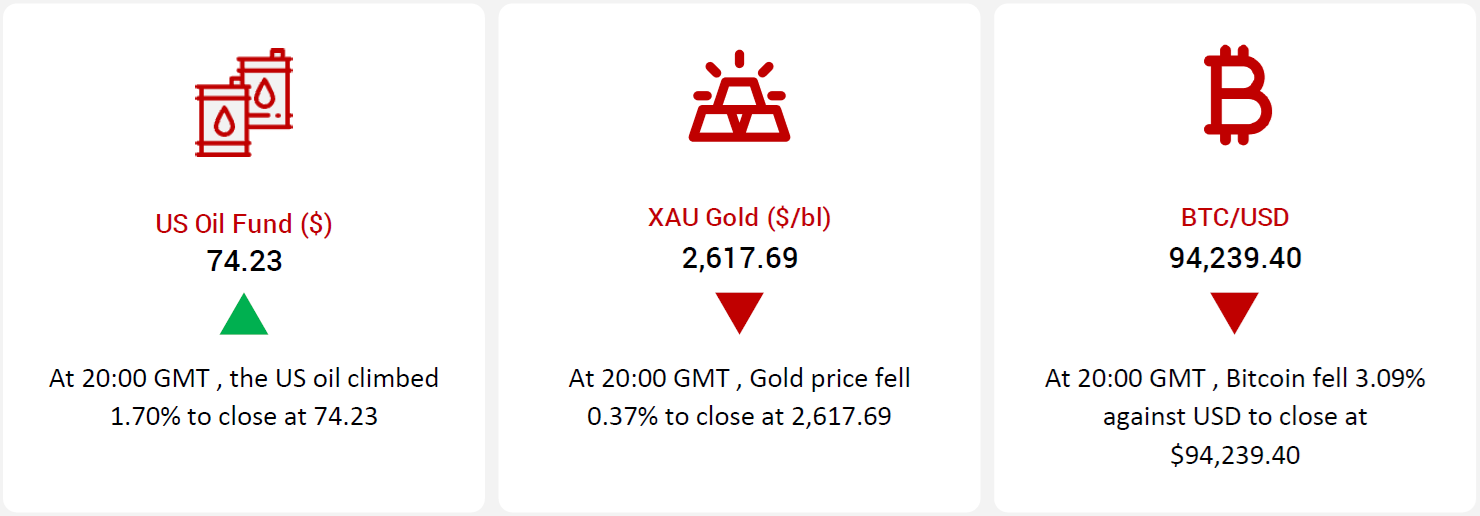

Oil prices rose amid optimism over China’s 2025 economic stimulus plans, including a proposed issuance of 3 trillion yuan in Treasury bonds. The World Bank revised its growth forecasts for China upwards but noted challenges in the property sector and confidence levels. Fears of new sanctions on Iranian and Russian crude exports, along with a 3.2 million-barrel drop in U.S. crude stocks, supported oil prices.

Gold prices fell as markets awaited further clarity on the Fed’s 2025 rate path, with strong U.S. jobless claims suggesting sustained rate pressure. After easing aggressively, the Fed projected fewer rate cuts for 2025.

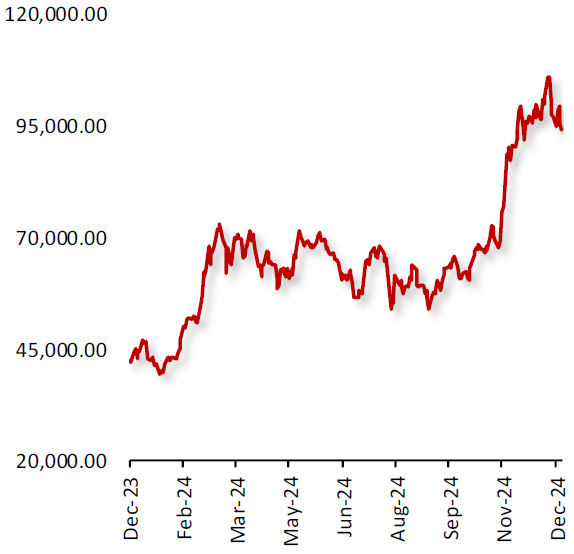

Bitcoin prices declined, influenced by the Fed’s hawkish tone and subdued demand. However, MicroStrategy’s $561 million Bitcoin purchase and pro-crypto Treasury and Commerce nominations in the incoming Trump administration offered support.

|

| |

|

|

Key Global Commodities

|

|

| |

| |

| |

|

| |

|

|

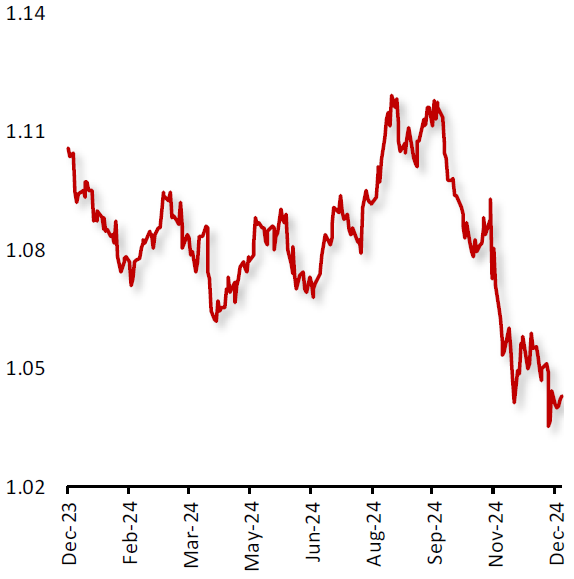

EUR/USD

|

|

|

Euro Declines Against Dollar Amid Diverging Policy Expectations

|

|

| |

|

|

The EUR/USD declined by 0.12% last week, reflecting contrasting monetary policy directions.

In the Eurozone, European Central Bank (ECB) President Christine Lagarde indicated the region is “very close” to meeting its medium-term inflation target of 2%. While headline inflation eased to 2.2%, persistent services inflation at 3.9% underscored ongoing challenges. The ECB’s December rate cut to 3.0% was accompanied by a cautious tone, suggesting limited room for further easing.

Meanwhile, robust U.S. economic data bolstered the dollar. Weekly jobless claims dropped to 219,000 for the week ending December 20, 2024, highlighting a strong labour market, and a sharp rebound in November new home sales emphasized housing sector resilience. The U.S. Federal Reserve’s hawkish outlook, with expectations for sustained monetary tightening and fewer rate cuts in 2025, further enhanced the dollar’s appeal, pressuring the euro.

|

|

| |

| |

| |

|

|

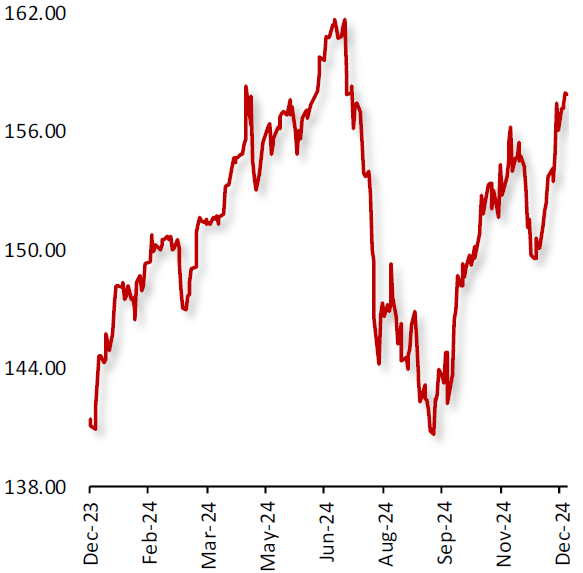

USD/JPY

|

|

|

US Economic Momentum Drives Dollar Higher, Weak Japanese Data Pressures Yen

|

|

| |

|

|

The USD advanced 1.13% against the JPY to close at 157.86 this week, following upbeat US weekly jobless claims data. Additionally, the US new home sales advanced more than forecasted in November signaling a healthy housing sector and positive economic momentum. Separately, last week the Federal Reserve’s Open Market Committee trimmed the number of rate cuts for next year from four to two after its third cut in a row.

Meanwhile, Japan’s significantly weaker-than-expected housing starts and dismal annual industrial production data for November contributed to the weakness in the Japanese Yen. On the contrary, Japan’s unemployment rate remained unchanged at 2.5% in November.

|

|

| |

| |

| |

|

|

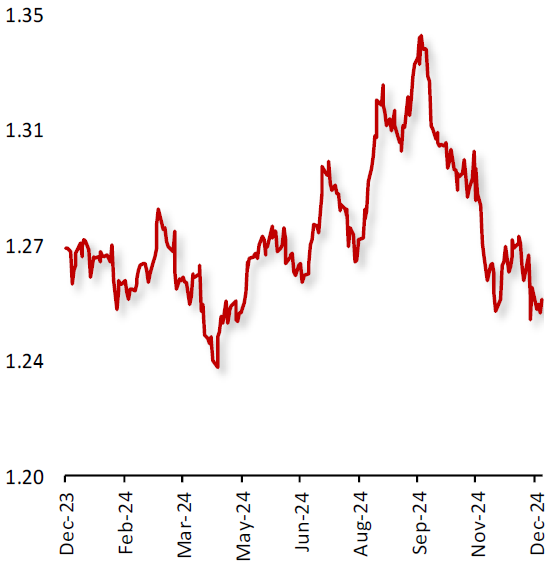

GBP/USD

|

|

|

Pound Declines Against Dollar Amid Economic Concerns

|

|

| |

|

|

The GBP/USD declined by 0.29% last week, pressured by weak UK economic data and robust U.S. macroeconomic performance.

In the UK, Q3 GDP figures confirmed stagnant growth, raising concerns about the nation’s economic trajectory. This, combined with subdued business confidence, weighed on the pound.

In the U.S., economic indicators painted a more optimistic picture. Weekly jobless claims declined to 219,000 in the week ended 20 December 2024, signalling a resilient labour market, while a sharp rebound in November’s new home sales highlighted strength in the housing sector. Although U.S. consumer confidence unexpectedly declined in December, the overall outlook remained solid, bolstering the dollar. The U.S. Federal Reserve’s hawkish tone, with expectations of continued monetary tightening, further enhanced the dollar’s appeal. Meanwhile, thin trading conditions during the holiday season amplified the pound’s losses, as markets leaned toward dollar strength amid global economic uncertainty.

|

|

| |

| |

| |

|

|

GBP/JPY

|

|

|

Sterling Rises as Trade Surprises, Yen Lags Amid Economic Concerns

|

|

| |

|

|

The GBP advanced 0.87% against the JPY to close at 198.42 this week as Britain’s current account deficit unexpectedly narrowed in 3Q24 revealing an improvement in trade.

On the flip side Japan’s disappointing annual industrial production data and dismal housing starts for November weighed on investor sentiment, contributing to the weakness in the Japanese Yen during the week. Additionally, Japan’s unemployment rate for November remained unchanged at 2.5%.

|

|

| |

| |

| |

|

|

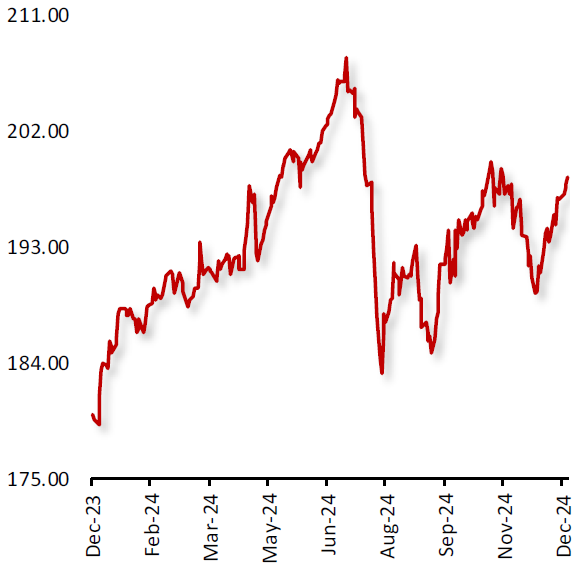

US Oil Fund ($)

|

|

|

Oil Prices Rise Amid Optimism Surrounding China’s Economic Stimulus

|

|

| |

|

|

Oil prices climbed this week, amid hopes that economic stimulus measures would prompt a recovery in the world's biggest oil importer, China. The Chinese government announced that it was planning to issue 3 trillion Yuan worth of special Treasury bonds in 2025, up from just 1 trillion in 2024, boosting investor sentiment.

Also, the World Bank raised its forecast for China's economic growth in 2024 and 2025, but warned that subdued household and business confidence, along with headwinds in the property sector, would keep weighing it down next year. Further, the outlook for new sanctions on Iranian and Russian crude exports fuelled concerns over global oil supply constraints.

Additionally, the American Petroleum Institute indicated that crude stocks fell last week by 3.2 million barrels.

|

|

| |

| |

| |

|

|

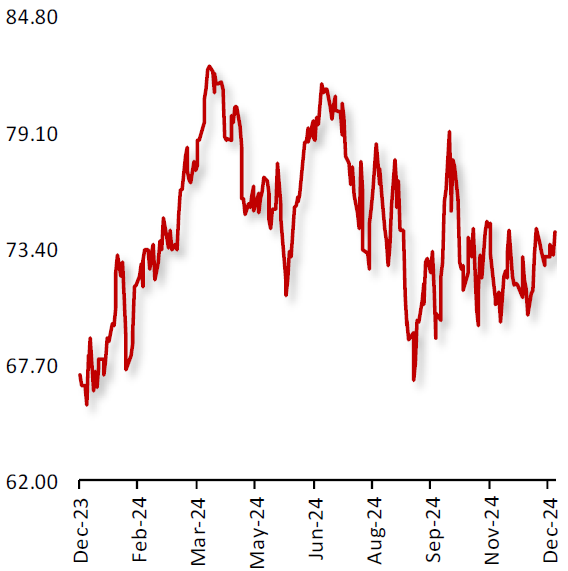

XAU Gold (XAU/USD)

|

|

|

Gold Prices Decline as Investors Await Further Cues on Fed’s Rate Cut Outlook

|

|

| |

|

|

Gold prices declined last week, as investors await cues on the Federal Reserve's interest rate path for 2025 and the incoming Donald Trump administration's policies.

Meanwhile, US jobless claims fell to a one-month low last week, indicating a strong labour market and potential pressure on the Fed to maintain interest rates. After aggressively cutting rates in September and November, the Fed persisted with easing in December. However, the Fed’s Open Market Committee trimmed the number of projected interest rate cuts for next year from five to two after its third cut in a row.

|

|

| |

| |

| |

|

|

BTC/USD

|

|

|

Bitcoin Declines Following US Fed’s Hawkish Policy Stance

|

|

| |

|

|

Bitcoin’s price dropped last week, as the US Federal Reserve’s (Fed) hawkish monetary policy stance raised expectations of slower interest rates cuts in 1Q2025 and as demand for the digital asset remained subdued. Additionally, the Fed’s Open Market Committee trimmed the number of projected interest rate cuts for next year from five to two after its third cut in a row.

On the other hand, US President-elect Donald Trump has also nominated pro-crypto hedge fund manager Scott Bessent as secretary of Treasury and Cantor Fitzgerald CEO Howard Lunik to head the Commerce Department.

Elsewhere, MicroStrategy Inc announced it had purchased an additional US$561 million of Bitcoin at an average price near last week’s record high.

|

|

| |

| |

| |

| |

|

| |

|

|

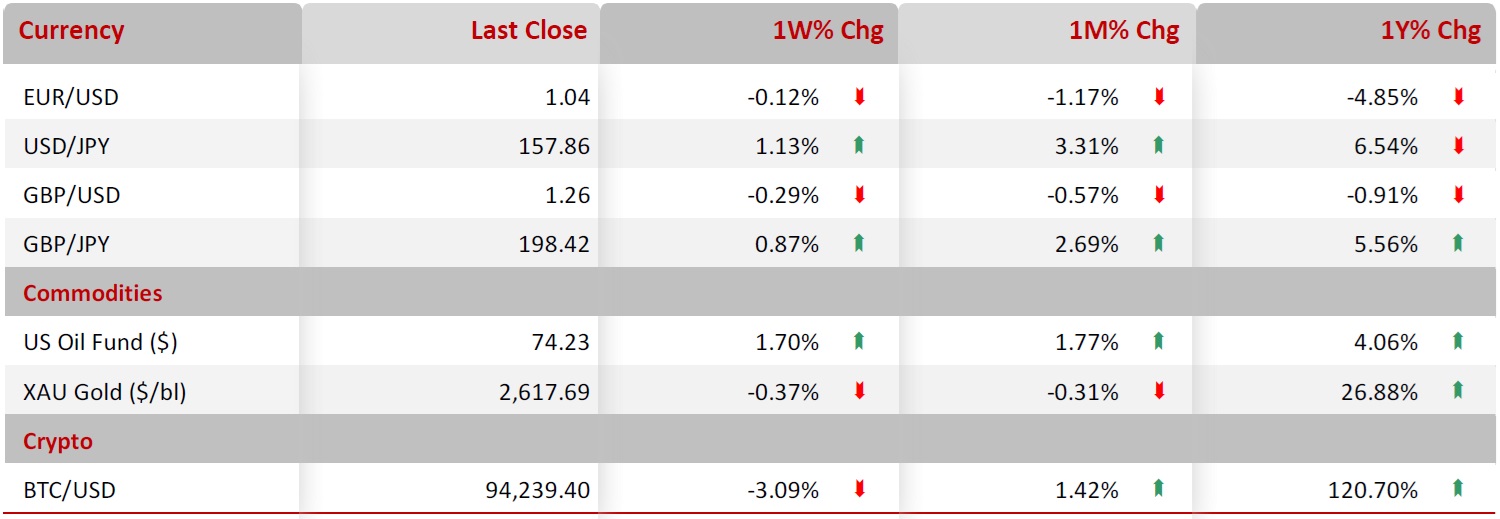

Key Global Currencies and Commodities

|

|

| |

| |

| |

|

Currency

|

| |

|

| |

|

Commodities & Crypto

|

| |

|

| |

|

| |

|